A measure to extend the Paycheck Protection Program (PPP) application deadline from March 31, 2021, to May 31, 2021, has passed the U.S. House of Representatives and the Senate. It now heads to President Biden’s desk for signature which he is expected to do promptly.

Small businesses will have until May 31, 2021, to continue submitting first and second-draw PPP loan applications to the Small Business Administration (SBA). The SBA was also granted an additional 30 days past May 31 to finish processing applications. The measure does not include any funding increases for the program.

Contact us for assistance with your PPP loan or forgiveness applications.

President Biden signed the $1.9 trillion American Rescue Plan Act (ARPA) on March 11. While the new law is best known for the provisions providing relief to individuals, there are also several tax breaks and financial benefits for businesses.

Here are some of the tax highlights of the ARPA.

The Employee Retention Credit (ERC). This valuable tax credit is extended from June 30 until December 31, 2021. The ARPA continues the ERC rate of credit at 70% for this extended period of time. It also continues to allow for up to $10,000 in qualified wages for any calendar quarter. Taking into account the Consolidated Appropriations Act extension and the ARPA extension, this means an employer can potentially have up to $40,000 in qualified wages per employee through 2021.

Employer-Provided Dependent Care Assistance. In general, an eligible employee’s gross income doesn’t include amounts paid or incurred by an employer for dependent care assistance provided to the employee under a qualified dependent care assistance program (DCAP).

Previously, the amount that could be excluded from an employee’s gross income under a DCAP during a tax year wasn’t more than $5,000 ($2,500 for married individuals filing separately), subject to certain limitations. However, any contribution made by an employer to a DCAP can’t exceed the employee’s earned income or, if married, the lesser of employee’s or spouse’s earned income.

Under the ARPA, for 2021 only, the exclusion for employer-provided dependent care assistance is increased from $5,000 to $10,500 (from $2,500 to $5,250 for married individuals filing separately).

This provision is effective for tax years beginning after December 31, 2020.

Paid Sick and Family Leave Credits. Changes under the ARPA apply to amounts paid with respect to calendar quarters beginning after March 31, 2021. Among other changes, the law extends the paid sick time and paid family leave credits under the Families First Coronavirus Response Act from March 31, 2021, through September 30, 2021. It also provides that paid sick and paid family leave credits may each be increased by the employer’s share of Social Security tax (6.2%) and employer’s share of Medicare tax (1.45%) on qualified leave wages.

Grants to restaurants. Under the ARPA, eligible restaurants, food trucks, and similar businesses that provide food and drinks may receive restaurant revitalization grants from the Small Business Administration. For tax purposes, amounts received as restaurant revitalization grants aren’t included in the gross income of the person who receives the money.

Much more

These are only some of the provisions in the ARPA. There are many others that may be beneficial to your business. Contact us for more information about your situation.

© 2021

The American Rescue Plan Act (ARPA) of 2021 passed Congress and President Biden signed the bill into law on March 12, 2021. The ARPA approves $1.9 trillion in spending for individuals, businesses, governments, and certain industries impacted by the COVID-19 pandemic. The third Act in a year, the ARPA approves additional economic impact payments for individuals; the extension of federal unemployment benefits; additional funds for Paycheck Protection Program (PPP) Loans, and Economic Injury Disaster Loans (EIDL) for hard-hit small businesses; and grants for food and beverage establishments. Here are the key individual and business provisions in the bill.

The bill extends and slightly alters two key benefits many individuals have been relying upon through the pandemic.

Unemployment – Federal benefits of $300 per week (in addition to state benefits) are extended through Sep. 6, 2021. The first $10,200 in federal unemployment benefits is tax-free for households making less than $150,000 per year in 2020. Taxpayers who received unemployment income may need to update 2020 tax returns if already filed.

Economic impact (stimulus) payments (EIPs) – The IRS will issue another round of EIPs at $1,400 per individual, $2,800 per married filing joint (MFJ), plus $1,400 per dependent. Income phase-out limits reduce from previous EIPs to $80,000 for individuals and $150,000 for MFJ. Full-time students under the age of 24 are now eligible for economic impact payments (EIP), unlike previous rounds. Your 2019 or 2020 adjusted gross income (AGI) is the basis for EIPs, so taxpayers will want to consider when to file their 2020 tax return to ensure a maximum EIP benefit.

The bill includes additional funding for small business relief programs, including the PPP, EIDLs, and industry-specific relief.

PPP – The Act allocates an additional 7.25 billion in additional funds, and the eligibility expands to include:

The deadline is still Mar. 31, 2021, to apply, so don’t delay.

EIDL advance payments – The Act allocates $15 billion for EIDL advance payments, and eligibility requirements state:

Restaurants, bars, and other eligible food and beverage providers – The Act allocates $28.6 billion for grants, and $5 billion is set aside for applicants with 2019 gross receipts of $500,000 or less.

Shuttered venue operators – The program is extended from the Consolidated Appropriations Act (CAA) with $1.25 billion allocated.

Community navigator pilot programs – $175 million is allocated for programs that increase awareness of and participation in COVID-19 relief programs for socially and economically disadvantaged business owners.

For assistance with any of these provisions, please contact us.

Form 1040, Schedule C taxpayers received an updated interim final rule (IFR) on the Paycheck Protection Program (PPP) from the Small Business Association (SBA). The IFR clarifies guidance released on Feb. 22 that made changes to how self-employed and sole proprietors could calculate their maximum loan amount to help expand the program for these groups. Approximately 2.6 million sole proprietors have applied for PPP loans, and it is estimated there are about 25 million sole proprietors across the country.

The biggest adjustment made by the IFR is that these borrowers may calculate their maximum loan amount using their gross income. Previously, the calculation was done by using payroll costs plus net profits. This excluded many sole proprietors who had little or negative net profit.

For sole proprietors with no employees the calculation is as follows:

First-draw and second-draw owner compensation is capped at $20,833; however, for accommodations and food services, second-draw owner compensation is capped at $29,167

For sole proprietors with employees, the calculation is as follows: Use either line 31 net profit or calculate the following using gross receipts:

The same owner compensation limits apply as for those with no employees.

Limited liability companies with only one member do qualify for these updated calculations, but single member S-corporations do not.

The calculation is only for loans submitted after the rule’s effective date of Mar. 3, 2021, meaning loans submitted between Jan. 1 and Mar. 2, 2021, would not be eligible for this new calculation. You can access the new forms here:

Additionally, the IFR states that first-draw PPP loans with $150,000 or less in gross income on a Schedule C will be eligible for the economic necessity safe harbor, but loans above will not and could receive additional SBA review.

The current PPP application period expires Mar. 31, 2021, and lenders are experiencing delays in implementing these new calculations. It is anticipated they will begin accepting applications the week of Mar. 8. We are continuously monitoring the situation for additional clarifications and updates.

The nation’s smallest businesses are getting revamped Paycheck Protection Program (PPP) rules and a special filing period announced in recent changes from the Biden-Harris administration. Small businesses with fewer than 20 employees make up 98% of the small businesses in the U.S. but have not received much assistance from the PPP so far and have accounted for a significant portion of business closures during the pandemic. These new rules seek to remedy that. Here’s what you should know.

Dedicated filing period – Small businesses with fewer than 20 employees will get a dedicated filing period starting Wednesday, Feb. 24 and running through Tuesday, March 9 to allow lenders to focus on loans for these businesses. This includes individuals who receive 1099s or are considered self-employed who file a Schedule C.

New calculations for ‘no-payroll’ business owners – Specifics have not yet been released, but self-employed, independent contractors, and sole proprietors can expect a new calculation method to account for the missing payroll component of their PPP loans. Additionally, $1 billion is being set aside for this group for those located in low and moderate-income areas.

More opportunities for underserved communities – Former felons (with nonfraud convictions) and non-citizen small business owners with Individual Taxpayer Identification Numbers (ITINs), green card holders, and those with visas will be eligible to apply for relief. Further guidance is expected.

Greater access for business owners with delinquent student loan debt – Business owners with delinquent or defaulted federal debt over the last seven years will now be able to apply for a PPP loan.

Address PPP processing delays – Anti-fraud violation checks have been a significant hold up for PPP processing, and the White House expects to continue to work with the Small Business Administration (SBA) to address this issue while maintaining program integrity.

Further guidance is expected in many of these areas, and we will continue to update you as it becomes available. Contact us for assistance with your PPP loan application or forgiveness application.

Last spring, the CARES Act created the ERC for businesses that were affected by the COVID-19 pandemic. However, the CARES Act disallowed the credit for businesses that received a Paycheck Protection Program (PPP) loan. Fast forward to December 2020, when Congress declared that businesses that had obtained PPP loans could also qualify for the ERC. In addition, Congress extended the availability of the ERC into the first two quarters of 2021, with a few new favorable provisions. The credit is refundable, which means that qualified businesses are able to get cash to the extent that the credit exceeds the payroll tax liabilities. The chart below outlines the terms of the ERC for both the original and extended filing periods:

|

As I previously noted, a business cannot “double dip,” or utilize the same wages to obtain PPP loan forgiveness while still benefiting from the ERC. However, the ERC was not available to PPP recipients prior to December 27, 2020. Accordingly, those businesses that applied for loan forgiveness would have included all eligible payroll costs paid or incurred during the covered period pursuant to the instructions in the loan forgiveness applications. Certainly, those businesses shouldn’t be penalized for already receiving forgiveness prior to this change in the law; however, this wouldn’t be the first time we’ve seen something like that with the evolution of the PPP.

On January 15, the American Institute of Certified Public Accountants (AICPA) sought clarification on this matter. In a letter to the IRS, the AICPA “recommends that the IRS and Treasury provide guidance stating that the filing of a PPP loan forgiveness application does not constitute an election to forgo the ERC with respect to the amount of wages reported on the application exceeding the amount of wages necessary for loan forgiveness.” It is clear — additional guidance is imminent.

As we await clarification from the IRS, businesses who have already received forgiveness on their PPP loans should first evaluate their eligibility for the ERC. After concluding their eligibility, businesses should begin gathering payroll reports, government shutdown orders and financial statements to calculate and claim their credits.

Borrowers of PPP loans who have yet to apply for loan forgiveness have an alternative path; those businesses looking to leverage the ERC now have an additional element to consider in their evolving journey to loan forgiveness. This change in guidance further emphasizes the importance of an intentional strategy to maximize the benefits of both programs, but also leaves questions unanswered for borrowers who have already received forgiveness on their PPP loans.

The Small Business Administration (SBA) announced that the Paycheck Protection Program (PPP) reopened the week of January 11. If you’re fortunate to get a PPP loan to help during the COVID-19 crisis (or you received one last year), you may wonder about the tax consequences.

In March of 2020, the CARES Act became law. It authorized the SBA to make loans to qualified businesses under certain circumstances. The law established the PPP, which provided up to 24 weeks of cash-flow assistance through 100% federally guaranteed loans to eligible recipients. Taxpayers could apply to have the loans forgiven to the extent their proceeds were used to maintain payroll during the COVID-19 pandemic and to cover certain other expenses.

At the end of 2020, the Consolidated Appropriations Act (CAA) was enacted to provide additional relief related to COVID-19. This law includes funding for more PPP loans, including a “second draw” for businesses that received a loan last year. It also allows businesses to claim a tax deduction for the ordinary and necessary expenses paid from the proceeds of PPP loans.

The CAA permits certain smaller businesses who received a PPP loan and experienced a 25% reduction in gross receipts to take a PPP second draw loan of up to $2 million.

To qualify for a second draw loan, a taxpayer must have taken out an original PPP Loan. In addition, prior PPP borrowers must now meet the following conditions to be eligible:

To be eligible for full PPP loan forgiveness, a business must generally spend at least 60% of the loan proceeds on qualifying payroll costs (including certain health care plan costs) and the remaining 40% on other qualifying expenses. These include mortgage interest, rent, utilities, eligible operations expenditures, supplier costs, worker personal protective equipment and other eligible expenses to help comply with COVID-19 health and safety guidelines or equivalent state and local guidelines.

Eligible entities include for-profit businesses, certain non-profit organizations, housing cooperatives, veterans’ organizations, tribal businesses, self-employed individuals, sole proprietors, independent contractors and small agricultural co-operatives.

The CARES Act didn’t address whether expenses paid with the proceeds of PPP loans could be deducted on tax returns. Last year, the IRS took the position that these expenses weren’t deductible. However, the CAA provides that expenses paid from the proceeds of PPP loans are deductible.

Generally, when a lender reduces or cancels debt, it results in cancellation of debt (COD) income to the debtor. However, the forgiveness of PPP debt is excluded from gross income. Your tax attributes (net operating losses, credits, capital and passive activity loss carryovers, and basis) wouldn’t generally be reduced on account of this exclusion.

This only covers the basics of applying for PPP loans, as well as the tax implications. Contact us if you have questions or if you need assistance in the PPP loan application or forgiveness process.

© 2021

The employee retention tax credit (ERTC) is intended to provide liquidity to employers during the pandemic and was greatly expanded in the Consolidated Appropriations Act of 2021 thanks to Sections 206 and 207 of the Taxpayer Certainty and Disaster Relief Act portion, opening the doors to more businesses to be able to qualify for and receive this credit who are facing significant hardship as a result of the coronavirus pandemic. Many changes from the original credit were enacted including an expansion in the amount of credit and business eligibility, and how it plays with the Paycheck Protection Program (PPP).

Here’s what you need to know about this credit, how it works, and how to apply. Note that when a provision is designated as effective Jan. 1, 2021, it does not apply to any retroactive credit claims.

The following businesses and organizations engaged in a trade or business are eligible to qualify for the ERTC:

An eligible organization can qualify for the ERTC if:

The gross receipts test is Effective Jan. 1, 2021, this is an increase from the previous law and expands the threshold for eligible businesses.

Effective Jan. 1, 2021, businesses with 500 employees or less are eligible to claim the credit even if an employee is working during the first two quarters of 2021 (an increase in the threshold from 100 employees in the original law). For affiliated companies sharing more than 50% common ownership, the 500 count is aggregated.

The passage of the bill at the end of December extended the availability of the ERTC through the first two quarters of 2021, allowing for more relief as the pandemic continues on. Qualified wages paid after March 12, 2020, and before July 1, 2021, are eligible for the credit.

Additionally, the new law will allow for an advanced credit for companies with 500 or fewer employees, allowing these companies to monetize the credit before wages are paid. The amount is based on 70% of the average quarterly payroll for the same quarter in 2019, and if there is excess advance payment, companies will need to repay the credit to the government.

Effective Jan. 2021, 70% of qualified wages are eligible for the ERTC including the cost to continue providing health benefits (such as if an employee is on furlough). This is an increase from the 50% provided in the previous stimulus bill. The qualified wage limit was increased to $10,000 per quarter per employee for the first 2 quarters of 2020. Previously was $10,000 per employee for the entirety of 2020.

Also, effective Jan. 1, 2021, the credit maxes out at an aggregate $14,000 per employee, or $7,000 for the first two quarters of 2021, and is available even if the employer received the maximum credit for wages paid to the same employee in 2020. This is an increase from the $5,000 max in the previous bill.

Additionally, the credit is now available for certain pay raises including hazardous duty pay increases (previously not allowed and is retroactive).

First and foremost, companies with PPP loans can now also claim the ERTC, and the change is retroactive to the effective date of the original law (March 12, 2020). Key to note is that the ERTC cannot be applied toward wages covered by the PPP.

If, for example, your business received a PPP loan in 2020 and paid qualified wages in excess of the PPP loan amount, you could qualify and apply for the ERTC through an amended employment tax return (Forms 941X). This also applies to affiliate companies related to a PPP borrower. Furthermore, if your PPP payroll costs are not forgiven, those same payroll costs can be applied toward ERTC qualified wages. Your accountant can help you calculate and designate these costs.

Claiming the ERTC, with or without a PPP loan, requires careful calculation and documentation. Contact us for assistance with this credit.

The U.S. Small Business Administration (SBA) and Treasury have announced that lenders with $1 billion or less in assets will be able to open applications for the next round of Paycheck Protection Program (PPP) funding starting Friday, Jan. 15 at 9 a.m. ET. Both first and second-draw loans will be able to apply at that time. For large lenders, the application opens on Tuesday, Jan. 19 for first and second-draw loans.

Community financial institutions (CFIs) began accepting applications for underserved small businesses on Jan. 11 for first-draw loans and Jan. 13 for second-draw loans. More than 9,100 applications were submitted so far totaling over $1.4 billion of the $284.5 billion available in this round of funding.

As a reminder, the second round of PPP funding expanded certain provisions of the original program including:

You can read more about the provisions of the second round of PPP funding in our blog. Contact us for assistance with a first or second-draw PPP loan and your forgiveness application.

Three new interim final rules (IFRs) for the Paycheck Protection Program (PPP) have been released from the Small Business Administration (SBA) and Treasury in response to the changes and second round of funding enacted by the relief portion of the Consolidated Appropriations Act signed at the end of December.

Here’s the breakdown on the first two IFRs.

First-time borrowers of PPP forgivable loans received consolidated rules in the IFR “Business Loan Program Temporary Changes; Paycheck Protection Program as Amended” as well as an outline of changes made by the Act. Here’s what this rule clarified:

Additionally, specific funds were set aside for minority, underserved, veteran, and women-owned businesses. When the PPP portal reopens on Monday, Jan. 11, lenders for underserved communities will have exclusive access for two days for first-draw loans and will be able to offer second-draw loans on Wednesday, Jan. 13. The portal will be open to all borrowers following these exclusive access days.

In the IFR “Business Loan Program Temporary Changes; Paycheck Protection Program Second Draw Loans,” much-awaited guidance was released for those looking to apply for a second PPP loan. Here’s what it said:

Eligible borrowers must

In an IFR released on Jan. 19, the SBA and Treasury made a few notable changes and clarifications to the PPP that apply regardless of which type of forgiveness application a business uses. Here are the key points:

Additionally, the three forgiveness applications have been updated to account for changes in these IFRS. Here are the links:

New PPP application forms have been released for first or second-draw loans. We will continue to update you as further guidance becomes available. Contact us for assistance with your application for a first or second-draw loan or forgiveness.

The U.S. House of Representatives and U.S. Senate have passed the Coronavirus Response & Relief Supplemental Appropriations Act, and President Trump is expected to sign the bill immediately. The agreement comes after weeks of negotiations and two funding extensions to keep Congress open until a bill was passed with a $1.4 trillion government-wide funding plan. The $900 billion coronavirus relief portion includes another round of Paycheck Protection Program (PPP) funding, extended unemployment benefits, and direct payments to taxpayers. Here’s an overview of the key provisions in the bill.

The Act designates $267.5 billion for this round of PPP funding, and the program specifically sets aside $25 billion for businesses with 10 employees or less as of Feb. 15, 2020. Regulations for this round of PPP funding are required to be released within 10 days of enactment.

Borrowers who received PPP funding in the first round following the CARES Act will receive some additional updates to their existing PPP loans. Borrowers who would like to adjust their requested loan amount based on these updated regulations may do so, provided they have not yet received forgiveness. Here are the key updates:

The second round of funding provided by this Act has a few key differences from the first round in the CARES Act. Key to note is that borrowers can apply for a second PPP loan through this program if they have fully used their first PPP loan and meet the employer size and gross revenue criteria listed below. PPP loans in this round are capped at $2 million. Here are the key differences:

As with the first round of PPP loans, 60% of the funds must be spent on payroll over the covered period (8 or 24 weeks).

Further guidance and regulations are expected in various components of the bill and are due in periods of 10 to 45 days depending on the issue and reporting agency. Not included in the bill was aid for state and local governments, an agreement on liability protections for businesses, nor a continued freeze on payments and interest for federal student loans set to expire for many in February. Lawmakers have indicated they expect to pass another stimulus bill addressing some of these issues in early 2021.

More guidance and updates are expected on the Coronavirus Response & Relief Supplemental Appropriations Act. Stay tuned for more details in the days and weeks to come.

Please note that information and guidance on the PPP loan program is changing on a daily basis. The information provided in this article is current as of December 22, 2020. It is intended for general informational purposes only. Consult with your financial advisor about your specific situation.

On November 18, 2020, the Internal Revenue Service issued Revenue Ruling 2020-27 which provides needed clarity on a taxpayers’ ability to deduct eligible expenses for Paycheck Protection Program (PPP) loan forgiveness.

The Ruling notes that a taxpayer that received a covered loan guaranteed under the PPP and paid or incurred certain otherwise deductible expenses listed in section 1106(b) of the CARES Act may not deduct those expenses in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the covered loan on the basis of the expenses it paid or accrued during the covered period, even if the taxpayer has not submitted an application for forgiveness of the covered loan by the end of such taxable year.

What if forgiveness is denied, in whole or part, or not requested?

In conjunction with the Ruling, the IRS issued Revenue Procedure 2020-51 to outline the steps for when:

1.) The eligible expenses are paid or incurred during the taxpayer’s 2020 taxable year,

2.) The taxpayer receives a covered loan guaranteed under the PPP, which at the end of the taxpayer’s 2020 taxable year the taxpayer expects to be forgiven in a subsequent taxable year, and

3.) In a subsequent taxable year, the taxpayer’s request for forgiveness of the covered loan is denied, in whole or in part, or the taxpayer decides never to request forgiveness of the covered loan.

The Rev Procedure provides for two safe harbors for taxpayers in the event forgiveness is denied, in whole or in part, or otherwise not requested that would allow for the deduction of expenses in either the 2020 or a subsequent tax year.

Questions we still have

While the Ruling provides information on the deductibility of expenses and the tactical approach for borrowers whose forgiveness is denied or not requested, additional clarification is still needed. This guidance does not address the order in which the eligible expenses (payroll, rent, utilities and mortgage interest) lose the ability to be deducted.

Further, the guidance does not address other matters that could have significant tax implications including, but not limited to, the impact on the following:

Need Assistance in Choosing the Right PPP Loan Forgiveness Application?

We have put together a flowchart that can help: How to Select the Right Loan Forgiveness Application

The Small Business Administration (SBA) and Treasury announced on October 8 that a simplified application (Form 3508S) for Paycheck Protection Program (PPP) loan forgiveness is now available for borrowers whose loans fall in the $50,000 or less threshold. As more and more businesses begin filing for PPP loan forgiveness, this change outlined in a new interim final rule greatly simplifies the process for borrowers with smaller loans. However, it is important to note that this simplified form is not equal to automatic forgiveness.

Among the simplified provisions for borrowers with $50,000 or less in PPP loans is the exemption from a reduction in forgiveness based on reductions in full-time-equivalent (FTE) employees as well as reductions in employee salaries or wages. While certifications and documentation of payroll and non-payroll costs will still be required, this move streamlines the process significantly for borrowers with smaller loans who will not be responsible for potentially complicated calculations for FTE and salary reductions.

Borrowers with loans of $50,000 or less who are also included in affiliate loans totaling $2 million or more are not eligible for the new application. The SBA estimates that approximately 3.57 million loans were issued for $50,000 or less or $63 billion of the PPP funds, and that about 1.71 million of the loans were for businesses with one or zero employees.

Below are additional considerations to keep in mind:

Lenders should note the further guidance on their responsibilities released with the notice which includes review of borrower documentation for eligible costs for forgiveness for all forgiveness applications. Lenders are required to confirm receipt of the borrower certifications the borrower’s documentation of payroll and non–payroll costs. Borrowers are responsible for their calculations and accuracy of the information provided, and lenders are permitted to rely on what the borrower has submitted.

It’s important to note that the amount of forgiveness cannot exceed the principal amount of the loan even if a borrower submits documentation for eligible costs exceeding the amount of their PPP loan.

Regardless of what form is submitted for forgiveness, lenders must:

Many questions remain about the tax treatment of some expenses that fall under the PPP. Contact your CPA for assistance with your forgiveness application and to have a thorough discussion about the impact your PPP loan has on your tax strategy and when is the best time to apply for forgiveness.

With the M&A market in flux after all the unexpected challenges of 2020, buyers and sellers are likely wondering how their Paycheck Protection Program (PPP) loan comes into play in an M&A transaction. On Oct. 2, we got some answers when the Small Business Administration (SBA) released guidance on what to do if you are buying or selling a business with a PPP loan. The Procedural Notice was addressed to SBA employees and PPP lenders and clarifies how a change of ownership is defined, the steps that need to be taken with a PPP loan, and the obligations of borrowers regardless of change of ownership. Here’s what you need to know:

What defines a change of ownership?

The guidance states that a change of ownership requires at least one of the following conditions to be true for a PPP borrower:

Aggregation of sales and transfers since the date of the approval of the PPP loan is required. Sales or other transfers for publicly traded borrowers must be aggregated when they result in one person or entity holding or owning at least 20% of the common stock or other ownership interest.

What must I do before the ownership change?

1. Notify your lender if you are contemplating a transaction that will change ownership – this must be done in writing and include relevant documentation.

2. If your lender is accepting PPP loan forgiveness applications, submit your application with all required documentation (we can help with this).

3. Set up an interest-bearing escrow account with your PPP lender which will be required in most cases by the SBA.

4. Determine if SBA approval of the change of ownership is required for your transaction.

How do I determine if SBA approval is required for my transaction?

SBA approval is not required for:

SBA approval is required for sales that cannot meet the above criteria. The SBA will have 60 calendar days to review and approve or not approve. The PPP lender is responsible for notifying the SBA within five business days from the completion of the transaction and must submit to the SBA:

What if I don’t set up an escrow account?

Borrowers attempting to make an asset sale with 50% of assets and no escrow account will require a condition of the purchasing entity to assume all of the PPP borrower’s obligations under the PPP loan. The purchaser will then be responsible for compliance with PPP loan terms, and the assumption must be part of the purchase and sale agreement.

What do I do if I end up with two PPP loans?

Transactions resulting in an owner holding two PPP loans will require the owner to segregate and delineate the PPP funds and expenses with documentation demonstrating PPP requirement compliance for both loans. Being thorough and accurate with your documentation is key.

Anything else I should know?

Loans that are repaid in full or are fully forgiven by the SBA have no restrictions for change in ownership. Note that all PPP borrowers are responsible for the performance of PPP loan obligations, certifications related to the PPP loan application including economic necessity, compliance with all PPP requirements, and supporting PPP documentation and forms. Borrowers will be responsible for providing any and all of this documentation to a PPP lender/servicer or the SBA upon request.

For questions and assistance with an M&A transaction and your PPP loan, reach out to us.

On Aug. 24, the Small Business Administration (SBA) and Treasury issued the latest interim final rule update to the Paycheck Protection Program (PPP) that seeks to clarify guidance related to owner-employee compensation and non-payroll costs. This guidance has been long-awaited and clears up several questions borrowers have had about forgiveness. Here are the main points:

1. Owner-employees of C or S corporations are exempt from the PPP owner-employee compensation rule for loan forgiveness if they have a less than 5% stake in the business. The intent is to provide forgiveness for compensation of owner-employees who do not have a considerable or meaningful ability to influence decisions over loan allocations. This clarifies earlier guidance that capped the owner-employee compensation regardless of what stake they have in the business.

2. Loan forgiveness for non-payroll costs may not include amounts attributable to the business operation of a tenant or subtenant of the PPP borrower. The SBA provides a few examples of what this means:

3. To achieve loan forgiveness on rent or lease payments to a related third–party, borrowers must ensure that (1) the amount of loan forgiveness requested does not exceed the amount of mortgage interest owed on the property attributable to the business’s rented space during the covered period, and (2) the lease and mortgage meet the Feb. 15, 2020, requirement for establishment. Earlier guidance had not addressed related third-party leases.

It’s important to note that mortgage interest payments to a related party are not eligible for forgiveness as PPP loans are not intended to cover payments to a business’s owner because of how the business is structured – they are intended to help businesses cover non-payroll costs owed to third parties.

For questions on any of these rules or assistance with your PPP loan forgiveness application, contact us today.

The Small Business Administration (SBA) and Treasury released an updated Paycheck Protection Program (PPP) FAQ on Aug. 4 in an effort to address PPP loan forgiveness issues that have arisen as borrowers begin to complete their applications. The 23 FAQs address various aspects of PPP forgiveness including general loan forgiveness, payroll costs, non-payroll costs, and loan forgiveness reductions. Here is a brief overview of some of the most notable clarified guidance.

The FAQ document also includes several examples for making calculations related to the above questions. Contact us for questions and assistance with your PPP loan forgiveness application.

The U.S. Senate and House of Representatives have both unanimously agreed to extend the Paycheck Protection Program (PPP) by five weeks in an effort to continue providing relief for small businesses hit hard by the pandemic. Applications officially closed for the program on June 30 when the Senate voted for a last-minute extension. President Trump is expected to sign the bill.

This extension would give small businesses until Aug. 8 to apply for a share of the approximately $129 billion in remaining PPP funding through the Small Business Administration (SBA). Thanks to the PPP Flexibility Act passed on June 5, recipients have 24 weeks to use loan funds for payroll and other essential expenses like rent/mortgage and utilities. The Flexibility Act also lowered the threshold for payroll expenses to 60% to achieve full forgiveness with a few safe harbor considerations. Over 4.9 million loans have been approved by the SBA so far, worth more than $520 billion.

Contact us for assistance in compiling information for your PPP forgiveness application to present to your lender.

On June 22, 2020, the U.S. Small Business Administration (SBA) released the: Paycheck Protection Program (PPP) Revisions to Loan Forgiveness Interim Final Rule

This guidance details two noteworthy changes impacting PPP loan borrowers, including:

The updated regulations also make minor updates to existing guidance addressing the extension of the covered period derived from the June 5, 2020 enactment of the Paycheck Protection Program Flexibility Act (H. R. 7010).

Read our blog summary of changes from H.R. 7010 here.

When Can a Borrower Apply for Loan Forgiveness?

A borrower can apply for forgiveness at any time on or before the loan maturity date. However, if the borrower applies for forgiveness before the end of the covered period and has reduced any employee’s salaries or wages by more than 25 percent, the borrower must account for the excess salary reduction for the full 8-week or 24-week covered period.

Expanded Limitations on Owner Compensation

The release of Revisions to the Third and Sixth Interim Final Rules on June 17, 2020, increased the maximum compensation for all employees and owners, which was summarized in our blog here. The new interim rules added that the employer portion of retirement plan funding for owner-employees of S-Corporations and C-Corporations is now capped at 2.5 months’ worth of the 2019 contribution amount. Furthermore, healthcare costs paid on behalf of owner-employees of S-Corporations are not eligible for forgiveness.

HT2 has established a dedicated PPP loan forgiveness team that is constantly monitoring new guidance from the SBA, as well as the Treasury, Congress, and the IRS, to ensure we have the latest information when advising our clients.

On June 16, 2020, the U.S. Small Business Administration (SBA) released the updated Paycheck Protection Program (PPP) Loan Forgiveness Application (see link below) which supersedes the application previously released on May 15, 2020. The new application incorporates changes to the PPP per the Paycheck Protection Program Flexibility Act (H. R. 7010), which was signed into law on June 5, 2020. The latest PPP loan forgiveness application, in conjunction with the June 17, 2020 release of the Revisions to the Third and Sixth Interim Final Rules, addresses some of the previously unanswered questions, including:

The SBA also released the PPP Loan Forgiveness Application Form 3508EZ (Form EZ) on June 16, 2020. The Form EZ is a simplified version of the loan forgiveness application and is applicable to PPP loan borrowers who are willing to certify they have met one of the following conditions:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

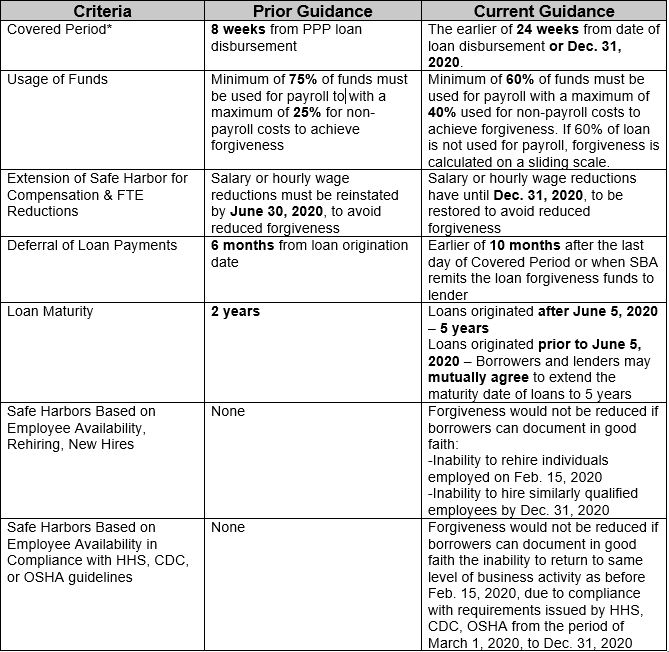

On June 10, 2020, the Small Business Administration (SBA) issued an updated interim final rule for the Paycheck Protection Program (PPP) in response to the PPP Flexibility Act passed on June 5, 2020. The updated guidance accounts for revisions made to the covered period, usage of funds changes, extended safe harbors, and more.

Here is a quick rundown of the changes made by the PPP Flexibility Act.

Also of note:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

Helpful Links:

On June 5, 2020, the president signed into law the Paycheck Protection Program Flexibility Act after it passed the Senate with a unanimous vote. The bill drafted by the House extends certain provisions of the Paycheck Protection Program (PPP) to provide small businesses with relief in the time frame and use of their PPP loan funds.

The most notable changes of the PPP Flexibility Act were:

June 30 remains the deadline for applying for a PPP loan. As of June 8, 2020, PPP funds are still available for funding. Contact one of our PPP Team Members for assistance with your loan forgiveness application.

On May 28, 2020, in a nearly unanimous vote, the U.S. House of Representatives voted to extend certain provisions of the Paycheck Protection Program (PPP) to provide small businesses with relief in the timeframe and use of their PPP loan funds. While President Trump has encouraged changes to PPP, and the Senate had been developing a plan of its own, the Paycheck Protection Program Flexibility Act is the first to pass its branch.

House representatives took into consideration the most debated aspects of the PPP when they wrote the Flexibility Act including the timeframe and parameters for usage of loan funds. The most notable changes of the Paycheck Protection Program Flexibility Act were:

The bill must next pass the Senate, which has not yet signaled support but is expected to take up the bill when it’s in session next week. We will continue to update this story as developments occur.

On May 23, the Small Business Administration (SBA) issued an interim final rule for the Paycheck Protection Program (PPP) that included the loan forgiveness application guidance released May 15, as well as other updated guidance.

The rule, Paycheck Protection Program – Requirements – Loan Forgiveness, is the formal guidance that accompanies the forgiveness application and should be used by borrowers and their advisors, as well as lenders, to ensure accurate completion and review of the forgiveness application. Since the passage of the CARES Act on March 25 and the opening of PPP loan applications on April 3, questions, concerns, and clarifications have abounded regarding loan forgiveness on all sides. The release of the interim final rule clarifies many questions, but guidance is still expected for borrowers and lenders.

Clarifications on borrower responsibility

Alternative payroll period – Until the application was released on May 15, the 8-week rule was strict for payroll. The interim rule now allows borrowers to establish the forgiveness period with the start of the first payroll period following loan disbursement, rather than the date of loan disbursement. This allows for greater flexibility for employers with less frequent pay periods and should make meeting forgiveness requirements for some businesses a little easier.

Eligible payroll costs – Payroll costs must make up a hefty 75% of the loan to qualify for forgiveness, but borrowers have questioned what qualifies because employee compensation can be paid in a multitude of ways. The rule clarified that eligible payroll costs include salary, wages, commission, bonuses, hazard pay, cash tips or equivalent, PTO/sick/family/medical leave, separation or dismissals, employee benefits related to group health care coverage and retirement, state and local taxes assessed on payroll, and independent contractor/sole proprietor wages/commissions/income paid by employers to contractors up to the pro-rated amount of a $100,000 annual salary.

Caps on eligible costs for self-employed/owner-employees – For these individuals, guidance on forgiveness was somewhat incomplete and unclear. The rule clarifies that forgiveness is capped at 8/52 of 2019 compensation up to $15,385 across all businesses and that retirement and health insurance contributions are not eligible for forgiveness for self-employed individuals (benefit contributions do qualify for owner-employees) which had been in question prior to guidance issuance.

Costs paid vs costs incurred – The 8-week-from-disbursement rule in the original PPP documentation created some unforeseen restrictions on claiming eligible non-payroll costs for businesses operating on a schedule that did not align with the 8 weeks. The May 15 guidance and the most recent interim rule clarified that non-payroll costs may be paid during the 8-week period or simply incurred as long as they are paid on or before the next billing date. These costs include interest payments on business mortgage on real or personal property, business rent on real or personal property under a lease, and business utility payments, including electricity, gas, water, transportation, telephone, or internet, all incurred, in force, or in service before Feb 15., 2020. The rule also clarified that advance payments on interest are not eligible for forgiveness.

Clarification on calculating FTE employees

The interim rule included much-needed clarification on calculating FTE employees considering the many possible changes and circumstances as a result of the crisis, which was a looming question for borrowers, including when and how safe harbors apply.

First, it is important to note that the FTE calculation for PPP forgiveness differs from previous legislation in that 40 hours is considered FTE status rather than 32 hours, like for the Affordable Care Act. FTEs are calculated by the average number of hours paid per week per employee / 40, rounded to nearest tenth. FTEs can be calculated using the formula available on the forgiveness application or contact us for assistance.

Wage reductions must be analyzed on a per employee annualized basis – Employers may reduce wages and still qualify for forgiveness as long as they follow certain restrictions. Salary or hourly calculations should be done on an average annualized basis compared to period of Jan. 1, 2020, to March 31, 2020. If the average for the 8-week period is 25% less than first quarter of 2020, loan forgiveness will be reduced, unless the reduction is restored at equal to or greater levels by June 30, 2020, then forgiveness will not be reduced.

Rehiring employees – Similar to the above, borrowers who rehire employees and/or reverse reductions to salary and wages by June 30 are still eligible for forgiveness. The guidance also clarified that, for hours and wage reductions on the same employee, loan forgiveness will not be reduced.

Employees who reject return – What happens if employees refuse to return to work for reasons such as personal or familial high-risk health concerns or other reasons? The guidance states that employers will not be beholden to employees who reject returning to work in their total FTE count. Key here is that borrowers will be required to demonstrate they made a good faith effort to rehire the employee with a written offer and must receive a written rejection. Employers must also notify the state unemployment office within 30 days following an employee’s rejection to return to work.

Cause or voluntary employee changes – Concessions have also been granted for employers whose reduction in FTE account was out of their control. The rule clarifies that borrowers who fired employees for cause, employees who voluntarily resigned, or voluntarily requested and received reduction in hours will not be counted against forgiveness. All these procedures should be documented in writing.

Clarification on loan forgiveness procedures

When working with lenders and the SBA, borrowers should be aware of additional guidance and clarification on the procedures for loan forgiveness. Most notably, all forgiveness applications must be submitted to the lender, not the SBA or other entity, and your lender will notify you of your forgiveness amount. Other points to note include:

Understanding non-forgiveness – Borrowers concerned about unforgiveable expenses received clarification that they will have 2 years at 1% interest to repay portions of the loans not forgiven by the maturity date. These terms are more generous that most SBA loans.

Factoring in EIDL – Some borrowers also qualified for, applied, and received Economic Injury Disaster Loan (EIDL) grants from the SBA. How this impacts PPP forgiveness has been a hot topic among borrowers and their advisors, but the guidance has clarified that EIDL grants will be factored into forgiveness calculations. If you want to avoid EIDL grants impacting your PPP forgiveness, they may be paid back prior to forgiveness, if applicable to your circumstances.

SBA may review any loan – While earlier guidance indicated that loans under $2 million will not be audited for economic need, the rule clarified that the SBA still has the right to review any loan, regardless of size, to ensure it meets eligibility requirements and is calculated correctly and funds are used properly. A separate ruling is expected on these procedures. Proper documentation will be essential here. Contact us for assistance.

Borrowers may appeal – Even if you feel you have all your ducks in a row, the SBA may still think differently. Fortunately, the interim rule allows borrowers 30 days to appeal SBA determinations. More guidance is expected on this.

Lenders have a deadline – The interim rule also issued clear guidance and deadlines for lenders and the SBA to handle the forgiveness applications. Lenders have 60 days to decide on loan forgiveness from receipt of application (and to notify the borrower of forgiveness amount), followed by 90 days for the SBA to review the application. Borrowers may be asked questions by the lenders and the SBA during these reviews, so they should be prepared with accurate documentation.

The first PPP loans were disbursed on April 3, so early borrowers are closing in the final weeks of the 8-week period. More guidance is expected in the coming days and weeks, but borrowers should begin preparing their documentation now. Contact us for assistance with your loan forgiveness application.

The Small Business Administration (SBA) has released its long-awaited Paycheck Protection Program (PPP) forgiveness form for borrowers. The release on May 15 brought with it significant changes to the interpretation of some components of forgiveness that were not previously known.

Clarity is still needed on many of the components of forgiveness. Changes were made to the following components of the program based on the release of the form.

Covered payroll periods – Until this release, the guidance indicated the covered payroll period began immediately after loan disbursement and lasted eight weeks. For those with payroll schedules that did not align with the disbursement and covered period, this generated many questions and concerns. However, this latest guidance indicates that the eight-week period may begin starting with the borrower’s first payroll following disbursement, not necessarily on the day of disbursement. This alternative period only covers payroll costs, not other allowable expenses, although adjustments do exist for other allowable expenses.

Incurred and/or paid expenses – The CARES Act originally indicated that, for costs to be covered under PPP, they would need to be incurred and paid during the eight-week period. The latest guidance, however, forgives costs that are incurred, but not paid, as long as they are paid on or before the regular billing date. This expansion applies to costs such as mortgage interest, rent, utilities, and payroll incurred during the loan period. Payroll costs incurred during the last payroll period but not paid during the covered or alternative periods (mentioned above) may be forgiven if those payroll costs are paid on or before the next regular payroll date.

Full-time equivalent (FTE) employee counts and wages – The guidance also included several clarifications to the FTE employee count and wage calculations necessary for forgiveness including:

Amounts paid to owners (owner-employees, a self-employed individual, or general partners), capped at the lower of:

1) $15,385 (the eight-week equivalent of $100,000 per year) for each individual; or

2) the eight-week equivalent of their applicable compensation in 2019

We expect further guidance to be issued from the SBA on PPP forgiveness beyond the changes outlined above. Borrowers will be required to submit the information in the forgiveness form through their lender, but your CPA can help with calculating and completing your form. Contact us for assistance.

In an update to the Small Business Administration’s (SBA) Paycheck Protection Program (PPP) FAQs, the SBA and Treasury have announced that borrowers with an original principal amount less than $2 million “will be deemed to have made the required certification concerning the necessity of the loan request in good faith.”

Released just ahead of the May 14 repayment deadline, the SBA indicated in FAQ #46 that this safe harbor was introduced because borrowers who requested less than $2 million were less likely to have access to alternative funding options. The access to other capital was the sticking point in FAQ #31, which requested businesses that could not certify in good faith their need for funds to repay them by May 14.

Borrowers with a principal amount greater than $2 million can still meet the good faith certification. Still, the SBA continues to emphasize that they will be reviewing those larger loan applications for compliance with program requirements. See question 47 for update source .

Contact us for assistance with your PPP loan obligations.

For those of our clients who have received their PPP loan and endured the painful application process, we have just one word to share – Congratulations!!!! Now what?

Now, you are on the clock! You have 8-weeks to determine how much of that loan will have to be returned and how much of that loan may be forgiven.

In our opinion, we think most of our clients will be left with some amount of loan. We hope that this article will provide some guidance that can be used to help you through this 8-week time period and to maximize what your loan forgiveness will be. With that said, we must qualify our comments in that there remains many unanswered questions and the SBA still must provide guidance to those answers. Accordingly, some of our comments and observations could be incorrect based on our present interpretations.

Based on our experience with the application process, the banking industry had developed their own due diligence rules and the documents required varied from bank to bank and how they interpreted what was includible costs. Be prepared for potential conflicts once the 8-week time period ends and you enter the “loan forgiveness” stage.

The SBA guidance provides that the PPP loan must be used only for qualified expenditures and if not used properly, the fine print of the loan document has a very heavy statement. “If you knowingly use the funds for unauthorized purposes, you will be subject to additional liability such as charges for fraud”. We know that our clients would never knowingly misuse the funds, but we would be negligent if we did not share that statement with you.

The good news is that the categories of what you can use the loan proceeds for are limited. They are made up of “Payroll Costs” and “Non-Payroll Costs” which are defined as follows:

PAYROLL COSTS- At least 75% of PPP Loan

NON-PAYROLL COSTS – Remaining 25% of PPP Loan

As mentioned above, you have 8-weeks starting from the time your loan hits your bank account. Unlike a tax return, no extensions are allowed.

With respect to documentation, go overboard with organization and expect that you will have to provide your banker with copies of everything. Here are some of the steps we are recommending to our clients:

The computations for purposes of the loan forgiveness creates some traps and could result in a significant portion of the PPP loan not being forgiven. In the mad rush to apply for the PPP Loan, many businesses did not spend a lot of time on the loan forgiveness computations. The following are some of the traps that will limit the forgiveness amount and we will spend time doing a deeper dive into each of the traps.

If you maximized your PPP loan by using your “average monthly payroll” costs from 2019 and then multiplied that by 2.5 to determine your loan it will be difficult to achieve 100% of forgiveness unless everything aligns in your favor. With that said, let us address each of the above items that may limit your forgiveness.

“Full-time Equivalents (FTE)” CALCULATION IS IMPORTANT:

FINALLY, AND MAYBE THE MOST IMPORTANT STEP, IS TO TRACK WHERE YOU ARE AT WITH THE LOAN FORGIVENESS. HERE ARE THE STEPS WE WOULD RECOMMEND:

We understand the PPP Loan Forgiveness step is confusing and we are here to help you and answer any questions you may have. We anticipate additional guidance from the SBA to be released in mid- May and will keep updating the information as it becomes available. As always, visit our dedicated COVID-19 Resource Page for continued updates and alerts.

Over the last several days, there have been some developments and clarifications related to the Paycheck Protection Program (PPP).

The PPP program loan funds were increased by $310 billion to a total of $659 billion on Friday, April 24, 2020, when the President signed the Paycheck Protection and Healthcare Enhancement Act (PPHE). The PPP program has faced an immense amount of scrutiny and has been wrought with delays, changes, and a lack of clarity. Most small businesses did not receive funding in the initial round. While we have diligently supported our clients in their efforts, the Lenders have generally struggled with the massive amount of applications being submitted. While the law extends the funds, realistically, it will not be enough to fund every small business. Below, we outline some critical provisions from the most recent Act and changes as well as suggestions on what else you could do if you don’t anticipate receiving the PPP or have not applied yet.

For many businesses that have or will receive PPP funds, the forgiveness part of the loan program creates a lot of questions. There are still more questions than answers, and we anticipate the coming days will provide some clarity. The treasury published additional guidance on Thursday related to who qualifies after many large businesses with access to liquidity received PPP funds.

Do businesses owned by large companies with adequate sources of liquidity to support the business’s ongoing operations qualify for a PPP loan?

Answer: All borrowers must assess their economic need for a PPP loan under the standard established by the CARES Act and the PPP regulations at the time of the loan application. Although the CARES Act suspends the ordinary requirement that borrowers must be unable to obtain credit elsewhere (as defined in section 3(h) of the Small Business Act), borrowers still must certify in good faith that their PPP loan request is necessary. Specifically, before submitting a PPP application, all borrowers should review the required certification carefully that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.” Borrowers must make this certification in good faith, taking into account their current business activity and their ability to access other sources of liquidity sufficient to support their ongoing operations in a manner that is not significantly detrimental to the business. For example, it is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith, and such a company should be prepared to demonstrate to SBA, upon request, the basis for its certification. Lenders may rely on a borrower’s certification regarding the necessity of the loan request. Any borrower that applied for a PPP loan prior to the issuance of this guidance and repays the loan in full by May 7, 2020, will be deemed by SBA to have made the required certification in good faith.

There is still a lot of unknown about how exactly the lenders will evaluate loan forgiveness around the forgiven uses versus approved uses.

Start by evaluating whether you meet the conditions that certify you for the PPP loan in light of the additional guidance issued. This is a decision each business will need to make based on your facts and circumstances. If you don’t feel like you meet the conditions, you should return any funds received by May 7, 2020. If you have already submitted your PPP application, you may contact your lender to rescind your application.

For anyone that has received their PPP loan funds and plans on keeping those funds, you should be focused on documenting your use of funds based on guidance provided by your lender.

For those that don’t qualify for the PPP, there are other options for creating liquidity available. The

PPHE act also increased the SBA Economic Injury Disaster Loans (EIDL) funding by $10 billion and also added am additional $50 billion in funding for EIDL loans related to COVID-19.

There are also many other considerations companies can explore, such as tax credits, small business loans, and other local grants.

We continue to monitor the PPP and EIDL. All information contained in this article is based on information currently available and is subject to change. Please contact our firm with any questions about the PPP loan as well as other alternatives.

Tina Tharp, Judy Hamilton, Kim Spinardi and Jessica Jordan

Our Team is diligently working to keep abreast of all the changes and assisting clients!