The U.S. House of Representatives and U.S. Senate have passed the Coronavirus Response & Relief Supplemental Appropriations Act, and President Trump is expected to sign the bill immediately. The agreement comes after weeks of negotiations and two funding extensions to keep Congress open until a bill was passed with a $1.4 trillion government-wide funding plan. The $900 billion coronavirus relief portion includes another round of Paycheck Protection Program (PPP) funding, extended unemployment benefits, and direct payments to taxpayers. Here’s an overview of the key provisions in the bill.

The Act designates $267.5 billion for this round of PPP funding, and the program specifically sets aside $25 billion for businesses with 10 employees or less as of Feb. 15, 2020. Regulations for this round of PPP funding are required to be released within 10 days of enactment.

Borrowers who received PPP funding in the first round following the CARES Act will receive some additional updates to their existing PPP loans. Borrowers who would like to adjust their requested loan amount based on these updated regulations may do so, provided they have not yet received forgiveness. Here are the key updates:

The second round of funding provided by this Act has a few key differences from the first round in the CARES Act. Key to note is that borrowers can apply for a second PPP loan through this program if they have fully used their first PPP loan and meet the employer size and gross revenue criteria listed below. PPP loans in this round are capped at $2 million. Here are the key differences:

As with the first round of PPP loans, 60% of the funds must be spent on payroll over the covered period (8 or 24 weeks).

Further guidance and regulations are expected in various components of the bill and are due in periods of 10 to 45 days depending on the issue and reporting agency. Not included in the bill was aid for state and local governments, an agreement on liability protections for businesses, nor a continued freeze on payments and interest for federal student loans set to expire for many in February. Lawmakers have indicated they expect to pass another stimulus bill addressing some of these issues in early 2021.

More guidance and updates are expected on the Coronavirus Response & Relief Supplemental Appropriations Act. Stay tuned for more details in the days and weeks to come.

Please note that information and guidance on the PPP loan program is changing on a daily basis. The information provided in this article is current as of December 22, 2020. It is intended for general informational purposes only. Consult with your financial advisor about your specific situation.

The pandemic created by the novel coronavirus has drastically changed the way we live and work. As more businesses are forced to send their employees home, work-from-home life has become a mainstay especially in knowledge-based jobs (jobs that do not require physical labor), and many of these industries are not going back to the workplace anytime soon. This can create wrinkles for both employers and employees when it comes to their tax situations.

Here’s what employers and employees need to know about remote work and the impact it can have on taxes.

Nexus – Employers who have transitioned their workforce to be remote must be conscious of potential nexus implications due to any employees now working from another state. Working out of state from the employer can create physical nexus which means the employer will be responsible for the taxes imposed from the employee’s location. This could include taxes on income, gross receipts, and sales and use from both the city and county level.

Some states have waived these nexus rules or have adjusted in light of COVID-19 including Minnesota, Indiana, Ohio, New Jersey, Mississippi, Pennsylvania, North Dakota, and the District of Columbia. Check with your CPA to ensure you’re following your state’s remote worker nexus law.

Labor and employment law – Changes in an employee’s location across state lines can result in new wage and hour rules, termination of employment considerations, noncompetition agreements, trade secrets protections, and paid sick and family leave rules. Employers will want to be mindful of worker’s compensation insurance as states usually require employers to register and obtain premiums to cover the employee in that state. Additionally, unemployment insurance is also required by states for employees even if the employer operates in a different state.

Remote worker supplies – Employers who purchased items and provided them to workers in order to move operations remotely may deduct those expenses on their tax return. As these supplies are usually purchased for non-compensatory business reasons, employees do not need to pay taxes on them. Employers who reimbursed employees for purchased supplies deemed “ordinary and necessary” should have accountability plans and policies in place to protect the employee from taxation.

Consistent and accurate communication with employees during this time is key in order to avoid employer and employee tax violations as tax updates continue to be released regarding nexus and tax responsibilities. Be mindful that employee tax obligations are not the employer’s responsibility, so remind your employees to stay vigilant about their personal tax situation.

Double-taxation – Double-taxation can be a large burden for employees living in one state and working in another. Double-taxation occurs when the resident state doesn’t provide and employee with a credit on their return for taxes paid to their employer’s state. States where this can occur include New York, Arkansas, Connecticut, Delaware, Nebraska, and Pennsylvania.

Home office deductions – The Tax Cuts and Jobs Act (TCJA) of 2017 removed the itemized home office deduction for unreimbursed expenses exceeding 2% of AGI. This means that even though new remote employees have had to procure supplies during the pandemic and they were not either directly purchased by the employer or the employee was not reimbursed, those expenses are not tax-deductible.

Self-employed individuals are still eligible for the home office deduction if they are purchasing their own supplies. If a contracting client purchases supplies for them, those would be tax-deductible for the client, but not the self-employed individual.

Relocation – If you’ve permanently relocated across state lines during the pandemic, you will need to file tax returns for both states in 2021. Even temporary relocations of six months or longer may require tax returns to be filed in two states. It is likely states will be monitoring these moves closely in order to recover lost revenue.

Employers who have never operated with remote workers prior to the pandemic could face significant headaches come tax time. Likewise, employees who are working in one state and living in another could face large tax bills in 2021. For assistance with your obligations as an employer or individual taxpayer, reach out to us.

On November 18, 2020, the Internal Revenue Service issued Revenue Ruling 2020-27 which provides needed clarity on a taxpayers’ ability to deduct eligible expenses for Paycheck Protection Program (PPP) loan forgiveness.

The Ruling notes that a taxpayer that received a covered loan guaranteed under the PPP and paid or incurred certain otherwise deductible expenses listed in section 1106(b) of the CARES Act may not deduct those expenses in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the covered loan on the basis of the expenses it paid or accrued during the covered period, even if the taxpayer has not submitted an application for forgiveness of the covered loan by the end of such taxable year.

What if forgiveness is denied, in whole or part, or not requested?

In conjunction with the Ruling, the IRS issued Revenue Procedure 2020-51 to outline the steps for when:

1.) The eligible expenses are paid or incurred during the taxpayer’s 2020 taxable year,

2.) The taxpayer receives a covered loan guaranteed under the PPP, which at the end of the taxpayer’s 2020 taxable year the taxpayer expects to be forgiven in a subsequent taxable year, and

3.) In a subsequent taxable year, the taxpayer’s request for forgiveness of the covered loan is denied, in whole or in part, or the taxpayer decides never to request forgiveness of the covered loan.

The Rev Procedure provides for two safe harbors for taxpayers in the event forgiveness is denied, in whole or in part, or otherwise not requested that would allow for the deduction of expenses in either the 2020 or a subsequent tax year.

Questions we still have

While the Ruling provides information on the deductibility of expenses and the tactical approach for borrowers whose forgiveness is denied or not requested, additional clarification is still needed. This guidance does not address the order in which the eligible expenses (payroll, rent, utilities and mortgage interest) lose the ability to be deducted.

Further, the guidance does not address other matters that could have significant tax implications including, but not limited to, the impact on the following:

Need Assistance in Choosing the Right PPP Loan Forgiveness Application?

We have put together a flowchart that can help: How to Select the Right Loan Forgiveness Application

This year has been unique and beyond comparison in many ways, and tax planning is just one of the implications of current events. Both individual and business taxes have the potential to be significantly impacted by the various legislation that has passed like the FFCRA and the CARES Act, the loan programs made available like the PPP and the EIDL, and the unemployment/stimulus programs that touched many Americans.

It’s imperative that we take into account all these potential factors when implementing your tax plan for 2020. In this article, we’ll take a look at the main areas to consider, both common and pandemic-related, when planning for 2020 year-end taxes.

As mentioned in our previous article – Tax planning considerations: Election results, sunset provisions – changes to the tax code in the next two to four years may still be imminent depending on the finalizations of certain Senate elections. If those changes become a likely scenario, some adjustments may still be possible in this year’s tax plan to account for those potential tax code changes. Work with your CPA to have a plan for all scenarios.

According to news outlets, as of this writing, Joe Biden will be the president-elect of the U.S. following the Electoral College vote on Dec. 14. Vote counting is still ongoing and election results have not yet been certified, but this news may have some taxpayers wondering what changes, if any, they should make in their tax planning to close out an eventful tax year.

The likelihood of a major tax overhaul in the next two years is up in the air as the Senate is not yet decided and may not be until two Georgia run-off elections in January 2021. If Republicans retain the majority, it’s likely there won’t be many changes, but that doesn’t completely lock out any potential adjustments that could come in the next two to four years. Items of agreement on tax policy exist between both parties such as increasing the child tax credit. However, with provisions of the Tax Cuts and Jobs Act (TCJA) set to sunset in 2026, updates to the tax code will be on the horizon by the next election.

Additionally, if the Republican Party indeed holds onto a 51-vote majority in the Senate, it is not unreasonable to imagine a legislative vote in which 2 republican senators vote against the majority of the Republican party to push a tax legislation bill through to the President. Accordingly, between the possibility of a loss of Republican control in 2 to 4 years, the possibility of 2 Republicans voting for a tax reform bill, and the 2026 TCJA sunset, it is highly unlikely tax laws will become more favorable to taxpayers in the in future; thus, we believe there is an urgency to plan carefully and diligently in the last weeks of 2020.

In this article, we’ll examine the key points of the President-elect‘s tax plan, the sunsetting TCJA provisions, and what to keep in mind as you execute your tax plan to close out the year.

President-elect Biden has laid out several of his tax plans the past year on the campaign trail. Here’s what we know based on what he’s shared.

For individuals:

For businesses:

In addition to the President-elect’s plans, the TCJA is still in the spotlight. The TCJA was the most significant tax overhaul in decades when it was passed in 2017. However, as is the nature when dealing with budgetary constraints, many of the provisions of the TJCA are scheduled to sunset by 2026. Below we’ve highlighted a few of the anticipated changes.

For businesses, approximately $4 trillion is expected in new taxes over the next 10 years as provisions begin to sunset including changes to:

For individuals, changes are coming for:

It’s important to note that the above considerations are not an exhaustive list of tax items to review as we close 2020. Work with us to have a proactive plan in place that takes into account various potential scenarios that could manifest in the coming weeks and months. In our follow-up article – 2020 tax planning considerations for businesses, individuals – we’ve laid out some of the key provisions to take into account as you work with us on your end–of–year tax planning.

With all of the curveballs 2020 has thrown at the nation, the economy, and businesses, there’s never been a better time to get an early jump on year-end planning for your business. While all the usual year-end tasks are still on the docket, you’ll want to consider implications related to the Paycheck Protection Program (PPP), any disaster loan assistance you received, and changes made by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

We’ve put together a checklist of what you need to do now to prepare for a great year-end that includes annual tasks as well as 2020-specific tasks. Keep reading for assistance getting your financials organized, reviewing your tax strategy, and preparing for next year.

1. Bring order to your books – Now is the time to collect, organize, and file all of your receipts for the year if you haven’t been staying on top of it. Get with your CPA to ensure everything is clean and in order before the end of the year to help avoid surprises come tax time.

2. Examine your finances – This includes having your balance sheet, income statement, and cash-flow statements prepared and up to date. Reviewing this information allows you to see where your money went for the year so you can properly prepare for next year.

3. Work with your CPA on your PPP loan forgiveness application – We are currently awaiting further guidance on the PPP’s impact to taxes, but it’s important to work with your CPA on your PPP loan forgiveness application. Knowing where your PPP loan lies can help determine how to spread out your cash flow for the remainder of the year.

4. Organize all disaster loan assistance documentation – This includes your Economic Injury Disaster Loan (EIDL) documentation if you received an advance grant. EIDL advances must be added to your taxable income (unless different guidance is released), but you’ll be able to deduct any expenses paid with this grant.

5. Review your taxes with your CPA – Do not put off your tax planning meeting with your CPA. Especially after the year you’ve had and any potential federal state aid your business received, your tax plan needs a review. Getting a jump on this early, well before the new year, can help you plan for what’s to come on Tax Day. It’s even more imperative to plan early for any tax obligations you may have at tax time as it’s likely the COVID-19 pandemic will continue to create a volatile environment for many industries’ revenue projections.

6. Execute on year-end tax strategy adjustments such as:

7. Prepare your tax documents – Once you’ve met with your CPA, it’s time to line up all the info you need to prepare your final tax documents or have your CPA take care of it. Be sure not to put this off to the last minute as it will be a complicated year for everyone.

8. Automate your tax function – Instead of spending valuable time and energy on manual tasks and repetitive processes this year, consider investing in data analytics and automation tools to optimize and streamline your in-house accounting and tax functions. There’s never been a better time to invest in technology that will help you become more efficient and accurate.

9. Evaluate your goals – There’s no doubt that 2020 likely threw a wrench in many of your goals for the year. However, you should still review the goals you set last year and see if you’ve met or made progress on any of them. This will help with 2021 business planning.

10. Set goals for the new year – No one knows how 2021 will play out, and it’s unlikely the market or business will return to normal in the first part of the year. Take into consideration the challenges you’ve faced so far in the pandemic as you plan for 2021. Work with your trusted advisor to determine several back-up plans for what if scenarios in case of any state or national lockdowns.

In a year like no other, it’s crucial to prepare like no other so you’re not met with any surprises or devastating fees. Contact us today to set up your tax and business planning appointment.

The Tax Cuts & Jobs Act (TCJA) of 2017 made many significant changes for business tax deductions including the disallowing of the business deductions for most entertainment expenses. After a period of comments and proposed regulations, the IRS has released long-awaited final regulations for the treatment of meals and entertainment deductions, and businesses should apprise themselves of these changes.

The main change with the TCJA was the removal of certain entertainment expenses as tax deductible for a business. Prior to the TCJA, entertainment expenses were eligible for an up to 50% deduction in expenses directly related to the active conduct of a trade or business or for expenses incurred before or after a bona fide business discussion. The TCJA eliminated this deduction for activities considered to be entertainment, amusement, or recreation as well as removed the reference to entertainment as part of the 50% limitation of deductibility for food or beverages.

The final rules clarify that taxpayers may continue to deduct 50% of business meals if the taxpayer or an employee of the taxpayer is present, as long as the meal is not considered extravagant. Meals for current or potential business customers, clients, consultants, or similar business contacts are eligible. Food and beverages provided during entertainment events must be purchased separately from the event to qualify, otherwise they are considered part of the entertainment.

Note that the TCJA did not repeal the exception for certain recreational activities that benefit employees, reimbursed expenses, entertainment treated as employee compensation, or includable gross income of a nonemployee as compensation or as a prize or award, which must be properly reported by the taxpayer.

Separating meals and entertainment and aligning them in the right buckets for deduction can be tricky. Contact us for assistance in determining what qualifies.

The Small Business Administration (SBA) and Treasury announced on October 8 that a simplified application (Form 3508S) for Paycheck Protection Program (PPP) loan forgiveness is now available for borrowers whose loans fall in the $50,000 or less threshold. As more and more businesses begin filing for PPP loan forgiveness, this change outlined in a new interim final rule greatly simplifies the process for borrowers with smaller loans. However, it is important to note that this simplified form is not equal to automatic forgiveness.

Among the simplified provisions for borrowers with $50,000 or less in PPP loans is the exemption from a reduction in forgiveness based on reductions in full-time-equivalent (FTE) employees as well as reductions in employee salaries or wages. While certifications and documentation of payroll and non-payroll costs will still be required, this move streamlines the process significantly for borrowers with smaller loans who will not be responsible for potentially complicated calculations for FTE and salary reductions.

Borrowers with loans of $50,000 or less who are also included in affiliate loans totaling $2 million or more are not eligible for the new application. The SBA estimates that approximately 3.57 million loans were issued for $50,000 or less or $63 billion of the PPP funds, and that about 1.71 million of the loans were for businesses with one or zero employees.

Below are additional considerations to keep in mind:

Lenders should note the further guidance on their responsibilities released with the notice which includes review of borrower documentation for eligible costs for forgiveness for all forgiveness applications. Lenders are required to confirm receipt of the borrower certifications the borrower’s documentation of payroll and non–payroll costs. Borrowers are responsible for their calculations and accuracy of the information provided, and lenders are permitted to rely on what the borrower has submitted.

It’s important to note that the amount of forgiveness cannot exceed the principal amount of the loan even if a borrower submits documentation for eligible costs exceeding the amount of their PPP loan.

Regardless of what form is submitted for forgiveness, lenders must:

Many questions remain about the tax treatment of some expenses that fall under the PPP. Contact your CPA for assistance with your forgiveness application and to have a thorough discussion about the impact your PPP loan has on your tax strategy and when is the best time to apply for forgiveness.

If a relative needs financial help, offering an intrafamily loan might seem like a good idea because they allow you to take advantage of low interest rates for wealth transfer purposes. But if not properly executed, such loans can carry negative tax consequences — such as unexpected taxable income, gift tax or both. Here are five tips to help avoid any unwelcome tax surprises:

1. Create a paper trail. In general, to avoid undesirable tax consequences, you need to be able to show that the loan was bona fide. To do so, document evidence of:

Be sure to make your intentions clear — and help avoid loan-related misunderstandings — by also documenting the loan payments received.

2. Demonstrate an intention to collect. Even if you think you may eventually forgive the loan, ensure the borrower makes at least a few payments. By having some repayment history, you’ll make it harder for the IRS to argue that the loan was really an outright gift. And if a would-be borrower has no realistic chance of repaying a loan, don’t make it. If you’re audited, the IRS is sure to treat such a loan as a gift.

3. Charge interest if the loan exceeds $10,000. If you lend more than $10,000 to a relative, charge at least the applicable federal interest rate (AFR). Be aware that interest on the loan will be taxable income to you. If no or below-AFR interest is charged, taxable interest is calculated under the complicated below-market-rate loan rules. In addition, all of the forgone interest over the term of the loan may have to be treated as a gift in the year the loan is made. This will increase your chances of having to use some of your lifetime exemption.

4. Use the annual gift tax exclusion. If you want to, say, help your daughter buy a house but don’t want to use up any of your lifetime gift and estate tax exemption, you can make the loan and charge interest and then forgive the interest, the principal payments or both each year under the annual gift tax exclusion. For 2020, you can forgive up to $15,000 per borrower ($30,000 if your spouse joins in the gift) without paying gift taxes or using any of your lifetime exemption. But you will still have interest income in the year of forgiveness.

Here is an example of how an intrafamily loan can save on taxes:

A $2 million interest-only loan is made from parent to child at an interest rate of 0.38%. If the loan proceeds are invested and grow at a rate of 5%, after repayment of interest and principal in year 5, the child is left with approximately $510,000 estate and gift tax-free. This arrangement also offers the flexibility to utilize the gift tax exemption at any time.

5. Forgive or file suit. If an intrafamily loan that you intended to collect is in default, don’t let it sit too long. To prove this was a legitimate loan that soured, you’ll need to take appropriate legal steps toward collection. If you know you’ll never collect and don’t want to file suit, begin forgiving the loan using the annual gift tax exclusion, if possible.

© 2020

With the M&A market in flux after all the unexpected challenges of 2020, buyers and sellers are likely wondering how their Paycheck Protection Program (PPP) loan comes into play in an M&A transaction. On Oct. 2, we got some answers when the Small Business Administration (SBA) released guidance on what to do if you are buying or selling a business with a PPP loan. The Procedural Notice was addressed to SBA employees and PPP lenders and clarifies how a change of ownership is defined, the steps that need to be taken with a PPP loan, and the obligations of borrowers regardless of change of ownership. Here’s what you need to know:

What defines a change of ownership?

The guidance states that a change of ownership requires at least one of the following conditions to be true for a PPP borrower:

Aggregation of sales and transfers since the date of the approval of the PPP loan is required. Sales or other transfers for publicly traded borrowers must be aggregated when they result in one person or entity holding or owning at least 20% of the common stock or other ownership interest.

What must I do before the ownership change?

1. Notify your lender if you are contemplating a transaction that will change ownership – this must be done in writing and include relevant documentation.

2. If your lender is accepting PPP loan forgiveness applications, submit your application with all required documentation (we can help with this).

3. Set up an interest-bearing escrow account with your PPP lender which will be required in most cases by the SBA.

4. Determine if SBA approval of the change of ownership is required for your transaction.

How do I determine if SBA approval is required for my transaction?

SBA approval is not required for:

SBA approval is required for sales that cannot meet the above criteria. The SBA will have 60 calendar days to review and approve or not approve. The PPP lender is responsible for notifying the SBA within five business days from the completion of the transaction and must submit to the SBA:

What if I don’t set up an escrow account?

Borrowers attempting to make an asset sale with 50% of assets and no escrow account will require a condition of the purchasing entity to assume all of the PPP borrower’s obligations under the PPP loan. The purchaser will then be responsible for compliance with PPP loan terms, and the assumption must be part of the purchase and sale agreement.

What do I do if I end up with two PPP loans?

Transactions resulting in an owner holding two PPP loans will require the owner to segregate and delineate the PPP funds and expenses with documentation demonstrating PPP requirement compliance for both loans. Being thorough and accurate with your documentation is key.

Anything else I should know?

Loans that are repaid in full or are fully forgiven by the SBA have no restrictions for change in ownership. Note that all PPP borrowers are responsible for the performance of PPP loan obligations, certifications related to the PPP loan application including economic necessity, compliance with all PPP requirements, and supporting PPP documentation and forms. Borrowers will be responsible for providing any and all of this documentation to a PPP lender/servicer or the SBA upon request.

For questions and assistance with an M&A transaction and your PPP loan, reach out to us.

If you haven’t converted to cloud-based accounting, it’s likely that COVID-19 may prompt you to make the switch. With more and more businesses and industries operating virtually, cloud access and real-time data has become more important than ever for making the best business decisions possible in uncertain times. With so much up in the air, you don’t want to be caught with a static accounting system that cannot keep up and provide the answers you need.

If you’re on the fence, we’ve put together the top 11 benefits of cloud-based accounting and the real-time data it provides.

1. Drill down on business performance – Real-time data through cloud-based accounting allows you to drill down on the key components of your business’s performance. You can get global or granular on factors such as location, project, customer, vendor, or department and see how each part is impacting your business in real-time. Additionally, you can use snapshots of your cash flow, revenue, expenses, and more to see how they compare year-over-year and how they are measuring up to your goals for this year.

2. Make better data-driven, real-time decisions – You’ve likely experience that last year’s or even last month’s data is irrelevant during these uncertain times. With real-time data, you can see clearly what’s holding you back now, or what’s working, and adjust accordingly. Without the real, hard data, these decisions can feel like a guessing game with a wait-and-see outcome, which is something most businesses cannot afford right now.

3. Make accurate predictions and forecasts – This accurate, up-to-date data allows you to feel more confident in the forecasting for the future your business. You have the facts in front of you to make more strategic predictions over the course of the year. Through the real-time data and historical facts, you can assess past performance, identify trends, and set goals and plans, making adjustments as needed along the way.

4. Automate processes – More and more, businesses are focused on automation, and there’s no better place to start than with your accounting. With cloud-based solutions, you can create automated workflows that handle much of the busy work for you like invoicing and paying vendors. This all funnels back into your real-time data so you can stay on top of your revenue and expenses.

5. Mitigate fraud and reduce errors – Mistakes and fraudulent activity can be more quickly and easily identified when you can see the transactions in real-time. The simplification of the software means less memorization of accounting practices, formulas, and Excel shortcuts – all of which can contribute to errors. And, the automatic reconciliation can help you detect fraud early. Being able to take timely action on errors and fraud can save your business big in the long run.

6. Simplify your reporting and EOY – Have you ever scrambled when a stakeholder asked for an up-to-date report on your business? Cloud-based accounting allows you to present an accurate, timely report in no time, simplifying the process for you and your stakeholders. Additionally, you avoid the end-of-year rush because you’ve been entering your information and tracking all year long, so tax bills aren’t as much of a surprise.

7. Simplify GST compliance – If you have general sales tax to track and monitor, you know it can be a challenge to assemble and file your GST returns. Cloud-based accounting tracks and applies GST automatically for you and allows you to pull a quick report when you’re ready to file.

8. Get access from anywhere – One of the best benefits of cloud-based accounting is that you can access your data from anywhere at any time. In the age of COVID-19 and working from home, this is especially beneficial for you and your team so everyone can stay on track and on task.

9. Collaborate with your accountant – Cloud-based accounting has simplified the transfer process of client information to accountant and saved both sides time and energy in equal measure. Gone are the days of having to download everything to a CD or flash drive and delivering it to your accountant. Now, you can collaborate together virtually and trust you’re both on the same page.

10. Simplify your technology – Cloud-based accounting eliminates hard downloads across multiple computers and saves your IT department (or you) the headache of making sure everyone is up-to-date across the company. Thanks to online hosting, IT doesn’t have to worry about updating the software either, so they can focus on other projects.

11. Get the tech support you need – Most cloud-based accounting platforms offer regular tech support to help you any hour of the day. You’ll also have access to forums of thousands of other users so you can discuss issues and share best practices. Keeping your program up and running and optimized contributes to better real-time data.

For assistance with choosing the right cloud-based accounting platform for your business, contact us today.

The unprecedented global pandemic and record unemployment has resulted in a dramatic drop in interest rates. Many people focus on the Fed rate and mortgage rates, and rightfully so, but for some, the focal point should be on the historically low IRS interest rates.

The IRS posts various interest rates, generally on a monthly basis. The Applicable Federal Rate (“AFR”) and the Internal Revenue Code Section 7520 Rate (“7520 Rate”) are among the most important. Many tax strategies are a function of calculations driven by the AFR and 7520 rates. Some strategies work best in high rate environments while other work best in low rate environments. Accordingly, any time the IRS rates dramatically rise or fall, we should take notice and consider tax planning.

The May 2020 IRS Rates include:

Short-Term AFR: 0.25%

Mid-Term AFR: 0.58%

Long-Term AFR: 1.15%

7520 Rate: 0.80%

These rates are exceptionally low. To provide some context for comparison, the May 2019 Rates were: Short-Term AFR 2.39%, Mid-Term AFR 2.37%, and Long Term AFR 2.74%. Viewing this from a historical perspective, the May 2019 rates were low in their own right, but clearly the rates today, just one year later, are materially lower.

The remainder of this paper outlines three strategies that work particularly well in low interest rate environments. Although we have elected to highlight three strategies specifically, low interest rate tax strategies are not limited to just these three. Accordingly, we encourage you to contact our office to discuss your specific set of circumstances.

A Charitable Lead Trust (“CLT”) is a split interest trust, meaning there are two categories of beneficiaries: (1) a current beneficiary and (2) a remainder beneficiary. The current beneficiary receives distributions from the CLT for a period of time (the “Term”) and must be a charitable organization, such as a public charity, a church, most schools and universities, and even a private foundation operated by the donor. The remainder beneficiary receives all the assets remaining in the CLT after the Term expires and is generally the donor or the donor’s children. Depending on the design of the CLT, the donor may receive an income tax deduction in the tax year the CLT is established in an amount equal to the present value of all payments that will go to charity during the CLT’s term. Accordingly, it can generate a substantial income tax deduction for gifts that have not yet gone to the charity. This gives the donor the ability to continue investing and growing the CLT assets, thereby ultimately benefiting the donor who will receive the assets back upon expiration of the CLT term.

Why CLTs during low interest rates?

The donor’s income tax deduction is a present-value calculation. We take the sum of all scheduled future charitable distributions and discount that number to present value using a calculation based on the 7520 Rate. The lower the 7520 Rate, the lower the discount. The lower the discount, the greater the deduction. Accordingly, in today’s environment, all other factors being exactly the same (i.e. same growth rate, same amount to charity, etc.), a CLT today will generate a significantly higher income tax deduction, than the same CLT when interest rates are higher.

Grantor Retained Annuity Trusts (“GRATs”) are estate planning trusts that provide a tremendous opportunity to transfer wealth from one generation (“Generation 1”) to the next (“Generation 2”), often without incurring gift or estate taxes. GRATs are established with Generation 1 assets for a period of time (the “Term”). During the Term, the GRAT makes distributions to Generation 1. At the end of the Term, if designed properly, the assets remaining in the GRAT transfer to Generation 2 free of gift, estate, or transfer taxes. Many individuals will establish a series of GRATs in order to provide necessary lifetime cash flow to Generation 1.

Why GRATs during low interest rates?

Payments made from the GRAT to Generation 1 are based on the IRS rates. The donor makes the “bet” that the assets inside the GRAT will grow at a rate higher than the IRS rates. Lower rates mean a lower hurdle, a lower hurdle means more wealth can transfer to Generation 2 tax-free.

Intentionally Defective Grantor Trusts (“IDGTs”), are irrevocable estate planning trusts that are generally utilized by high net worth business owners and those with assets likely to significantly increase in value (such as stock and real estate). The IDGT will purchase the asset from the individual primarily in exchange for a promissory note (there are no income taxes due on the sale because the IDGT is disregarded for income tax purposes). The IDGT will make installment payments to the individual for the term of the promissory note. The assets in the IDGT are outside of the individual’s estate, therefore any growth in the asset from the time it is sold remains outside of the individual’s estate for estate tax purposes.

Why IDGTs during low interest rates?

Similar to any traditional lending arrangement, the IDGT promissory note must yield interest. Because this is a related-party transaction, the IRS mandates a certain minimum interest rate, which is based on the AFR. The lower the AFR, the lower the required monthly payments, and thus more taxable wealth remains outside of the Grantor’s estate.

Don’t let this exceptionally low interest rate environment get away. Please contact your Heritage financial advisor, CPA, or attorney to schedule a planning session.

This article has been edited by Hamilton Tharp LLP. This article originally appeared on the HWM newsletter.

As consumers become more conscious of their environmental footprint, and look for ways to save money, more and more electric vehicles can be seen on the roads today stretching from coast to coast. At this point, most taxpayers know or have heard of an electric vehicle tax credit program, but what they may not know is that there are specific conditions and limitations that must be met, and that some vehicles have actually phased out of the program. So, before you consider an electric vehicle for your next purchase, make sure it qualifies.

Here’s a rundown of what you need to know about the electric vehicle tax credit, how it works, and what qualifies.

The new car or truck must:

· Have at least four wheels and gross vehicle weight of less than 14,000 pounds

· Draw energy from a battery with at least 4 kWh hours and recharged from an external source

· Purchased after 2010 and begun driving in the year claiming the credit

· Be primarily used in the U.S.

Two or three-wheeled vehicles purchased in 2012 or 2013 and used within that year may qualify under section 30D(g) if they draw from a battery with at least 25 kWh and charged from an external source.

The tax credit for an electric vehicle can range from $2,500 to $7,500 depending on the vehicle with higher credit amounts for specific battery capacities and vehicle sizes. For two or three-wheeled vehicles, the credit is 10% of the purchase price up to $2,500.

The non-refundable tax credit is filed on your federal tax return (for individuals on your 1040), and your liability determines how much credit you qualify for. The non-refundable caveat means that in order to receive the full $7,500 credit, your tax liability must be at least that much. If your liability is only $3,000, you’ll only receive $3,000. You won’t receive the difference in a refund check.

Unfortunately, the answer is no to both of those circumstances. The credit only applies to the new purchase and the person who actually owns it. Used vehicle purchases, even transfers to family members don’t qualify, and if you lease, the credit actually goes to the manufacturer

offering the lease. Some manufacturer dealers offer lower prices on leased electric vehicles as a result of the incentive, but are not forced to do so.

As sales of electric vehicles increase, the tax credit will phase out. Once a manufacturer reaches 200,000 qualified vehicles, the credit begins to phase out with a step-down process over the course of a year. No tax credits are available for Tesla vehicles sold after Dec. 31, 2019, as they hit their mark in July 2018, and no credits are available for GM vehicles after March 31, 2020, as they hit their mark as well. You can see a list of the vehicles available for credits at fueleconomy.gov.

Some states and regions do offer tax credits for electric vehicles and alternative-fuel vehicles, but these often apply to businesses. Individuals may receive incentives such as carpool lane access or free parking. Some states offer rebates for retail buyers. The U.S. Department of Energy offers a chart of state incentives.

For Californians, a $2,000 or $1,000 rebate is available depending on which type of electric car you purchase. Fully electric cards usually receive the higher rebate with hybrids on the lower end. Hydrogen fuel vehicles are eligible for a $4,500 rebate in California. These rebates are in addition to the federal tax credit and can reduce the out of pocket cost for a car by close to $10,000. You can learn more about California’s Clean Vehicle Rebate Project on their website.

For assistance with the electric vehicle tax credit and determining any extra state or local incentives, reach out to us.

Employers can now defer payroll tax withholding on employee compensation for the last four months of 2020 and then withhold the deferred amounts in the first four months of 2021, confirms a recent update from the IRS. President Trump’s memorandum on Aug. 8 gave employers the ability to defer payroll taxes for employees affected by the COVID-19 pandemic in an effort to provide financial relief.

The guidance directs that employers can defer the withholding, deposit, and payment of the employee portion of the old-age, survivors, and disability insurance (OASDI) tax under Sec. 3102(a) and Railroad Retirement Act Tier 1 under Sec. 3201 from employee wages from Sept. 1 to Dec. 31, 2020.

Employers must then withhold and pay the deferred taxes from wages and compensation during the period from Jan. 1, 2021, and April 30, 2021, with interest, penalties, and additions to tax to begin accruing starting May 1, 2021. Included in the notice is a line that indicates, if necessary, employers can “make arrangements to otherwise collect the total Applicable Taxes from the employee,” such as if an employee leaves the company before the end of April 2021, but does not provide details on what that entails.

Employees with pretax wages or compensation during any biweekly pay period totally less than $4,000 qualify for the deferral. Amounts normally excluded from wages or compensation under Secs. 3121(a) or 3231(e) are not included in calculating the applicable wages. The determination of applicable wages should be made on a period-by-period basis.

Companies may choose whether or not to enact the payroll tax deferral. We are closely monitoring updates related this and other presidential executive orders and will communicate if more information becomes available. For questions or assistance with this payroll tax deferral, contact us.

On Aug. 24, the Small Business Administration (SBA) and Treasury issued the latest interim final rule update to the Paycheck Protection Program (PPP) that seeks to clarify guidance related to owner-employee compensation and non-payroll costs. This guidance has been long-awaited and clears up several questions borrowers have had about forgiveness. Here are the main points:

1. Owner-employees of C or S corporations are exempt from the PPP owner-employee compensation rule for loan forgiveness if they have a less than 5% stake in the business. The intent is to provide forgiveness for compensation of owner-employees who do not have a considerable or meaningful ability to influence decisions over loan allocations. This clarifies earlier guidance that capped the owner-employee compensation regardless of what stake they have in the business.

2. Loan forgiveness for non-payroll costs may not include amounts attributable to the business operation of a tenant or subtenant of the PPP borrower. The SBA provides a few examples of what this means:

3. To achieve loan forgiveness on rent or lease payments to a related third–party, borrowers must ensure that (1) the amount of loan forgiveness requested does not exceed the amount of mortgage interest owed on the property attributable to the business’s rented space during the covered period, and (2) the lease and mortgage meet the Feb. 15, 2020, requirement for establishment. Earlier guidance had not addressed related third-party leases.

It’s important to note that mortgage interest payments to a related party are not eligible for forgiveness as PPP loans are not intended to cover payments to a business’s owner because of how the business is structured – they are intended to help businesses cover non-payroll costs owed to third parties.

For questions on any of these rules or assistance with your PPP loan forgiveness application, contact us today.

CFOs are playing more pivotal roles in modern corporations than ever before, and the impact of the COVID-19 pandemic is shedding light on how CFOs can impact short and long-term financial stability. While growth is frequently considered the ultimate goal for a business, economic downturns like the one created by the pandemic show us that CFOs with eyes on long-term financial stability, and not just on growth, will be able to better help their organizations weather the storms of an economic crisis.

A CFO’s strategy for long-term success should incorporate thorough cost management protocols, a comprehensive and holistic approach to increasing value, and stewardship and championship of the bigger picture. Here’s what that means.

As the financial head of the organization, the CFO naturally serves as the rightful guardian of a business’s expenses. It’s through these direct costs that CFOs can implement stronger internal controls and recover lost revenue for long-term benefit. A CFO can improve long-term viability by analyzing:

Cost of Goods Sold (COGS) – COGS are a key area for reduction as they represent the largest operating expense for the business. Depending on the industry, these costs can be complex, and the biggest expense can come in the form of purchased components and materials. CFOs can optimize this area with help from sourcing programs that consolidate costs by choosing more goal-aligned suppliers.

Indirect Taxes – Indirect taxes are an often-overlooked area of opportunity for many businesses. These taxes can be found in areas like R&D, procurement, labor, utilities, and manufacturing and can represent 25% of personnel expenses. Making indirect taxes a regular component of your tax strategy allows you to reduce costs in this area by 10-20% with quick realization rates. Bonus: “Look-back” provisions can help you save even more.

Real Estate – With real estate, take a holistic inventory of your business and consolidate where possible. The COVID-19 pandemic showed us how much can be done at home or in fewer locations. Consider whether you need all your locations, your facility management costs, and negotiating your contracts. Also, plan for a future workforce that may expect a more flexible work-from-home situation. Just because you‘re growing doesn’t mean you will actually need all that extra space.

Product Optimization – If you haven’t invested and implemented benchmarking and KPIs for your products, you need to now. Data and analytics are key to understanding how you can improve margins and grow profit. With product rationalization, you can drill down into what is really profitable and make decisions on what to cut and what to expand. Look at customer buying habits and your company overhead and determine what’s really worth keeping on the shelves.

Labor – The key to optimizing labor costs lies within efficiency. Do you have the right people in the right seats? Can current employees be retrained to fill open needs? Consider where you can use automation and outsourcing to save on salaries/benefits and overhead.

Working Capital – Assessing your working capital for cost efficiency involves taking a look at:

CFOs not only help to optimize costs, but they are also integral in increasing company value because of their instinct and insight into the finances, the business, and how everything relates. Value is the ultimate determinate for long-term success in a business as it is the final measurement taken into consideration at the time of succession or buy-out. And, as any good business valuation professional will tell you, the business is not worth what you think it’s worth. The consensus among international accounting organizations is that value is defined by your customers/stakeholders and created and sustained through the responsible management of your organization’s tangible and intangible assets, resources, and relationships.:

One can clearly see how the areas of impact for CFOs listed in the costs section above directly relates to value creation in a business and the management of financial resources. The CFO is the gatekeeper for value creation and thus long-term viability.

Because the CFO is intimately connected to the financial health of the organization, they are also the eyes of the market. They see the trends and shifts directly in the numbers and can advocate for the right kinds of measurements to make long-term decisions. CFOs should take an active role in their organization’s strategic planning process and use their knowledge to translate the ebbs and flows of the business into scalable growth.

Now more than ever, CFOs are at the forefront of business viability and growth. Their knowledge is invaluable in times of crisis and prosperity, and their voice and action are essential for long-term financial stability.

Our outsourced CFO services can help you establish and maintain a long-term financial strategy for your business. Contact us for more information.

In an effort to help businesses cope with the impact of COVID-19, the CARES Act passed by Congress in March of this year eliminated some of the restrictions on the business interest deduction set in place in 2017 by the Tax Cuts and Jobs Act (TCJA). Now, the IRS has released much-needed guidance and final regulations for business interest expense deductions.

Limiting the business interest deduction was originally a way of helping pay for the TCJA and began with tax years starting after Dec. 31, 2017. The deduction was limited to the sum of:

The final regulations state that the deduction does not apply to:

Taxpayers must use Form 8990 to calculate and report their deduction and the carry-forward amount of disallowed business interest expense.

Additional regulations released by the IRS cleared up some of the remaining questions including issues related to the CARES Act. These additional regulations can be used with limitations until the final regulations are published in the Federal Register.

Additionally, a safe harbor was created in Notice 2020-59 that allows taxpayers engaged in a trade or a business managing or operating qualified residential living facilities to treat that as a real property trade or businesses in order to qualify as an electing real property trade or business.

Reach out for assistance with understanding and reporting your business interest expense.

On August 8, 2020, President Trump signed an executive order extending certain aspects of COVID-19 relief in the absence of a new bill from Congress. The executive order includes several measures to protect individuals as provisions of the CARES Act expire or have expired.

Here’s what was in the order:

Payroll tax delay – The order authorizes the Treasury to consider methods to defer the employee share of Social Security taxes (IRC section 3101(a) and Railroad Retirement Act taxes under section 3201(a)) for employees earning up to $104,000 per year ($4,000 biweekly) for a period beginning Sept. 1, 2020, through Dec. 31, 2020. No interest, penalty, or additional assessment would be charged on the deferred amount. At this point, this is not effective. It means the Treasury can exercise authority and explore ways to achieve forgiveness on the deferred amounts, such as legislation. While nothing will be done until the Treasury issues guidance, employers will need to be mindful of this as the liability of this payment could fall on them depending on the final rule.

Unemployment benefits – The $600 per week unemployment benefit authorized by the CARES Act expired on July 31. The executive order retroactively authorizes $400 per week from Aug. 1; however, states must contribute $100 and the remaining $300 would come from the federal government. The funding for the federal portion would come from the FEMA Disaster Relief Funds and would continue until the earlier of Dec. 6, 2020, or a drop in the Fund balance to below $25 billion. The state portion is to come from federal funds already distributed to the states. Questions of whether the FEMA funds can be used for this purpose are still outstanding.

Evictions – The evictions portion of the executive order asks the secretary of HHS and director of CDC to consider whether halting residential evictions is reasonably necessary to help prevent further spread of COVID-19 and also authorizes the Treasury Secretary and HUD Secretary to consider potential financial assistance for renters. The CARES Act banned evictions through July 25 for properties with federal mortgage programs or HUD funds.

Student loans – The student loan interest deferral enacted by the CARES Act is set to expire Sept. 30, 2020. The executive order would waive student loan interest until Dec. 31, 2020, for loans held by the Department of Education only.

Final guidance is required from the respective agencies before some of these measures can be enacted. Contact us with questions.

The Small Business Administration (SBA) and Treasury released an updated Paycheck Protection Program (PPP) FAQ on Aug. 4 in an effort to address PPP loan forgiveness issues that have arisen as borrowers begin to complete their applications. The 23 FAQs address various aspects of PPP forgiveness including general loan forgiveness, payroll costs, non-payroll costs, and loan forgiveness reductions. Here is a brief overview of some of the most notable clarified guidance.

The FAQ document also includes several examples for making calculations related to the above questions. Contact us for questions and assistance with your PPP loan forgiveness application.

Economic downturns are an almost inevitable reality for nearly every business owner. Decisions made far away from your community, catastrophic and unpredictable weather events, and even global pandemics as we’ve seen this year can disrupt the health and viability of a business. During these challenging times, business owners have to make difficult decisions about the future of their business that not only affect them but also their employees, vendors, clients, and communities. It’s an enormous responsibility to bear, but you don’t have to go it alone.

Your CPA advisor is your best resource for tackling the challenges of an economic downturn. As an outside party, they can help you make smart business decisions that protect your vision and mission while remaining financially responsible. Your CPA can help you:

Optimize your books

Never underestimate the power of good bookkeeping. By keeping your books in order, your CPA can help you plan and project for the future at each stage of an economic downturn. This includes planning for temporary closures and tiered re-openings (and potentially a back-and-forth of both depending on the state of the country and market). When your books are clean and up to date, you can better project how events and decisions will impact your finances on a weekly, monthly, and quarterly basis. Your CPA can help you flex the numbers on fixed and variable expenses to account for increases in costs, decreases in income, and potential changes to payroll. Knowing your numbers intimately can help you make better-informed decisions.

Minimize your tax burden

During times of economic crisis, staying abreast of new and changing tax legislation will be essential to projecting tax burden and uncovering tax savings opportunities. Your CPA is the best person to handle this because they know your business and your industry inside and out and can help you uncover tax savings opportunities that are unique to your circumstances. They do all the research, and you reap the rewards. With a CPA’s assistance, you achieve deductions and credits you may not have realized were available and develop a plan to defer costs where allowed depending on your business, industry, and location. Taxes are not an area you should or need to face alone during an economic downturn. Your CPA has done the homework, so you don’t have to.

Rationalize your decision making

When markets are in flux and your business is facing unprecedented challenges, the decisions you make can make or break your business. But you don’t have to go it alone. Your accountant can help you make data-informed decisions whether that be how to pay vendors, when and how to apply lines of credit, and the best ways to use your capital. Negotiating contracts with vendors that meet your needs and theirs during a downturn will not only achieve cost savings but also preserve relationships – your CPA can help develop a plan that makes sense. Knowing when to engage lines of credit can help you make better moves that you can either afford to pay back later, or maybe prevent you from taking on credit you can’t handle – your CPA can guide you in this process. Knowing where to allocate capital will be key to maintaining operations, and you may need guidance on what expenses to cut and what to keep such as marketing and payroll – your CPA can help you project the ramifications. With your CPA by your side, you don’t have to operate in a silo of decision-making.

Maximize your sense of relief

Most of all, your CPA can provide perspective, alleviate business back-end burden, and help advise you on financially feasible and sound decisions when much of the world feels like it’s in chaos. You have a lot to focus on during a downturn including how to handle your customers and employees in a changing marketplace. Having someone who can help you stay fiscally viable as you work through tough times, and develop a plan for future success, provides a welcome peace of mind.

You don’t have to go through any economic downturn alone. Your CPA can help you shoulder the challenges and weather the storms so you can continue doing what you do best – running your business.

The U.S. Senate and House of Representatives have both unanimously agreed to extend the Paycheck Protection Program (PPP) by five weeks in an effort to continue providing relief for small businesses hit hard by the pandemic. Applications officially closed for the program on June 30 when the Senate voted for a last-minute extension. President Trump is expected to sign the bill.

This extension would give small businesses until Aug. 8 to apply for a share of the approximately $129 billion in remaining PPP funding through the Small Business Administration (SBA). Thanks to the PPP Flexibility Act passed on June 5, recipients have 24 weeks to use loan funds for payroll and other essential expenses like rent/mortgage and utilities. The Flexibility Act also lowered the threshold for payroll expenses to 60% to achieve full forgiveness with a few safe harbor considerations. Over 4.9 million loans have been approved by the SBA so far, worth more than $520 billion.

Contact us for assistance in compiling information for your PPP forgiveness application to present to your lender.

In the midst of the uncertainty and instability that the COVID-19 pandemic has created for businesses and individuals, some relief is available for taxpayers in the form of deductible losses thanks to the preexisting Internal Revenue Code (IRC) Section 165(i). While the CARES Act and FFCRA have received much of the attention, taxpayers may also find relief thanks to Section 165(i) which allows for losses sustained as a result of the pandemic in 2020 to be claimed on the taxpayer’s 2019 tax return.

This deduction is triggered by a federally declared disaster, like the pandemic which was declared a national emergency on March 13, 2020. In the case of this deduction, losses attributed to federally declared disasters can be deducted on the previous year’s return. While not often used, this deduction comes at the right time for businesses struggling during the pandemic.

In order to claim the Section 165(i) deduction, losses must:

While some taxpayers will fit into this deduction, the rules and procedures are complex.

Examples of deductible losses as a result of COVID-19 vary from costs related to running your business during a pandemic like investments in personal protective equipment and cleaning supplies and services, to the closure of stores and facilities and disposal of unsaleable inventory. Other eligible costs include certain termination payments, losses from property sales or exchanges, abandonment of leasehold improvements, and nonrefundable event payments, to name a few.

To make the Section 165(i) election, taxpayers must include Form 4684, “Casualties and Thefts,” with their return within six months from the due date for filing the taxpayer’s federal income tax return for the disaster year.

We can assist you with identifying your deductible expenses and following the complex rules and procedures for making this election. Reach out for assistance.

On June 22, 2020, the U.S. Small Business Administration (SBA) released the: Paycheck Protection Program (PPP) Revisions to Loan Forgiveness Interim Final Rule

This guidance details two noteworthy changes impacting PPP loan borrowers, including:

The updated regulations also make minor updates to existing guidance addressing the extension of the covered period derived from the June 5, 2020 enactment of the Paycheck Protection Program Flexibility Act (H. R. 7010).

Read our blog summary of changes from H.R. 7010 here.

When Can a Borrower Apply for Loan Forgiveness?

A borrower can apply for forgiveness at any time on or before the loan maturity date. However, if the borrower applies for forgiveness before the end of the covered period and has reduced any employee’s salaries or wages by more than 25 percent, the borrower must account for the excess salary reduction for the full 8-week or 24-week covered period.

Expanded Limitations on Owner Compensation

The release of Revisions to the Third and Sixth Interim Final Rules on June 17, 2020, increased the maximum compensation for all employees and owners, which was summarized in our blog here. The new interim rules added that the employer portion of retirement plan funding for owner-employees of S-Corporations and C-Corporations is now capped at 2.5 months’ worth of the 2019 contribution amount. Furthermore, healthcare costs paid on behalf of owner-employees of S-Corporations are not eligible for forgiveness.

HT2 has established a dedicated PPP loan forgiveness team that is constantly monitoring new guidance from the SBA, as well as the Treasury, Congress, and the IRS, to ensure we have the latest information when advising our clients.

The CARES Act includes provisions that allow individuals to take early retirement plan distributions within certain rules. These changes include provisions for people with COVID-19 or who have family members with the illness. It also includes those who experience adverse financial consequences as a result of being quarantined, laid off, furloughed or having work hours reduced because of the illness.

The recently passed CARES Act includes provisions that allow individuals to take early retirement plan distributions of up to $100,000 from their retirement accounts without being subjected to the 10% penalty and gives them three years to pay the taxes on the distribution or return the funds to their account.

Also included, is the provision allowing individuals required to take Required Minimum Distributions (RMD’s) to elect to return the funds they have taken during 2020 or to not take their RMD for the year. In order to take these early distributions, or to return RMD’s taken prior to January 31, 2020, an individual must be able to designate them as a Coronavirus-Related Distribution. To establish these items as Coronavirus-Related Distributions the individual must fall into one of the following categories:

It is important to note that these items only apply to early distributions and to RMD’s taken prior to January 31, 2020 for the current year that would therefore not fall in the normal 60-day window an individual would have to return distributions without repercussions.

If you have taken an RMD after January 31, 2020 you can simply write a check within 60 days of receiving the distribution and return those funds to your account without having to meet any of these requirements.

If you have not yet taken any RMD and do not wish to take the funds for the current year, there is nothing you will need to do to defer that payment. For any individuals that deferred their 2019 payment because they reached 70 ½ in 2019 and would have been required to take two distributions in 2020, this requirement is also eliminated.

Additionally, for those who typically use a portion of their RMD to support charitable organizations, these funds can still be withdrawn for those purposes allowing individuals to use pre-tax dollars to support the organizations that mean the most to them.

On June 16, 2020, the U.S. Small Business Administration (SBA) released the updated Paycheck Protection Program (PPP) Loan Forgiveness Application (see link below) which supersedes the application previously released on May 15, 2020. The new application incorporates changes to the PPP per the Paycheck Protection Program Flexibility Act (H. R. 7010), which was signed into law on June 5, 2020. The latest PPP loan forgiveness application, in conjunction with the June 17, 2020 release of the Revisions to the Third and Sixth Interim Final Rules, addresses some of the previously unanswered questions, including:

The SBA also released the PPP Loan Forgiveness Application Form 3508EZ (Form EZ) on June 16, 2020. The Form EZ is a simplified version of the loan forgiveness application and is applicable to PPP loan borrowers who are willing to certify they have met one of the following conditions:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

With personal income tax representing 61% of California’s total general fund revenue sources, it is no surprise that the California Franchise Tax Board in the last few years has become more aggressive in its enforcement and interpretation of California residency law, using residency audits to do so.

What is California Residency Audit?

According to California’s residency laws, residents must pay state tax on their worldwide income, no matter the source of the income. Meanwhile, part-year residents are only required to pay taxes on income received while a resident of the state. Therefore, a person’s “residence” under California law is the key to understanding their state income tax liability. For this reason, the FTB conducts residency audits that will determine a person’s residency.

The 3 Types of “Residency” According to California Residence Law

When the FTB conducts a residency audit, the outcomes are generally broken down into three different categories. These are resident, nonresident, or part-year resident. The audit is simply meant to help determine which category taxpayers fall into.

According to California residency is defined as an individual who is in the state for anything else other than a temporary or transitory purpose or domiciled in California but physically outside the state for a temporary or transitory purpose. While the above definition might seem very straightforward, in reality the law is broadly written and leaves room for interpretation. As a result, if the FTB says you are a state resident, the burden now lies with you to prove them wrong.

How the FTB Determines Residency Status

California residency law defines the class of persons that are expected to contribute tax revenue to the state. California’s Revenue and Tax Code (R&TC) § 17014 includes every person in the state of California except for those in California for “a temporary or transitory purpose.”

It is important to note that this definition of residency is very broad, and includes everyone currently in the state except for those remaining in the state for a temporary or transitory purpose. It also includes those people domiciled in the state of California but currently outside the state for a temporary or transitory purpose.

Much of the residency determination depends upon the definition of “a temporary or transitory purpose.” California Code of Regulations (CCR) § 17014(b) defines in great detail what “temporary or transitory purpose” means. It states that those domiciled in the state who leave for a short period of time for both business and pleasure are outside the state for “a temporary or transitory purpose,” and as such are to be taxed as California residents.

Those domiciled outside the state, but staying within the state for business, medical or retirement purposes that are long-term and indefinite in time will not be considered in the state for “a temporary or transitory purpose,” and will be subject to the state tax.

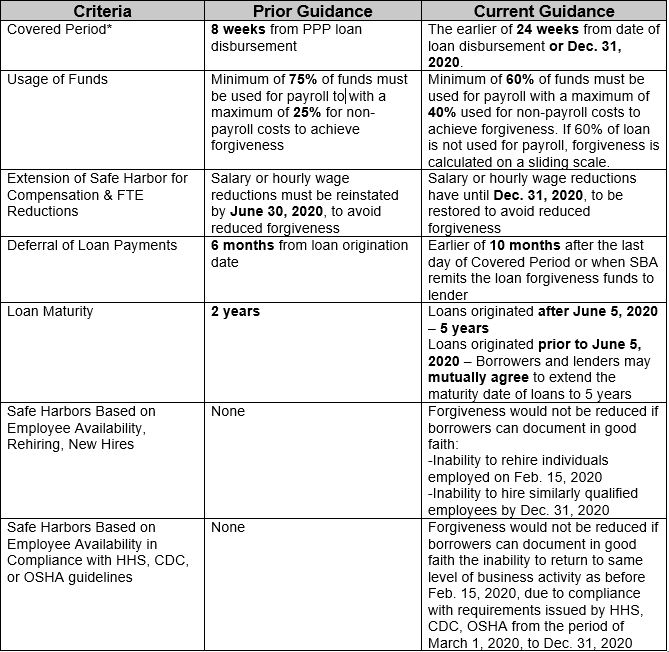

On June 10, 2020, the Small Business Administration (SBA) issued an updated interim final rule for the Paycheck Protection Program (PPP) in response to the PPP Flexibility Act passed on June 5, 2020. The updated guidance accounts for revisions made to the covered period, usage of funds changes, extended safe harbors, and more.

Here is a quick rundown of the changes made by the PPP Flexibility Act.

Also of note:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

Helpful Links:

Nothing is more important than the health and safety of you and your loved ones as you deal with the COVID-19 pandemic. The coronavirus crisis has had a wide-reaching effect on just about every aspect of our lives. We’ve all been asked to adjust our daily routines. Unfortunately, our health and wellbeing aren’t the only things of which we need to be concerned. The sudden downward shift in our economy has had a devastating effect on employment. The U.S. is currently experiencing a jobless rate unseen since the Great Depression. If you, or someone close to you, lost a job as a result of the economic shutdown caused by COVID-19, we’re sure you’ve got questions. In this article, we’ll address some of those questions, particularly with respect to unemployment benefits.

In March 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law. The CARES Act expands the states’ ability to provide Unemployment Insurance (UI) to those affected by COVID-19. You may be eligible for UI if you are unemployed through no fault of your own, meet certain work and wage requirements, and satisfy any additional state requirements. Under the new law, even self-employed individuals and independent contractors may qualify.

Normally, UI benefits are available for up to 26 weeks. The CARES Act allows states to extend that coverage up to 13 additional weeks. To help provide a little more support, states also are able to increase UI benefits by $600 per week. These extended benefits are available through 12/31/20.

UI benefits are administered at the state level, so each state sets its own eligibility guidelines. To find state-specific information regarding eligibility, benefits, and applications, go to: www.careeronestop.org/LocalHelp/UnemploymentBenefits/Find-Unemployment-Benefits.aspx

One very important thing to remember is that UI benefits are taxable income. In order to avoid an unexpected tax bill next April, you may need to make estimated tax payments or have federal income tax withheld from your UI payments. You’ll need to complete Form W-4V to have tax withheld. We can help you determine the best course of action.

Note: By 1/31/21, you should receive Form 1099-G from your state showing the amount of taxable UI benefits paid in 2020. This form will help us prepare your 2020 Form 1040.

Obviously, this information barely scratches the surface of unemployment benefits and how to best handle your exact situation. These are challenging times, to say the least. If you find yourself in the unfortunate position of being unemployed right now, please know we are here for you. If you’d like to discuss this issue further, please give us a call. We’d love the opportunity to speak with you over the phone, via an online meeting, or in-person if you are comfortable doing so. We can address this issue or anything else you want to discuss. We are here to help!

On June 5, 2020, the president signed into law the Paycheck Protection Program Flexibility Act after it passed the Senate with a unanimous vote. The bill drafted by the House extends certain provisions of the Paycheck Protection Program (PPP) to provide small businesses with relief in the time frame and use of their PPP loan funds.

The most notable changes of the PPP Flexibility Act were:

June 30 remains the deadline for applying for a PPP loan. As of June 8, 2020, PPP funds are still available for funding. Contact one of our PPP Team Members for assistance with your loan forgiveness application.

On May 28, 2020, in a nearly unanimous vote, the U.S. House of Representatives voted to extend certain provisions of the Paycheck Protection Program (PPP) to provide small businesses with relief in the timeframe and use of their PPP loan funds. While President Trump has encouraged changes to PPP, and the Senate had been developing a plan of its own, the Paycheck Protection Program Flexibility Act is the first to pass its branch.

House representatives took into consideration the most debated aspects of the PPP when they wrote the Flexibility Act including the timeframe and parameters for usage of loan funds. The most notable changes of the Paycheck Protection Program Flexibility Act were:

The bill must next pass the Senate, which has not yet signaled support but is expected to take up the bill when it’s in session next week. We will continue to update this story as developments occur.

On May 23, the Small Business Administration (SBA) issued an interim final rule for the Paycheck Protection Program (PPP) that included the loan forgiveness application guidance released May 15, as well as other updated guidance.

The rule, Paycheck Protection Program – Requirements – Loan Forgiveness, is the formal guidance that accompanies the forgiveness application and should be used by borrowers and their advisors, as well as lenders, to ensure accurate completion and review of the forgiveness application. Since the passage of the CARES Act on March 25 and the opening of PPP loan applications on April 3, questions, concerns, and clarifications have abounded regarding loan forgiveness on all sides. The release of the interim final rule clarifies many questions, but guidance is still expected for borrowers and lenders.

Clarifications on borrower responsibility

Alternative payroll period – Until the application was released on May 15, the 8-week rule was strict for payroll. The interim rule now allows borrowers to establish the forgiveness period with the start of the first payroll period following loan disbursement, rather than the date of loan disbursement. This allows for greater flexibility for employers with less frequent pay periods and should make meeting forgiveness requirements for some businesses a little easier.

Eligible payroll costs – Payroll costs must make up a hefty 75% of the loan to qualify for forgiveness, but borrowers have questioned what qualifies because employee compensation can be paid in a multitude of ways. The rule clarified that eligible payroll costs include salary, wages, commission, bonuses, hazard pay, cash tips or equivalent, PTO/sick/family/medical leave, separation or dismissals, employee benefits related to group health care coverage and retirement, state and local taxes assessed on payroll, and independent contractor/sole proprietor wages/commissions/income paid by employers to contractors up to the pro-rated amount of a $100,000 annual salary.