Partnerships are often used for business and investment activities. So are multi-member LLCs that are treated as partnerships for tax purposes. A major reason is that these entities offer federal income tax advantages, the most important of which is pass-through taxation. They also must follow some special and sometimes complicated federal income tax rules.

A partnership is governed by a partnership agreement, which specifies the rights and obligations of the entity and its partners. Similarly, an LLC is governed by an operating agreement, which specifies the rights and obligations of the entity and its members. These governing documents should address certain tax-related issues. Here are some key points when creating partnership and LLC governing documents.

The tax numbers of a partnership are allocated to the partners. The entity issues an annual Schedule K-1 to each partner to report his or her share of the partnership’s tax numbers for the year. The partnership itself doesn’t pay federal income tax. This arrangement is called pass-through taxation, because the tax numbers from the partnership’s operations are passed through to the partners who then take them into account on their own tax returns (Form 1040 for individual partners).

Partners can deduct partnership losses passed through to them, subject to various federal income tax limitations such as the passive loss rules.

Partnerships are allowed to make special tax allocations. This is an allocation of partnership loss, deduction, income or gain among the partners that’s disproportionate to the partners’ overall ownership interests. The best measure of a partner’s overall ownership interest is the partner’s stated interest in the entity’s distributions and capital, as specified in the partnership agreement. An example of a special tax allocation is when a 50% high-tax-bracket partner is allocated 80% of the partnership’s depreciation deductions while the 50% low-tax-bracket partner is allocated only 20% of the depreciation deductions.

Any special tax allocations should be set forth in the partnership agreement. However, to make valid special tax allocations, you must comply with complicated rules in IRS regulations.

Partners must recognize taxable income for their allocations of partnership income and gains — whether those income and gains are distributed as cash to the partners or not. Therefore, a common partnership agreement provision is one that calls for the partnership to make cash distributions to help partners cover their partnership-related tax liabilities. Of course, those liabilities will vary, depending on the partners’ specific tax circumstances. The partnership agreement should specify the protocols that will be used to calculate distributions intended to help cover partnership-related tax bills.

For instance, the protocol for long-term capital gains might call for distributions equal to 15% or 20% of each partner’s allocation of the gains.

Such distributions may be paid out in early April of each year to help cover partners’ tax liabilities from their allocations of income and gains from the previous year.

Contact us for assistance

When putting together a partnership or LLC deal, tax issues should be addressed in the agreement. Contact us to be involved in the process.

© 2024

Your businesses may have a choice between using the cash or accrual method of accounting for tax purposes. The cash method often provides significant tax benefits for those that qualify. However, some businesses may be better off using the accrual method. Therefore, you need to evaluate the tax accounting method for your business to ensure that it’s the most beneficial approach.

“Small businesses,” as defined by the tax code, are generally eligible to use either cash or accrual accounting for tax purposes. (Some businesses may also be eligible to use various hybrid approaches.) Before the Tax Cuts and Jobs Act (TCJA) took effect, the gross receipts threshold for classification as a small business varied from $1 million to $10 million depending on how a business was structured, its industry and whether inventory was a material income-producing factor.

The TCJA simplified the definition of a small business by establishing a single gross receipts threshold. It also increased the threshold to $25 million (adjusted for inflation), expanding the benefits of small business status to many more companies. For 2024, a small business is one whose average annual gross receipts for the three-year period ending before the 2024 tax year are $30 million or less (up from $29 million in 2023).

In addition to eligibility for the cash method of accounting, small businesses enjoy simplified inventory accounting, exemption from the uniform capitalization rules and the business interest deduction limit, and several other tax advantages. Be aware that some businesses are eligible for cash accounting even if their gross receipts are above the threshold, including S corporations, partnerships without any C corporation partners, farming businesses and certain personal service corporations. Also, tax shelters are ineligible for the cash method, regardless of size.

For most businesses, the cash method provides significant tax advantages. Because cash-basis businesses recognize income when it’s received and deduct expenses when they’re paid, they have greater control over the timing of income and deductions. For example, they can defer income by delaying invoices until the following tax year or shift deductions into the current year by accelerating the payment of expenses.

In contrast, accrual-basis businesses recognize income when it’s earned and deduct expenses when they’re incurred, without regard to the timing of cash receipts or payments. That means they have little flexibility to time the recognition of income or expenses for income tax purposes.

The cash method also provides cash flow benefits. Because income is taxed in the year it’s received, it helps ensure that a business has the funds it needs to pay its tax bill.

For some businesses, however, the accrual method may be preferable. For instance, if a company’s accrued income tends to be lower than its accrued expenses, the accrual method may result in lower tax liability than the cash method. Other potential advantages of using the accrual method include the abilities to deduct year-end bonuses paid within the first 2½ months of the following tax year and to defer taxes on certain advance payments.

Even if your business would enjoy a tax advantage by switching from the accrual method to the cash method, or vice versa, it’s important to consider the administrative costs involved in making the change. For example, if your business prepares its financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP), it’s required to use the accrual method for financial reporting purposes.

Does that mean you can’t use the cash method for tax purposes? No, but it would require the business to maintain two sets of books. Changing accounting methods for tax purposes may also require IRS approval. Contact us to learn more about each method.

© 2024

Employee Stock Ownership Plans (ESOPs) are a powerful tool for businesses and their employees. They offer a pathway for business owners to transition out of their companies smoothly and provide significant tax benefits that can enhance the financial well-being of both the company and its employees. This article will break down how ESOPs work, the tax advantages they offer, and how they can be strategically used in business succession planning.

An ESOP is a retirement plan that allows employees to own stock in the company they work for. Unlike traditional retirement plans such as 401(k)s, which typically invest in a diversified portfolio of stocks, bonds, and other assets, ESOPs invest primarily in the employer’s stock. This unique structure turns employees into stakeholders, aligning their interests with the company’s long-term success.

Here’s how an ESOP generally operates:

An ESOP can be an ideal succession strategy for business owners looking to retire or transition out of their business. By selling shares to an ESOP, owners can gradually transfer ownership to employees while retaining business control during the transition period. This can be especially beneficial in privately held companies, where finding an outside buyer might be challenging or where the owners want to ensure the business stays in the hands of trusted employees.

Moreover, because ESOPs provide significant tax advantages, the company may have more cash flow available to fund growth, pay down debt, or reinvest in the business, making it a financially attractive option for succession planning.

While the benefits of ESOPs are substantial, they are complex financial instruments that require careful planning and execution. Establishing and maintaining an ESOP involves legal, financial, and administrative considerations that professionals should handle. Therefore, business owners and employees alike must consult with a CPA or financial advisor who is experienced in ESOPs to ensure that the plan is set up and managed to maximize the potential benefits while minimizing risks.

In conclusion, ESOPs offer a win-win situation for both business owners and employees, providing a flexible and tax-advantaged way to transition ownership while aligning the interests of the company and its workers. However, as with any complex financial strategy, proper guidance from a CPA or financial advisor is essential to maximize this opportunity.

Let’s say you own real estate that has been held for more than one year and is sold for a taxable gain. Perhaps this gain comes from indirect ownership of real estate via a pass-through entity such as an LLC, partnership or S corporation. You may expect to pay Uncle Sam the standard 15% or 20% federal income tax rate that usually applies to long-term capital gains from assets held for more than one year.

However, some real estate gains can be taxed at higher rates due to depreciation deductions. Here’s a rundown of the federal income tax issues that might be involved in real estate gains.

The current maximum federal long-term capital gain tax rate for a sale of vacant land is 20%. The 20% rate only hits those with high incomes. Specifically, if you’re a single filer in 2024, the 20% rate kicks in when your taxable income, including any land sale gain and any other long-term capital gains, exceeds $518,900. For a married joint-filing couple, the 20% rate kicks in when taxable income exceeds $583,750. For a head of household, the 20% rate kicks when your taxable income exceeds $551,350. If your income is below the applicable threshold, you won’t owe more than 15% federal tax on a land sale gain. However, you may also owe the 3.8% net investment income tax (NIIT) on some or all of the gain.

Gain attributable to real estate depreciation calculated using the applicable straight-line method is called unrecaptured Section 1250 gain. This category of gain generally is taxed at a flat 25% federal rate, unless the gain would be taxed at a lower rate if it was simply included in your taxable income with no special treatment. You may also owe the 3.8% NIIT on some or all of the unrecaptured Section 1250 gain.

Qualified improvement property (QIP) generally means any improvement to an interior portion of a nonresidential building that’s placed in service after the date the building is placed in service. However, QIP does not include expenditures for the enlargement of the building, elevators, escalators or the building’s internal structural framework.

You can claim first-year Section 179 deductions or first-year bonus depreciation for QIP. When you sell QIP for which first-year Section 179 deductions have been claimed, gain up to the amount of the Section 179 deductions will be high-taxed Section 1245 ordinary income recapture. In other words, the gain will be taxed at your regular rate rather than at lower long-term gain rates. You may also owe the 3.8% NIIT on some or all of the Section 1245 recapture gain.

What if you sell QIP for which first-year bonus depreciation has been claimed? In this case, gain up to the excess of the bonus depreciation deduction over depreciation calculated using the applicable straight-line method will be high-taxed Section 1250 ordinary income recapture. Once again, the gain will be taxed at your regular rate rather than at lower long-term gain rates, and you may also owe the 3.8% NIIT on some or all of the recapture gain.

Tax planning point: If you opt for straight-line depreciation for real property, including QIP (in other words, you don’t claim first-year Section 179 or first-year bonus depreciation deductions), there won’t be any Section 1245 ordinary income recapture. There also won’t be any Section 1250 ordinary income recapture. Instead, you’ll only have unrecaptured Section 1250 gain from the depreciation, and that gain will be taxed at a federal rate of no more than 25%. However, you may also owe the 3.8% NIIT on all or part of the gain.

As you can see, the federal income tax rules for gains from sales of real estate may be more complicated than you thought. Different tax rates can apply to different categories of gain. And you may also owe the 3.8% NIIT and possibly state income tax, too. We will handle the details when we prepare your tax return. Contact us with questions about your situation.

© 2024

Get ready: The upcoming presidential and congressional elections may significantly alter the tax landscape for businesses in the United States. The reason has to do with a tax law that’s scheduled to expire in about 17 months and how politicians in Washington would like to handle it.

The Tax Cuts and Jobs Act (TCJA), which generally took effect in 2018, made extensive changes to small business taxes. Many of its provisions are set to expire on December 31, 2025.

As we get closer to the law sunsetting, you may be concerned about the future federal tax bill of your business. The impact isn’t clear because the Democrats and Republicans have different views about how to approach the various provisions in the TCJA.

The TCJA cut the maximum corporate tax rate from 35% to 21%. It also lowered rates for individual taxpayers involved in noncorporate pass-through entities, including S corporations and partnerships, as well as from sole proprietorships. The highest rate today is 37%, down from 39.6% before the TCJA became effective.

But while the individual rate cuts expire in 2025, the law made the corporate tax cut “permanent.” (In other words, there’s no scheduled expiration date. However, tax legislation could still raise or lower the corporate tax rate.)

In addition to lowering rates, the TCJA affects tax law in many other ways. For small business owners, one of the most significant changes is the potential expiration of the Section 199A qualified business income (QBI) deduction. This is the write-off for up to 20% of QBI from noncorporate entities.

Another of the expiring TCJA business provisions is the gradual phaseout of first-year bonus depreciation. Under the TCJA,100% bonus depreciation was available for qualified new and used property that was placed in service in calendar year 2022. It was reduced to 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026 and 0% in 2027.

The outcome of the presidential election in three months, as well as the balance of power in Congress, will determine the TCJA’s future. Here are four potential outcomes:

How your tax bill will be affected in 2026 will partially depend on which one of these outcomes actually happens and whether your tax bill went down or up when the TCJA became effective years ago. That was based on a number of factors including your business income, your filing status, where you live (the SALT limitation negatively affects taxpayers in certain states), and whether you have children or other dependents.

Your tax situation will also be affected by who wins the presidential election and who controls Congress because Democrats and Republicans have competing visions about how to proceed. Keep in mind that tax proposals can become law only if tax legislation passes both houses of Congress and is signed by the President (or there are enough votes in Congress to override a presidential veto).

Look to the future

As the TCJA provisions get closer to expiring, and the election gets settled, it’s important to know what might change and what tax-wise moves you can make if the law does change. We can answer any questions you have and you can count on us to keep you informed about the latest news.

© 2024

Most businesses have websites today. Despite their widespread use, the IRS hasn’t issued formal guidance on when website costs can be deducted.

But there are established rules that generally apply to the deductibility of business expenses and provide business taxpayers launching a website with some guidance about proper treatment. In addition, businesses can turn to IRS guidance on software costs. Here are some answers to questions you may have.

Let’s start with the hardware you may need to operate a website. The costs fall under the standard rules for depreciable equipment. Specifically, for 2024, once these assets are operating, you can deduct 60% of the cost in the first year they’re placed in service. This favorable treatment is allowed under the first-year bonus depreciation break.

Note: The bonus depreciation rate was 100% for property placed in service in 2022 and was reduced to 80% in 2023, 60% in 2024 and it will continue to decrease until it’s fully phased out in 2027 (unless Congress acts to extend or increase it).

Alternatively, you may be able to deduct all or most of these costs in the year the assets are placed in service under the Section 179 first-year depreciation deduction privilege. However, Sec. 179 deductions are subject to several limitations.

For tax years beginning in 2024, the maximum Sec. 179 deduction is $1.22 million, subject to a phaseout rule. Under the rule, the deduction is phased out if more than a specified amount ($3.05 million in 2024) of qualified property is placed in service during the year.

There’s also a taxable income limit. Under it, your Sec. 179 deduction can’t exceed your business taxable income. In other words, Sec. 179 deductions can’t create or increase an overall tax loss. However, any Sec. 179 deduction amount that you can’t immediately deduct is carried forward and can be deducted in later years (to the extent permitted by the applicable limits).

Similar rules apply to purchased off-the-shelf software. However, software license fees are treated differently from purchased software costs for tax purposes. Payments for leased or licensed software used for your website are currently deductible as ordinary and necessary business expenses.

If, instead of being purchased, the website is designed in-house by the taxpayer launching it (or designed by a contractor who isn’t at risk if the software doesn’t perform), bonus depreciation applies to the extent described above. If bonus depreciation doesn’t apply, the taxpayer can either:

Deduct the development costs in the year paid or incurred, or

Choose one of several alternative amortization periods over which to deduct the costs.

Generally, the only allowable treatment will be to amortize the costs over the five-year period beginning with the midpoint of the tax year in which the expenditures are paid or incurred.

If your website is primarily for advertising, you can currently deduct internal website software development costs as ordinary and necessary business expenses.

Some companies hire third parties to set up and run their websites. In general, payments to third parties are currently deductible as ordinary and necessary business expenses.

What about expenses before business begins?

Start-up expenses can include website development costs. Up to $5,000 of otherwise deductible expenses that are incurred before your business commences can generally be deducted in the year business commences. However, if your start-up expenses exceed $50,000, the $5,000 current deduction limit starts to be chipped away. Above this amount, you must capitalize some, or all, of your start-up expenses and amortize them over 60 months, starting with the month that business commences.

We can help

We can determine the appropriate tax treatment of website costs. Contact us if you want more information.

© 2024

While many facets of the economy have improved this year, the rising cost of living and other economic factors have caused many businesses to close their doors. If this is your situation, we can help you, including taking care of various tax responsibilities.

To start with, a business must file a final federal income tax return and some other related forms for the year it closes its doors. The type of return that must be filed depends on the type of business you have. For example:

If you have employees, you must pay them final wages and compensation owed, make final federal tax deposits and report employment taxes. Failure to withhold or deposit employee income, Social Security and Medicare taxes can result in full personal liability for what’s known as the Trust Fund Recovery Penalty.

If you’ve paid any contractors at least $600 during the calendar year in which you close your business, you must report those payments on Form 1099-NEC, “Nonemployee Compensation.”

If your business has a retirement plan for employees, you’ll generally need to terminate the plan and distribute benefits to participants. There are detailed notice, funding, timing and filing requirements that must be met when terminating a plan. There are also complex requirements related to flexible spending accounts, Health Savings Accounts, and other programs for employees.

We can assist you with many other complicated tax issues related to closing your business, including debt cancellation, use of net operating losses, freeing up any remaining passive activity losses, depreciation recapture, and possible bankruptcy issues.

You also must cancel your Employer Identification Number (EIN) and close your IRS business account. In addition, you need to keep business records for a certain amount of time.

If your business is unable to pay all the taxes it owes, we can explain the available payment options to you. Contact us to discuss these responsibilities and get answers to any questions.

© 2024

If you’re selling property used in your trade or business, you should understand the tax implications. There are many complex rules that can potentially apply. To simplify this discussion, let’s assume that the property you want to sell is land or depreciable property used in your business, and has been held by you for more than a year.

Note: There are different rules for property held primarily for sale to customers in the ordinary course of business, intellectual property, low-income housing, property that involves farming or livestock, and other types of property.

Under tax law, your gains and losses from sales of business property are netted against each other. The tax treatment is as follows:

1. If the netting of gains and losses results in a net gain, then long-term capital gain treatment results, subject to “recapture” rules discussed below. Long-term capital gain treatment is generally more favorable than ordinary income treatment.

2. If the netting of gains and losses results in a net loss, that loss is fully deductible against ordinary income. (In other words, none of the rules that limit the deductibility of capital losses apply.)

The availability of long-term capital gain treatment for business property net gain is limited by “recapture” rules. Under these rules, amounts are treated as ordinary income, rather than capital gain, because of previous ordinary loss or deduction treatment.

There’s a special recapture rule that applies only to business property. Under this rule, to the extent you’ve had a business property net loss within the previous five years, any business property net gain is treated as ordinary income instead of long-term capital gain.

Under the Internal Revenue Code, different provisions address different types of property. For example:

Other rules apply to, respectively, Section 1250 property that you placed in service before 1987 but after 1980 and Section 1250 property that you placed in service before 1981.

As you can see, even with the simple assumptions in this article, the tax treatment of the sale of business assets can be complex. Contact us if you’d like to determine the tax implications of transactions, or if you have any additional questions.

© 2024

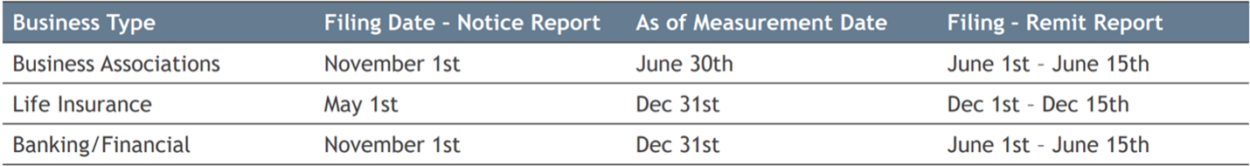

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

© 2024

A common question, and one where many taxpayers often make mistakes, is whether it is better to receive a home as a gift or as an inheritance. Generally, from a tax perspective, it is more advantageous to inherit a home rather than receive it as a gift before the owner’s death. This article will delve into the tax aspects of gifting a home, including gift tax implications, basis considerations for the recipient, and potential capital gains tax implications. Here are the key reasons why inheriting a home is often the better option.

Let’s first explore the tax ramifications of receiving a home as a gift. Gifting a home is a generous act with significant implications for both the donor and the recipient, particularly regarding taxes. Most gifts of this nature occur between parents and children, making it essential to understand the tax consequences.

When a homeowner gifts their home, the primary tax consideration is the federal gift tax. The Internal Revenue Service (IRS) requires individuals to file a gift tax return if the gift exceeds the annual exclusion amount of $18,000 per recipient for 2024. This amount is adjusted for inflation annually. Since a home’s value typically exceeds this amount, filing a Form 709 gift tax return is often necessary.

While a gift tax return may be required, actual gift tax may not be due because of the lifetime gift and estate tax exemption. For 2024, this exemption is $13.61 million per individual, meaning a person can gift up to this amount over their lifetime without incurring gift tax. The value of the home will count against this lifetime exemption.

The basis of the gifted property is a critical concept for the recipient. The recipient’s basis in the property is the same as the donor’s basis, known as “carryover” or “transferred” basis. For example, if a parent purchased a home for $200,000 and later gifts it to their child when its fair market value (FMV) is $500,000, the child’s basis in the home would be $200,000. If the parent made $50,000 in improvements, the adjusted basis would be $250,000, which would be the child’s starting basis.

This carryover basis can significantly impact the recipient if they sell the home. The capital gains tax will be calculated based on the difference between the sale price and the recipient’s basis. If the home has appreciated significantly, the recipient could face a substantial capital gains tax bill.

Homeowners who sell their homes may qualify for a $250,000 ($500,000 for married couples) home gain exclusion if they owned and used the residence for 2 of the prior 5 years. However, this gain qualification does not automatically pass on to the gift recipient. To qualify, the recipient must meet the 2 of the prior 5 years qualification. Thus, it may be tax-wise for the donor to sell the home, take the gain exclusion, and gift the cash proceeds.

The capital gains tax implications for the recipient of a gifted home are directly tied to the property’s basis and the donor’s holding period. If the recipient sells the home, they will owe capital gains tax on the difference between the sale price and their basis in the home. Given the carryover basis rule, this could result in a significant tax liability if the property has appreciated.

Sometimes, a homeowner may transfer the title but retain the right to live in it for their lifetime, establishing a de facto life estate. In such situations, the home’s value is included in the decedent’s estate upon their death, and the beneficiary’s basis would be the FMV at the date of death, potentially offering a step-up in basis and reducing capital gains tax implications.

There are significant differences between receiving a property as a gift and as an inheritance.

When you inherit a home, your basis in the property is generally “stepped up” to the FMV at the date of the decedent’s death. For example, if a home were purchased for $100,000 and is worth $300,000 at the time of the owner’s death, the inheritor’s basis would be $300,000. If sold for $300,000, there would be no capital gains tax on the sale.

The holding period for inherited property is always long-term, meaning gains are taxed at more favorable long-term capital gains rates.

The accumulated depreciation is reset for inherited property used for business or rental purposes, allowing the new owner to start depreciation afresh. This is not the case with gifted property, where the recipient takes over the giver’s depreciation schedule.

While each situation is unique and other factors might influence the decision, from a tax perspective, inheriting a property is often more beneficial than receiving it as a gift. Considering the overall estate planning strategy and potential non-tax implications is crucial. Consulting with a tax professional can provide personalized advice based on specific circumstances.

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages.

There are special tax breaks for hiring your offspring if you operate your business as one of the following:

These entities can hire an owner’s under-age-18 children as full- or part-time employees. The children’s wages then will be exempt from the following federal payroll taxes:

In addition, your dependent employee-child’s standard deduction can shelter from federal income tax up to $14,600 of 2024 wages from your business.

When hiring your child, you get a business tax deduction for employee wage expense. The deduction reduces your federal income tax bill, your self-employment tax bill and your state income tax bill, if applicable.

Note: There are different rules for corporations. If you operate as a C or S corporation, your child’s wages are subject to Social Security, Medicare and FUTA taxes, like any other employee’s. However, you can deduct your child’s wages as a business expense on your corporation’s tax return, and your child can shelter the wages from federal income tax with the $14,600 standard deduction for single filers.

No matter what type of business you operate, your child can contribute to an IRA or Roth IRA. With a Roth IRA, contributions are made with after-tax dollars. So, taxes are paid on the front end. After age 59½, the contributions and earnings that have accumulated in the account can be withdrawn free from federal income tax if the account has been open for more than five years.

In contrast, contributions to a traditional IRA are deductible, subject to income limits. So, unlike Roth contributions, deductible contributions to a traditional IRA lower the employee-child’s taxable income.

However, contributing to a Roth IRA is usually a much better idea for a young person than contributing to a traditional IRA for several reasons. Notably, your child probably won’t get any meaningful write-offs from contributing to a traditional IRA because the child’s standard deduction will shelter up to $14,600 of 2024 earned income. Any additional income will likely be taxed at very low rates.

In addition, your child can withdraw all or part of the annual Roth contributions — without any federal income tax or penalty — to pay for college or for any other reason. Of course, even though your child can withdraw Roth contributions without adverse tax consequences, the best strategy is to leave as much of the Roth balance as possible untouched until retirement to accumulate a larger tax-free sum.

The only tax law requirement for your child when making an annual Roth IRA contribution is having earned income for the year that at least equals what’s contributed for that year. There’s no age restriction. For the 2024 tax year, your child can contribute to an IRA or Roth IRA the lesser of:

Making modest Roth contributions can add up over time. For example, suppose your child contributes $1,000 to a Roth IRA each year for four years. The Roth account would be worth about $32,000 in 45 years when he or she is ready to retire, assuming a 5% annual rate of return. If you assume an 8% return, the account would be worth more than three times that amount.

Hiring your child can be a tax-smart idea. However, your child’s wages must be reasonable for the work performed. Be sure to maintain the same records as you would for other employees to substantiate the hours worked and duties performed. These include timesheets, job descriptions and W-2 forms. Contact us with any questions you have about employing your child at your small business.

© 2024

Now is an excellent time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum estimated tax amount without triggering the penalty for underpayment of estimated tax.

The required installment of estimated tax that a corporation must pay to avoid a penalty is the lowest amount determined under one of the following four methods:

Also, note that a corporation can switch among the four methods during a given tax year.

We can examine whether your corporation’s tax bill can be reduced. If you’d like to discuss this matter further, contact us.

© 2024

Navigating through various financial strategies is essential for any business owner aiming to enhance profitability and ensure sustainable growth. These financial benefits, offered by state governments, are designed to spur economic development and encourage investments within their jurisdictions. By leveraging such incentives, businesses can significantly reduce their tax liabilities, enhance cash flow, and optimize their financial strategy.

State tax credits and incentives are reductions in tax obligations provided by states to businesses that meet specific criteria. These can range from credits for job creation and investment in some geographic regions to incentives for implementing green initiatives or investing in new technology. Unlike deductions, which reduce the amount of income subject to tax, credits directly decrease the tax owed, often making them more valuable.

A typical scenario where a business might receive a state tax credit is through job creation incentives. For example, a company that expands its workforce might qualify for credits designed to encourage employment growth within the state. These credits often provide a direct offset against the business’s tax liability for each new job created under specific conditions such as salary levels and full-time status, aiming to stimulate local economic growth and reduce unemployment.

Reduced Tax Liability: One of the most immediate benefits of utilizing state tax credits and incentives is the potential reduction in tax liability. This helps improve your business’s bottom line and frees up resources that can be reinvested into the industry.

Enhanced Cash Flow: Many state tax incentives are refundable, which means they can provide cash refunds to businesses even if they owe no tax. This injection of cash can be crucial for funding operations, expansion, or new investments.

Strategic Business Growth: By taking advantage of incentives related to expansion or relocation, businesses can strategically position themselves in markets that offer the most economic benefit while minimizing costs.

Determining whether your business qualifies for specific state tax credits involves understanding the various criteria set by state laws. Typical qualifications include investing in property, creating jobs, or engaging in business activities such as research and development. Since these incentives vary widely from state to state and year to year, staying informed about the latest opportunities and legislative changes is vital.

Claiming these incentives can be complex, involving stringent compliance and reporting requirements. Additionally, the timing of claiming these credits is often critical, with many having specific filing deadlines or caps on the amount that can be claimed.

Given the complexities associated with state tax credits and incentives, consulting with a Certified Public Accountant (CPA) knowledgeable about tax law and the specifics of these incentives is crucial. A CPA can help you:

State tax credits and incentives represent a significant opportunity for business owners to reduce costs and enhance profitability. These financial tools can catalyze business growth and success with the right approach and professional guidance. As you consider your business’s financial planning and strategic direction, evaluating potential state tax credits and incentives with the help of a qualified CPA can provide a competitive edge and help ensure that your business thrives in an ever-evolving economic landscape.

The IRS recently released guidance providing the 2025 inflation-adjusted Health Savings Accounts (HSAs) amounts. These amounts are adjusted each year based on inflation, and the adjustments are announced earlier than other inflation-adjusted amounts, allowing employers to prepare for the next year.

An HSA is a trust created or organized exclusively to pay the qualified medical expenses of an account beneficiary. An HSA can only be established to benefit an eligible individual covered under a high-deductible health plan (HDHP). In addition, a participant can’t be enrolled in Medicare or have other health coverage (exceptions include dental, vision, long-term care, accident, and specific disease insurance).

Within specified dollar limits, an above-the-line tax deduction is allowed for an individual’s contribution to an HSA. This annual contribution limitation and the annual deductible and out-of-pocket expenses under the tax code are adjusted annually for inflation.

In Revenue Procedure 2024-25, the IRS released the 2025 inflation-adjusted figures for contributions to HSAs, which are as follows:

Annual contribution limits. For calendar year 2025, the annual contribution limit for an individual with self-only coverage under an HDHP will be $4,300, and for an individual with family coverage, it will be $8,550. These are up from $4,150 and $8,300, respectively, in 2024.

In addition, for 2024 and 2025, there’s a $1,000 catch-up contribution amount for those age 55 or older by the end of the tax year.

High-deductible health plan limits. For calendar year 2025, an HDHP will be a health plan with an annual deductible that isn’t less than $1,650 for self-only coverage or $3,300 for family coverage (these amounts are $1,600 and $3,200 for 2024). In addition, annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) won’t be able to exceed $8,300 for self-only coverage or $16,600 for family coverage (up from $8,050 and $16,100, respectively, for 2024).

The IRS also announced an inflation-adjusted Health Reimbursement Arrangements (HRAs) amount. An HRA must receive contributions from an eligible individual (employers can’t contribute). Contributions aren’t included in income, and HRA reimbursements for eligible medical expenses aren’t taxed. In 2025, the maximum amount that may be made newly available for the plan year for an excepted benefit HRA will be $2,150 (up from $2,100 in 2024).

There are a variety of benefits to HSAs that employers and employees appreciate. Contributions to the accounts are made on a pre-tax basis. The money can accumulate tax-free year after year and can be withdrawn tax-free to pay for a variety of medical expenses such as doctor visits, prescriptions, chiropractic care, and premiums for long-term care insurance. In addition, an HSA is “portable.” It stays with an account holder if he or she changes employers or leaves the workforce. Many employers find it to be a fringe benefit that attracts and retains employees. If you have questions about HSAs at your business, contact us.

© 2024

After experiencing a downturn in 2023, merger and acquisition activity in several sectors is rebounding in 2024. If you’re buying a business, you want the best results possible after taxes. You can potentially structure the purchase in two ways:

You must allocate the total purchase price to the specific assets acquired. The amount allocated to each asset becomes the initial tax basis of that asset.

For depreciable and amortizable assets (such as furniture, fixtures, equipment, buildings, software and intangibles such as customer lists and goodwill), the initial tax basis determines the post-acquisition depreciation and amortization deductions.

When you eventually sell a purchased asset, you’ll have a taxable gain if the sale price exceeds the asset’s tax basis (initial purchase price allocation, plus any post-acquisition improvements, minus any post-acquisition depreciation or amortization).

Let’s say you operate the newly acquired business as a sole proprietorship, a single-member LLC treated as a sole proprietorship for tax purposes, a partnership, a multi-member LLC treated as a partnership for tax purposes or an S corporation. In those cases, post-acquisition gains, losses and income are passed through to you and reported on your personal tax return. Various federal income tax rates can apply to income and gains, depending on the type of asset and how long it’s held before being sold.

If you operate the newly acquired business as a C corporation, the corporation pays the tax bills from post-acquisition operations and asset sales. All types of taxable income and gains recognized by a C corporation are taxed at the same federal income tax rate, which is currently 21%.

With an asset purchase deal, the most important tax opportunity revolves around how you allocate the purchase price to the assets acquired.

To the extent allowed, you want to allocate more of the price to:

Assets that generate higher-taxed ordinary income when converted into cash (such as inventory and receivables),

Assets that can be depreciated relatively quickly (such as furniture and equipment), and

Intangible assets (such as customer lists and goodwill) that can be amortized over 15 years.

You want to allocate less to assets that must be depreciated over long periods (such as buildings) and to land, which can’t be depreciated.

You’ll probably want to get appraised fair market values for the purchased assets to allocate the total purchase price to specific assets. As stated above, you’ll generally want to allocate more of the price to certain assets and less to others to get the best tax results. Because the appraisal process is more of an art than a science, there can potentially be several legitimate appraisals for the same group of assets. The tax results from one appraisal may be better for you than the tax results from another.

Nothing in the tax rules prevents buyers and sellers from agreeing to use legitimate appraisals that result in acceptable tax outcomes for both parties. Settling on appraised values becomes part of the purchase/sale negotiation process. That said, the appraisal that’s finally agreed to must be reasonable.

Remember, when buying the assets of a business, the total purchase price must be allocated to the acquired assets. The allocation process can lead to better or worse post-acquisition tax results. We can help you get the former instead of the latter. So get your advisor involved early, preferably during the negotiation phase.

© 2024

Choosing the right business entity has many implications, including the amount of your tax bill. The most common business structures are sole proprietorships, partnerships, limited liability companies, C corporations and S corporations.

In some cases, a business may decide to switch from one entity type to another. Although S corporations can provide substantial tax benefits over C corporations in some circumstances, there are potentially costly tax issues that you should assess before making the decision to convert from a C corporation to an S corporation.

Here are four considerations:

1. LIFO inventories. C corporations that use last-in, first-out (LIFO) inventories must pay tax on the benefits they derived by using LIFO if they convert to S corporations. The tax can be spread over four years. This cost must be weighed against the potential tax gains from converting to S status.

2. Built-in gains tax. Although S corporations generally aren’t subject to tax, those that were formerly C corporations are taxed on built-in gains (such as appreciated property) that the C corporation has when the S election becomes effective, if those gains are recognized within five years after the conversion. This is generally unfavorable, although there are situations where the S election still can produce a better tax result despite the built-in gains tax.

3. Passive income. S corporations that were formerly C corporations are subject to a special tax. It kicks in if their passive investment income (including dividends, interest, rents, royalties, and stock sale gains) exceeds 25% of their gross receipts, and the S corporation has accumulated earnings and profits carried over from its C corporation years. If that tax is owed for three consecutive years, the corporation’s election to be an S corporation terminates. You can avoid the tax by distributing the accumulated earnings and profits, which would be taxable to shareholders. Or you might want to avoid the tax by limiting the amount of passive income.

4. Unused losses. If your C corporation has unused net operating losses, they can’t be used to offset its income as an S corporation and can’t be passed through to shareholders. If the losses can’t be carried back to an earlier C corporation year, it will be necessary to weigh the cost of giving up the losses against the tax savings expected to be generated by the switch to S status.

These are only some of the factors to consider when switching a business from C to S status. For example, shareholder-employees of S corporations can’t get all the tax-free fringe benefits that are available as a C corporation. And there may be issues for shareholders who have outstanding loans from their qualified plans. These factors must be taken into account in order to understand the implications of converting from C to S status.

If you’re interested in an entity conversion, contact us. We can explain what your options are, how they’ll affect your tax bill and some possible strategies you can use to minimize taxes.

© 2024

Let’s say you plan to use a C corporation to operate a newly acquired business or you have an existing C corporation that needs more capital. You should know that the federal tax code treats corporate debt more favorably than corporate equity. So for shareholders of closely held C corporations, it can be a tax-smart move to include in the corporation’s capital structure:

Let’s review some basics. The top individual federal income tax rate is currently 37%. The top individual federal rate on net long-term capital gains and qualified dividends is currently 20%. On top of this, higher-income individuals may also owe the 3.8% net investment income tax on all or part of their investment income, which includes capital gains, dividends and interest.

On the corporate side, the Tax Cuts and Jobs Act (TCJA) established a flat 21% federal income tax rate on taxable income recognized by C corporations.

The non-tax advantage of using third-party debt financing for a C corporation acquisition or to supply additional capital is that shareholders don’t need to commit as much of their own money.

Even when shareholders can afford to cover the entire cost with their own money, tax considerations may make doing so inadvisable. That’s because a shareholder generally can’t withdraw all or part of a corporate equity investment without worrying about the threat of double taxation. This occurs when the corporation pays tax on its profits and the shareholders pay tax again when the profits are distributed as dividends.

When third-party debt is used in a corporation’s capital structure, it becomes less likely that shareholders will need to be paid taxable dividends because they’ll have less money tied up in the business. The corporate cash flow can be used to pay off the corporate debt, at which point the shareholders will own 100% of the corporation with a smaller investment on their part.

If your entire interest in a successful C corporation is in the form of equity, double taxation can arise if you want to withdraw some of your investment. But if you include owner debt (money you loan to the corporation) in the capital structure, you have a built-in mechanism for withdrawing that part of your investment tax-free. That’s because the loan principal repayments made to you are tax-free. Of course, you must include the interest payments in your taxable income. But the corporation will get an offsetting interest expense deduction — unless an interest expense limitation rule applies, which is unlikely for a small to medium-sized company.

An unfavorable TCJA change imposed a limit on interest deductions for affected businesses. However, for 2024, a corporation with average annual gross receipts of $30 million or less for the three previous tax years is exempt from the limit.

Let’s say you plan to use your solely owned C corporation to buy the assets of an existing business. You plan to fund the entire $5 million cost with your own money — in a $2 million contribution to the corporation’s capital (a stock investment), plus a $3 million loan to the corporation.

This capital structure allows you to recover $3 million of your investment as tax-free repayments of corporate debt principal. The interest payments allow you to receive additional cash from the corporation. The interest is taxable to you but can be deducted by the corporation, as long as the limitation explained earlier doesn’t apply.

This illustrates the potential federal income tax advantages of including debt in the capital structure of a C corporation. Contact us to explain the relevant details and project the tax savings.

© 2024

There are several financial and legal implications when adding a new partner to a partnership. Here’s an example to illustrate: You and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to the business. Assume that your basis in your partnership interests is sufficient so that the decrease in your portions of the partnership’s liabilities because of the new partner’s entry won’t reduce your basis to zero.

Although adding a new partner may appear to be simple, it’s important to plan the new person’s entry properly to avoid various tax problems. Here are two issues to consider:

The upshot of these rules is that the new partner must be allocated a portion of the depreciation equal to his or her share of the depreciable property based on current fair market value. This will reduce the amount of depreciation that can be taken by the current partners. The other outcome is that the built-in gain or loss on the partnership assets must be allocated to the current partners when the partnership assets are sold. The rules that apply in this area are complex, and the partnership may have to adopt special accounting procedures to cope with the relevant requirements.

Follow Your Basis

When adding a partner or making other changes, a partner’s basis in his or her interest can undergo frequent adjustment. It’s important to keep proper track of your basis because it can have an impact on these areas:

Contact us if you’d like assistance in dealing with these issues or any other issues that may arise in connection with your partnership.

© 2024

Businesses usually want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it wise to do the opposite? And why would you want to?

One reason might be tax law changes that raise tax rates. The Biden administration has proposed raising the corporate federal income tax rate from its current flat 21% to 28%. Another reason may be because you expect your noncorporate pass-through entity business to pay taxes at higher rates in the future and the pass-through income will be taxed on your personal return. There have also been discussions in Washington about raising individual federal income tax rates.

If you believe your business income could be subject to tax rate increases, you might want to accelerate income recognition into the current tax year to benefit from the current lower tax rates. At the same time, you may want to postpone deductions into a later tax year, when rates are higher and the deductions will be more beneficial.

Consider these options if you want to accelerate revenue recognition into the current tax year:

Consider the following actions to postpone deductions into a higher-rate tax year, which will maximize their value:

Contact us to discuss the best tax planning actions in the light of your business’s unique tax situation.

© 2024

Navigating the realm of capital gains and optimizing tax outcomes require strategic thinking and informed decision-making. Understanding and employing effective capital gains tax strategies is crucial for businesses contemplating asset sales or long-term investments. However, it’s important to note that every business situation is unique, and leveraging the expertise of a Certified Public Accountant (CPA) is advisable for tailored tax planning and advice.

Capital gains typically arise from selling an asset at a price higher than its purchase price. For small to medium-sized businesses, these gains can manifest in several common scenarios:

One fundamental strategy to manage capital gains involves the consideration of asset-holding periods. Long-term capital gains, typically from assets held for more than a year, are taxed at a lower rate than short-term gains from assets sold within a year of purchase. Planning the sale of assets to qualify for long-term capital gains tax rates can result in considerable tax savings.

Investing in designated Opportunity Zones offers another avenue for capital gains tax advantages. These investments encourage economic development in low-income areas, providing tax benefits such as deferral of capital gains taxes, potential reduction of the taxable amount, and, if held for at least 10 years, elimination of taxes on future appreciation of the Opportunity Zone investment. This strategy supports tax optimization and contributes to meaningful social impact.

For real estate investments, 1031 exchanges present a valuable strategy for deferring capital gains taxes. By reinvesting the proceeds from the sale of real estate into another property, businesses can defer the recognition of capital gains, thereby postponing tax liabilities. This tool is particularly useful for real estate investors looking to reinvest and grow their portfolios without the immediate tax burden.

The timing of asset sales and investments is crucial in managing capital gains and associated taxes. Monitoring market conditions and projecting future tax rate changes can guide strategic decision-making. Selling assets in a year when the business expects lower overall income may result in a lower tax rate on capital gains. Conversely, delaying asset sales or accelerating investment expenses can defer tax liabilities and improve cash flow in the short term.

Given the complexity of tax laws and the uniqueness of each business scenario, consulting with a CPA is invaluable. Tax professionals can provide personalized advice, ensuring compliance while optimizing tax strategies tailored to the business’s goals and circumstances. They can offer insights into current tax regulations, potential legislative changes, and their implications for your business strategy.

Managing capital gains effectively requires a multifaceted approach, incorporating strategic planning, understanding tax laws, and timely decision-making. Employing strategies such as optimizing asset holding periods, investing in Opportunity Zones, leveraging 1031 exchanges, and carefully timing asset sales can significantly impact a business’s tax liabilities and financial growth. Remember, each business’s situation is distinct, and professional advice from a CPA is essential to successfully navigate the complexities of capital gains tax planning.

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions.

For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $69,000 for 2024 (up from $66,000 for 2023). If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $69,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2024 by a whopping $22,080 (32% × $69,000).

There are more small business retirement plan options, including:

Depending on your situation, these plans may allow bigger or smaller deductible contributions than a SEP-IRA. For example, for 2024, a participant can contribute $23,000 to a 401(k) plan, plus a $7,500 “catch-up” contribution for those age 50 or older.

Thanks to a change made by the 2019 SECURE Act, tax-favored qualified employee retirement plans, except for SIMPLE-IRA plans, can now be adopted by the due date (including any extension) of the employer’s federal income tax return for the adoption year. The plan can then receive deductible employer contributions that are made by the due date (including any extension), and the employer can deduct those contributions on the return for the adoption year.

Important: This provision didn’t change the deadline to establish a SIMPLE-IRA plan. It remains October 1 of the year for which the plan is to take effect. Also, the SECURE Act change doesn’t override rules that require certain plan provisions to be in effect during the plan year, such as the provisions that cover employee elective deferral contributions (salary-reduction contributions) under a 401(k) plan. The plan must be in existence before such employee elective deferral contributions can be made.

For example, the deadline for the 2023 tax year for setting up a SEP-IRA for a sole proprietorship business that uses the calendar year for tax purposes is October 15, 2024, if you extend your 2023 tax return. The deadline for making a contribution for the 2023 tax year is also October 15, 2024. For the 2024 tax year, the deadline for setting up a SEP and making a contribution is October 15, 2025, if you extend your 2024 tax return. However, to make a SIMPLE-IRA contribution for the 2023 tax year, you must have set up the plan by October 1, 2023. So, it’s too late to set up a plan for last year.

While you can delay until next year establishing a tax-favored retirement plan for this year (except for a SIMPLE-IRA plan), why wait? Get it done this year as part of your tax planning, and start saving for retirement. We can provide more information on small business retirement plan options. Be aware that if your business has employees, you may have to make contributions for them, too.

© 2024

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim all the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in case you’re ever audited by the IRS.

Be aware that there’s no one way to keep business records. On its website, the IRS states: “You can choose any recordkeeping system suited to your business that clearly shows your income and expenses.” But there are strict rules when it comes to deducting legitimate expenses for tax purposes. And certain types of expenses, such as automobile, travel, meal and home office costs, require extra attention because they’re subject to special recordkeeping requirements or limitations on deductibility.

A business expense can be deducted if a taxpayer establishes that the primary objective of the activity is making a profit. To be deductible, a business expense must be “ordinary and necessary.” In one recent case, a married couple claimed business deductions that the IRS and the U.S. Tax Court mostly disallowed. The reasons: The expenses were found to be personal in nature and the taxpayers didn’t have adequate records for them.

In the case, the husband was a salaried executive. With his wife, he started a separate business as an S corporation. His sideline business identified new markets for chemical producers and connected them with potential customers. The couple’s two sons began working for the business when they were in high school.

The couple then formed a separate C corporation that engaged in marketing. For some of the years in question, the taxpayers reported the income and expenses of the businesses on their joint tax returns. The businesses conducted meetings at properties the family owned (and resided in) and paid the couple rent for the meetings.

The IRS selected the couple’s returns for audit. Among the deductions the IRS and the Tax Court disallowed:

The couple did prevail on deductions for contributions to 401(k) accounts for their sons. The IRS contended that the sons weren’t employees during one year in which contributions were made for them. However, the court found that 401(k) plan documents did mention the sons working in the business and the father “credibly recounted assigning them research tasks and overseeing their work while they were in school.” Thus, the court ruled the taxpayers were entitled to the retirement plan deductions. (TC Memo 2023-140)

As this case illustrates, a business can’t deduct personal expenses, and scrupulous records are critical. Make sure to use your business bank account for business purposes only. In addition, maintain meticulous records to help prepare your tax returns and prove deductible business expenses in the event of an IRS audit.

Contact us if you have questions about retaining adequate business records.

© 2024

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

© 2024

Your business should generally maximize current year depreciation write-offs for newly acquired assets. Two federal tax breaks can be a big help in achieving this goal: first-year Section 179 depreciation deductions and first-year bonus depreciation deductions. These two deductions can potentially allow businesses to write off some or all of their qualifying asset expenses in Year 1. However, they’re moving targets due to annual inflation adjustments and tax law changes that phase out bonus depreciation. With that in mind, here’s how to coordinate these write-offs for optimal tax-saving results.

Most tangible depreciable business assets — including equipment, computer hardware, vehicles (subject to limits), furniture, most software and fixtures — qualify for the first-year Sec. 179 deduction.

Depreciable real property generally doesn’t qualify unless it’s qualified improvement property (QIP). QIP means any improvement to an interior portion of a nonresidential building that’s placed in service after the date the building is placed in service — except for any expenditures attributable to the enlargement of the building, any elevator or escalator, or the internal structural framework. Sec. 179 deductions are also allowed for nonresidential building roofs, HVAC equipment, fire protection systems and security systems.

The inflation-adjusted maximum Sec. 179 deduction for tax years beginning in 2024 is $1.22 million. It begins to be phased out if 2024 qualified asset additions exceed $3.05 million. (These are up from $1.16 million and $2.89 million, respectively, in 2023.)

Most tangible depreciable business assets also qualify for first-year bonus depreciation. In addition, software and QIP generally qualify. To be eligible, a used asset must be new to the taxpayer.

For qualifying assets placed in service in 2024, the first-year bonus depreciation percentage is 60%. This is down from 80% in 2023.

The current Sec. 179 deduction rules are generous, but there are several limitations:

First-year bonus depreciation deductions aren’t subject to any complicated limitations. But, as mentioned earlier, the bonus depreciation percentages for 2024 and 2023 are only 60% and 80%, respectively.

So, the current tax-saving strategy is to write off as much of the cost of qualifying asset additions as you can with Sec. 179 deductions. Then claim as much first-year bonus depreciation as you can.

Example: In 2024, your calendar-tax-year C corporation places in service $500,000 of assets that qualify for both a Sec. 179 deduction and first-year bonus depreciation. However, due to the taxable income limitation, the company’s Sec. 179 deduction is limited to only $300,000. You can deduct the $300,000 on your corporation’s 2024 federal income tax return. You can then deduct 60% of the remaining $200,000 ($500,000 − $300,000), thanks to first-year bonus depreciation. So, your corporation can write off $420,000 in 2024 [$300,000 + (60% x $200,000) = $420,000]. That’s 84% of the cost! Note that the $200,000 bonus depreciation deduction will contribute to a corporate net operating loss that’s carried forward to your 2025 tax year.

As you can see, coordinating Sec. 179 deductions with bonus depreciation deductions is a tax-wise idea. We can provide details on how the rules work or answer any questions you have.

© 2024

If your small business is strapped for cash (or likes to save money), you may find it beneficial to barter or trade for goods and services. Bartering isn’t new — it’s the oldest form of trade — but the internet has made it easier to engage in with other businesses.

However, if your business begins bartering, be aware that the fair market value of goods that you receive in these types of transactions is taxable income. And if you exchange services with another business, the transaction results in taxable income for both parties.

Here are some examples of an exchange of services:

In these cases, both parties are taxed on the fair market value of the services received. This is the amount they would normally charge for the same services. If the parties agree to the value of the services in advance, that will be considered the fair market value unless there’s contrary evidence.

In addition, if services are exchanged for property, income is realized. For example:

Many businesses join barter clubs that facilitate barter exchanges. These clubs generally use a system of “credit units,” which are awarded to members who provide goods and services. The credits can be redeemed for goods and services from other members.

In general, bartering is taxable in the year it occurs. But if you participate in a barter club, you may be taxed on the value of credit units at the time they’re added to your account, even if you don’t redeem them for actual goods and services until a later year. For example, let’s say that you earn 2,500 credit units one year, and that each unit is redeemable for $2 in goods and services. In that year, you’ll have $5,000 of income. You won’t pay additional tax if you redeem the units the next year, since you’ve already been taxed on that income.

If you join a barter club, you’ll be asked to provide your Social Security number or Employer Identification Number. You’ll also be asked to certify that you aren’t subject to backup withholding. Unless you make this certification, the club is required to withhold tax from your bartering income at a 24% rate.

By January 31 of each year, a barter club will send participants a Form 1099-B, “Proceeds from Broker and Barter Exchange Transactions,” which shows the value of cash, property, services and credits that you received from exchanges during the previous year. This information will also be reported to the IRS.

By bartering, you can trade away excess inventory or provide services during slow times, all while hanging on to your cash. You may also find yourself bartering when a customer doesn’t have the money on hand to complete a transaction. As long as you’re aware of the federal and state tax consequences, these transactions can benefit all parties involved. Contact us if you need assistance or would like more information.

© 2024

For many business owners, taxes often represent a hurdle to clear rather than a strategic asset to leverage. However, those who look beyond mere compliance can unlock the transformative power of tax planning as a key driver for sustainable business growth. Rather than viewing tax as a static annual obligation, repositioning it as a dynamic component of your business strategy can substantially impact your bottom line. Effective tax planning goes beyond preparing for tax season; it integrates with your company’s financial decision-making process, influencing everything from cash flow management to long-term investment strategies. This article outlines practical steps for business owners to harness tax planning effectively in their growth strategies.

Initiate your tax strategy by comprehensively analyzing your company’s financial situation. Assess all aspects—revenue, expenses, investments, and potential risks—to understand your tax obligations. Engaging with financial advisors to conduct this analysis can uncover valuable tax-saving opportunities that align with your business growth plans.

Ensure that your tax strategies are in sync with your business objectives. If expansion or capital investments are on the horizon, tailor your tax approach to support these aims. This could involve tax planning methods like income deferral or identifying deductions that can be claimed to reduce taxable income, thereby aligning with your business’s future financial goals.

Stay informed about tax credits and incentives that could benefit your business. Regularly review government offerings for R&D, environmental initiatives, or employment practices, and consider how to integrate these into your tax planning effectively. Consult with tax professionals to apply these credits in the most advantageous ways for your business.

The timing of income recognition and expense incurrence is crucial. Make informed decisions about when to realize income and incur expenses to manage your tax liabilities effectively. Adjusting the timing can lead to a more favorable tax position and improved cash flow, aiding reinvestment in your business.

Invest in technology to enhance your tax planning and business management processes. Accounting software and automation tools can provide accurate, real-time data, allowing for better financial decisions. This technological support is essential for maintaining efficiency and compliance with tax obligations.

Review your compensation strategies to optimize tax outcomes for the business and employees. Consider various compensation models, such as deferred compensation plans or other fringe benefits, which may offer tax advantages while supporting your talent acquisition and retention objectives.

Business owners should view retirement planning as a component of the company’s tax strategy. Structuring retirement savings tax-efficiently benefits both the individual’s and the business’s future. This planning also involves considering the tax implications of business succession and transition.

Tax planning is more than compliance; it’s a critical element of a sustainable business strategy. While navigating through these areas, it’s essential to maintain a forward-thinking approach, utilize available resources, and continuously adapt to changing tax laws. Before implementing any tax-related changes, consult a CPA to ensure the strategies are appropriate and beneficial for your business’s unique context. This careful and informed approach to tax planning will support your business’s growth and stability over the long term.

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big tax saver.

The QBI deduction is written off at the owner level. It can be up to 20% of:

How is QBI defined? It’s qualified income and gains from an eligible business, reduced by related deductions. QBI is reduced by: 1) deductible contributions to a self-employed retirement plan, 2) the deduction for 50% of self-employment tax, and 3) the deduction for self-employed health insurance premiums.

Unfortunately, the QBI deduction doesn’t reduce net earnings for purposes of the self-employment tax, nor does it reduce investment income for purposes of the 3.8% net investment income tax (NIIT) imposed on higher-income individuals.

At higher income levels, QBI deduction limitations come into play. For 2024, these begin to phase in when taxable income before any QBI deduction exceeds $191,950 ($383,900 for married joint filers). The limitations are fully phased in once taxable income exceeds $241,950 or $483,900, respectively.

If your income exceeds the applicable fully-phased-in number, your QBI deduction is limited to the greater of: 1) your share of 50% of W-2 wages paid to employees during the year and properly allocable to QBI, or 2) the sum of your share of 25% of such W-2 wages plus your share of 2.5% of the unadjusted basis immediately upon acquisition (UBIA) of qualified property.

The limitation based on qualified property is intended to benefit capital-intensive businesses such as hotels and manufacturing operations. Qualified property means depreciable tangible property, including real estate, that’s owned and used to produce QBI. The UBIA of qualified property generally equals its original cost when first put to use in the business.

Finally, your QBI deduction can’t exceed 20% of your taxable income calculated before any QBI deduction and before any net capital gain (net long-term capital gains in excess of net short-term capital losses plus qualified dividends).

For a specified service trade or business (SSTB), the QBI deduction begins to be phased out when your taxable income before any QBI deduction exceeds $191,950 ($383,900 for married joint filers). Phaseout is complete if taxable income exceeds $241,950 or $483,900, respectively. If your taxable income exceeds the applicable phaseout amount, you’re not allowed to claim any QBI deduction based on income from a SSTB.

Other rules apply to this tax break. For example, you can elect to aggregate several businesses for purposes of the deduction. It may allow someone with taxable income high enough to be affected by the limitations described above to claim a bigger QBI deduction than if the businesses were considered separately.

There also may be an impact for claiming or forgoing certain deductions. For example, in 2024, you can potentially claim first-year Section 179 depreciation deductions of up to $1.22 million for eligible asset additions (subject to various limitations). For 2024, 60% first-year bonus depreciation is also available. However, first-year depreciation deductions reduce QBI and taxable income, which can reduce your QBI deduction. So, you may have to thread the needle with depreciation write-offs to get the best overall tax result.

The QBI deduction is scheduled to disappear after 2025. Congress could extend it, but don’t count on it. So, maximizing the deduction for 2024 and 2025 is a worthy goal. We can help.

© 2024

The credit for increasing research activities, often referred to as the research and development (R&D) credit, is a valuable tax break available to certain eligible small businesses. Claiming the credit involves complex calculations, which we’ll take care of for you.

But in addition to the credit itself, be aware that there are two additional features that are especially favorable to small businesses:

Let’s take a look at the second feature. The Inflation Reduction Act (IRA) has doubled the amount of the payroll tax credit election for qualified businesses and made a change to the eligible types of payroll taxes it can be applied to, making it better than it was before the law changes kicked in.

Subject to limits, your business can elect to apply all or some of any research tax credit that you earn against your payroll taxes instead of your income tax. This payroll tax election may influence you to undertake or increase your research activities. On the other hand, if you’re engaged in — or are planning to undertake — research activities without regard to tax consequences, you could receive some tax relief.