The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021).

So, you can take a customer out for a business meal or order take-out for your team and temporarily write off the entire cost — including the tip, sales tax and any delivery charges.

Basic rules

Despite eliminating deductions for business entertainment expenses in the Tax Cuts and Jobs Act (TCJA), a business taxpayer could still deduct 50% of the cost of qualified business meals, including meals incurred while traveling away from home on business. (The TCJA generally eliminated the 50% deduction for business entertainment expenses incurred after 2017 on a permanent basis.)

To help struggling restaurants during the pandemic, the Consolidated Appropriations Act doubled the business meal deduction temporarily for 2021 and 2022. Unless Congress acts to extend this tax break, it will expire on December 31, 2022.

Currently, the deduction for business meals is allowed if the following requirements are met:

In the event that food and beverages are provided during an entertainment activity, the food and beverages must be purchased separately from the entertainment. Alternatively, the cost can be stated separately from the cost of the entertainment on one or more bills.

So, if you treat a client to a meal and the expense is properly substantiated, you may qualify for a business meal deduction as long as there’s a business purpose to the meal or a reasonable expectation that a benefit to the business will result.

Provided by a restaurant

IRS Notice 2021-25 explains the main rules for qualifying for the 100% deduction for food and beverages provided by a restaurant. Under this guidance, the deduction is available if the restaurant prepares and sells food or beverages to retail customers for immediate consumption on or off the premises. As a result, it applies to both on-site dining and take-out and delivery meals.

However, a “restaurant” doesn’t include a business that mainly sells pre-packaged goods not intended for immediate consumption. So, food and beverage sales are excluded from businesses including:

The restriction also applies to an eating facility located on the employer’s business premises that provides meals excluded from an employee’s taxable income. Business meals purchased from such facilities are limited to a 50% deduction. It doesn’t matter if a third party is operating the facility under a contract with the business.

Keep good records

It’s important to keep track of expenses to maximize tax benefits for business meal expenses.

You should record the:

In addition, ask establishments to divvy up the tab between any entertainment costs and food/ beverages. For additional information, contact your tax advisor.

© 2022

The start of a new tax filing season often brings with it longer hold times with the IRS, as taxpayers and their tax preparers inundate phone lines with questions and concerns. But the 2022 filing season promises to be particularly challenging.

The IRS continues to work through a backlog of millions of paper-filed returns and correspondence from the 2021 tax filing season. Add staffing challenges and congressional underfunding to the issue and trying to track down a missing refund or deal with an unexpected tax notice is bound to be frustrating.

Roots, Results of the IRS Backlog

As of December 2021, the IRS had a backlog of 6 million unprocessed individual income tax returns, 2.3 million amended returns, and more than 2 million quarterly payroll tax returns, according to a statement from the Taxpayer Advocate Service (TAS).

That backlog stems from a combination of COVID-related shutdowns at many of the agency’s processing centers, budget cuts that forced reduced staff sizes, and the IRS overseeing new initiatives, such as stimulus payments and the expanded Child Tax Credit.

Reaching the IRS via phone hasn’t been easy in recent years, and the problem likely will worsen. According to the TAS report, there was a record 282 million taxpayer calls to the IRS in 2021, but the agency answered just 11% of those calls and those who did get through endured long wait times and frequent disconnects.

Understanding what’s going on behind the scenes isn’t much help when you’re facing missing tax refunds, incorrect notices, and other tax troubles. The following tips can help you navigate the IRS backlog and get the answers you need.

Send a complete copy of the correspondence and any other essential documents to your advisor as soon as you receive the notice. Tax professionals have access to a unique IRS customer service line reserved for practitioners, but delays are common there as well, so don’t wait until the last minute to loop them in.

Finally, have patience. The good news is the IRS is working to catch up by fast-tracking hiring, reassigning workers, and scrapping plans to close a tax processing center in Austin, Texas. In the meantime, stay in touch with your tax advisor to be as proactive as possible.

Has your company switched to a remote work or hybrid environment for employees? Government mandates and other health-related concerns at the beginning of the COVID-19 pandemic caused much of the workforce to transition from an office setting to a remote or hybrid work environment. As the pandemic stretched on and companies extended their remote work options, many employees started spreading out to find new locations to work from.

While many employers have researched return-to-work strategies, they’ve decided to allow employees to continue to work remotely either full-time or part-time based on their roles and responsibilities. The benefit is considerable for employees who wish for more flexibility or less time spent commuting to the office, but it may pose tax-withholding complications for companies.

Tax implications of remote workers

Most state and local sales-and-use taxes and payroll taxes are triggered by what’s considered a nexus event, which establishes a presence in a particular state. While a physical building or warehouse is the most widely known nexus, meeting a sales threshold for sales in that state or having an employee residing in the state can also trigger the tax withholding requirements for that state.

This means, if a remote worker moves to another state, it can complicate your organization’s tax situation immensely. For companies who are located near state borders, employees who previously commuted across state lines but are now working from home can change payroll and sales tax liabilities.

During COVID, many states granted exceptions for nexus events, while others loosened requirements. However, those requirements vary by state, sometimes overlap, and some are even coming to an end. This further complicates whether taxes should be withheld and filed in each state, and whether companies should collect and file sales-and-use taxes.

If you have remote workers, consider implementing a policy that includes (at minimum):

Remote workers who move without notifying their employer could open the company up to the consequences of misfiling tax payments.

Consequences of misfiling tax payments

Whether a remote worker moved without the company’s knowledge, or the company was unaware of the laws in place in the new state, the company remains liable for the payments and potential penalties. When payments are missed or misfiled, state and local jurisdictions may have fines and penalties in place.

For companies that have a worker in a new state where they previously did not have to file sales-and-use taxes, their system may be set up to waive sales-and-use taxes for that state or local jurisdiction. In that case, they may find themselves paying out of their revenue for these taxes that were not collected from their customers.

Solutions to manage taxes related to remote workers

Companies should consider several approaches to minimize the risk of misfiling sales-and-use taxes, as well as payroll and income taxes with a remote workforce.

Our team of accounting professionals can help you navigate the tax complexities associated with remote workers! Reach out to set up a consultation.

The sheer amount of student loan debt individuals are graduating from higher education with has been increasingly covered in the news. While the government has been working to forgive student loan debt for certain people, there is something employers can do to help take the burden off employees and their tax liability. In addition to decreasing employee stress, it can also be used as an employee retention incentive.

The CARES Act and student loan repayment

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 and its extensions include a provision that allows employers to provide relief to employees with outstanding student loan debt. This program allows employers to pay up to $5,250 toward the student loan debt for eligible employees. All monies paid are to be excluded from income and payroll taxes for both the employee and employer portion.

This could be a significant principal decrease for employees with a national student loan average of more than $30,000.

What student loan debit is qualified?

Any amount an employer pays to a student loan held by an employee up to $5,250 is qualified for the income and payroll tax exclusion, if the payments are made before Dec. 31, 2025. This includes federal and private student loans and payments made directly to the employee or the loan servicer.

It’s not too late to provide this benefit and take advantage of the tax incentives for the 2021 tax year. For assistance creating an education assistance program and establishing benefits with appropriate tax documentation steps in place, contact our team of knowledgeable tax professionals today.

The Employee Retention Credit (ERC) was a valuable tax credit that helped employers survive the COVID-19 pandemic. A new law has retroactively terminated it before it was scheduled to end. It now only applies through September 30, 2021 (rather than through December 31, 2021) — unless the employer is a “recovery startup business.”

The Infrastructure Investment and Jobs Act, which was signed by President Biden on November 15, doesn’t have many tax provisions but this one is important for some businesses.

If you anticipated receiving the ERC based on payroll taxes after September 30 and retained payroll taxes, consult with us to determine how and when to repay those taxes and address any other compliance issues.

The American Institute of Certified Public Accountants (AICPA) is asking Congress to direct the IRS to waive payroll tax penalties imposed as a result of the ERC sunsetting. Some employers may face penalties because they retained payroll taxes believing they would receive the credit. Affected businesses will need to pay back the payroll taxes they retained for wages paid after September 30, the AICPA explained. Those employers may also be subject to a 10% penalty for failure to deposit payroll taxes withheld from employees unless the IRS waives the penalties.

The IRS is expected to issue guidance to assist employers in handling any compliance issues.

Credit basics

The ERC was originally enacted in March of 2020 as part of the CARES Act. The goal was to encourage employers to retain employees during the pandemic. Later, Congress passed other laws to extend and modify the credit and make it apply to wages paid before January 1, 2022.

An eligible employer could claim the refundable credit against its share of Medicare taxes (1.45% rate) equal to 70% of the qualified wages paid to each employee (up to a limit of $10,000 of qualified wages per employee per calendar quarter) in the third and fourth calendar quarters of 2021.

For the third and fourth quarters of 2021, a recovery startup business is an employer eligible to claim the ERC. Under previous law, a recovery startup business was defined as a business that:

However, recovery startup businesses are subject to a maximum total credit of $50,000 per quarter for a maximum credit of $100,000 for 2021.

Retroactive termination

The ERC was retroactively terminated by the new law to apply only to wages paid before October 1, 2021, unless the employer is a recovery startup business. Therefore, for wages paid in the fourth quarter of 2021, other employers can’t claim the credit.

In terms of the availability of the ERC for recovery startup businesses in the fourth quarter, the new law also modifies the recovery startup business definition. Now, a recovery startup business is one that began operating after February 15, 2020, and has average annual gross receipts of less than $1 million. Other changes to recovery startup businesses may also apply.

What to do now?

If you have questions about how to proceed now to minimize penalties, contact us. We can explain the options.

© 2021

In light of the COVID-19 pandemic, the IRS expanded its electronic signatures program to include many more forms that historically needed a wet signature. The expansion is intended to make things easier for tax professionals and their clients, while in-person interactions may cause unnecessary risk.

The IRS has recently extended the ability to accept e-signatures on many documents through December 2021, simplifying the process for tax professionals.

What types of signatures are accepted?

The IRS has provided the following acceptable types of electronic signatures:

While there are additional ways to provide an e-signature, taxpayers are advised to stick to the outlined methods to prevent the possibility of the forms being returned or delayed during processing.

What forms are included in the recent extension?

While some forms can be electronically filed, others must be sent by mail and manually processed by the IRS. The forms in this electronic signature program all require the latter – a hardcopy sent to the IRS for processing. This includes:

Our firm continues to monitor the ability to electronically sign and submit IRS forms. If you have any questions about tax filings, please reach out to our team of tax professionals for help.

Note: We are closely monitoring H.R. 3684, known as the Infrastructure Investment and Jobs Act. The Senate has approved the infrastructure bill and now goes to the House of Representatives for consideration as of the publication. The infrastructure bill would terminate the employee retention credit early, making wages paid after September 30, 2021, ineligible for the credit.

The Employee Retention Credit (ERC) was introduced in 2020 to help businesses that have been affected by the COVID-19 pandemic. Since its release, it has been expanded and modified to help more businesses. Despite all of this, many businesses that are eligible for the credit haven’t filed for it. Did the pandemic impact your business? Don’t assume your business is ineligible. Keep reading to learn more.

What is the Employee Retention Credit?

The ERC allows businesses to claim a refundable credit for qualified employee wages and related expenses if there was a significant disruption to business because of the pandemic. That disruption is measured in a quarterly reduction of gross revenues – 50% reduction in 2020 vs. 2019; and only 20% reduction in 2021 vs. 2019. In addition, there is a “safe harbor” test that allows you to look back a quarter. For example, if your 4th quarter 2020 revenues were down 20% compared to the 4th quarter 2019, you are eligible for the first quarter of 2021, regardless of the first quarter test outcome.

The second disruption is a government shutdown – complete or temporary. For example, a restaurant limited to 75% seating capacity by the governor’s mandate has experienced a partial shutdown.

If you experienced EITHER one of these disruptions, you might be eligible for the employee retention credit.

Eligibility for 2020 includes businesses with 100 or fewer full-time equivalent employees in 2019, in which all wages qualify whether the business was open or (partially) closed because of governmental orders. For businesses with more than 100 employees, only wages paid to employees when they weren’t providing services because the pandemic are eligible.

For 2021 the full-time equivalent threshold increased to 500 employees in 2019.

For 2020 the credit is 50% of the first $10,000 of eligible employees’ earnings for the year – up to $5,000 per employee for the year.

For 2021 the credit is 70% of the first $10,000 of eligible employee earnings per QUARTER – up to $28,000 per employee for the year.

What new guidance was released?

The IRS released Notice 2021-49 on August 4, 2021, which provided additional ERC guidance.

Keep in mind, the ERC is a complex tax credit with ever-changing guidelines and requires interpretation. Reach out to our professional tax team, who are familiar with the credit and most up-to-date guidelines.

What if I missed filing for the ERC?

While some of the newer guidelines are retroactive, others only apply to wages paid more recently. In most cases, employers can file a correction to their quarterly tax documents to receive appropriate credit for qualified wages paid. Keep in mind that wages included in Payroll Protection Plan (PPP) forgiveness are not qualified (no double-dipping).

We have noted a longer processing time for amended returns. This means you’ll see benefits of the credit faster by filing for it with your quarterly returns; however, it could take 90 to 120 days for amended returns.

How can my business receive help?

If you’re like many businesses and need help understanding the ERC and the recent changes, reach out to our team of qualified professionals for help! We can help you:

We look forward to helping you!

Did your company receive funds from the Human Health Services (HHS) Cares Act stimulus? If so, you may be required to submit supporting documentation for how the funds were used.

The Human Health Services department calculated relief payments based on 2019 Fee for Services (FFS) Medicare payments and direct deposited them into hospital and medical provider accounts. Any payments of more than $10,000 require additional reporting by the deadline specified in the chart below, per the Terms and Conditions of the payments.

| Period | Payment Received Period (Payments Exceeding $10,000 in Aggregate Received) | Deadline to Use Funds | Reporting Time Period |

| 1 | From April 10, 2020 to June 30, 2020 | June 30, 2021 | July 1 to Sept. 30, 2021 |

| 2 | From July 1, 2020 to Dec. 31, 2020 | Dec. 31, 2021 | Jan. 1 to March 31, 2022 |

| 3 | From Jan. 1, 2021 to June 30, 2021 | June 30, 2022 | July 1 to Sept. 30, 2022 |

| 4 | From July 1, 2021 to Dec. 31, 2021 | Dec. 31, 2022 | Jan. 1 to March 31, 2023 |

Source: hhs.gov

These funds provided by the stimulus payments must be used for eligible expenses and lost revenues to allow hospitals and medical practices to prevent, prepare for, and respond to COVID-19. To provide the necessary reports, Health and Human Services has launched a Provider Relief Fund (PRF) reporting portal.

Before getting started, you may want to gather the following types of information:

You can learn more about the system and reporting requirements here. Our team of professionals is also available to help you sort through the necessary reporting requirements.

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules.

Background

Back in March of 2020, Congress originally enacted the ERTC in the CARES Act to encourage employers to hire and retain employees during the pandemic. At that time, the ERTC applied to wages paid after March 12, 2020, and before January 1, 2021. However, Congress later modified and extended the ERTC to apply to wages paid before July 1, 2021.

The ARPA again extended and modified the ERTC to apply to wages paid after June 30, 2021, and before January 1, 2022. Thus, an eligible employer can claim the refundable ERTC against “applicable employment taxes” equal to 70% of the qualified wages it pays to employees in the third and fourth quarters of 2021. Except as discussed below, qualified wages are generally limited to $10,000 per employee per 2021 calendar quarter. Thus, the maximum ERTC amount available is generally $7,000 per employee per calendar quarter or $28,000 per employee in 2021.

For purposes of the ERTC, a qualified employer is eligible if it experiences a significant decline in gross receipts or a full or partial suspension of business due to a government order. Employers with up to 500 full-time employees can claim the credit without regard to whether the employees for whom the credit is claimed actually perform services. But, except as explained below, employers with more than 500 full-time employees can only claim the ERTC with respect to employees that don’t perform services.

Employers who got a Payroll Protection Program loan in 2020 can still claim the ERTC. But the same wages can’t be used both for seeking loan forgiveness or satisfying conditions of other COVID relief programs (such as the Restaurant Revitalization Fund program) in calculating the ERTC.

Modifications

Beginning in the third quarter of 2021, the following modifications apply to the ERTC:

Contact us if you have any questions related to your business claiming the ERTC.

© 2021

Earlier this year, the American Rescue Plan (ARP) was announced, including some temporary updates to the child tax credits available for many parents. Under the ARP, eligible parents of dependent children can take a tax deduction of up to $3,600 per child, depending on the child’s age and household income.

Part of this tax deduction is currently planned to be distributed to parents in the form of monthly payments from the IRS. For every child under the age of 6, parents will receive $300 per month starting on July 15 and ending on December 15. For children age 6 to 17, parents will receive $250 per month. Any remaining amount on the child tax credits will be eligible to be taken during the regular tax filing season.

The child tax credit update portal

The IRS has released a website where parents, including eligible non-filer parents, may make their designations concerning the child tax credits and scheduled deposits. This includes updating bank account information for direct deposits, even if previous economic stimulus payments were sent via check.

For parents that want to forego the advance payments and take their child tax credit in one lump sum during their tax filings, you may opt-out using this portal. The deadline to opt-out for the first payment was June 28. If you opt-out after that deadline, you will still receive the first payment if you qualify. In addition to personal preference, filers may want to opt-out of these payments because:

Now would be a good time to discuss with a tax professional any benefits or drawbacks to accepting the monthly advance payments to the child tax credit.

Note: Parents who are married couples filing jointly must BOTH opt-out of receiving the payments, or you may still receive a partial payment.

Who will receive monthly payments?

Payments will be received by eligible parties starting around July 15, 2021. You can check your eligibility using this tool created by the IRS. Currently, the IRS is using 2019 and 2020 tax filings to decide who may be eligible. If you are a non-filer and have registered for the Economic Impact Payments online previously, you should not need to register for the child tax credit advance payments at this time. If you have not previously registered, you may do so at the Non-filer Sign Up Tool here.

You can also find more about the temporary increase for the child tax credit and the upcoming advance payments here.

Be sure to speak with your tax professional to determine the best course of action moving forward with these advance tax credit payments. Our team of experts is available to assist you.

The IRS and Treasury Department provided new information regarding the tax credits available through the American Rescue Plan (ARP). The ARP was created to help small businesses through the pandemic. This new guidance provides information on how eligible businesses can claim the credit for providing paid time off to employees receiving or recovering from the vaccine. Below, we’ve outlined which employers are eligible for the credits and when and how the credits can be taken.

Who is eligible?

Any business with fewer than 500 employees is eligible to take the tax credit. This includes tax-exempt organizations and governmental employers who are not the federal government or not outlined in section 501(c)(1) of the Internal Revenue Code. Self-employed individuals are eligible for similar credits.

What are the paid leave qualifications?

In order to qualify for the tax credit, employers/employees must meet the following guidelines:

For more information on the credits, including how they’re calculated, view the IRS Fact Sheet or reach out to our team of professionals.

A measure to extend the Paycheck Protection Program (PPP) application deadline from March 31, 2021, to May 31, 2021, has passed the U.S. House of Representatives and the Senate. It now heads to President Biden’s desk for signature which he is expected to do promptly.

Small businesses will have until May 31, 2021, to continue submitting first and second-draw PPP loan applications to the Small Business Administration (SBA). The SBA was also granted an additional 30 days past May 31 to finish processing applications. The measure does not include any funding increases for the program.

Contact us for assistance with your PPP loan or forgiveness applications.

President Biden signed the $1.9 trillion American Rescue Plan Act (ARPA) on March 11. While the new law is best known for the provisions providing relief to individuals, there are also several tax breaks and financial benefits for businesses.

Here are some of the tax highlights of the ARPA.

The Employee Retention Credit (ERC). This valuable tax credit is extended from June 30 until December 31, 2021. The ARPA continues the ERC rate of credit at 70% for this extended period of time. It also continues to allow for up to $10,000 in qualified wages for any calendar quarter. Taking into account the Consolidated Appropriations Act extension and the ARPA extension, this means an employer can potentially have up to $40,000 in qualified wages per employee through 2021.

Employer-Provided Dependent Care Assistance. In general, an eligible employee’s gross income doesn’t include amounts paid or incurred by an employer for dependent care assistance provided to the employee under a qualified dependent care assistance program (DCAP).

Previously, the amount that could be excluded from an employee’s gross income under a DCAP during a tax year wasn’t more than $5,000 ($2,500 for married individuals filing separately), subject to certain limitations. However, any contribution made by an employer to a DCAP can’t exceed the employee’s earned income or, if married, the lesser of employee’s or spouse’s earned income.

Under the ARPA, for 2021 only, the exclusion for employer-provided dependent care assistance is increased from $5,000 to $10,500 (from $2,500 to $5,250 for married individuals filing separately).

This provision is effective for tax years beginning after December 31, 2020.

Paid Sick and Family Leave Credits. Changes under the ARPA apply to amounts paid with respect to calendar quarters beginning after March 31, 2021. Among other changes, the law extends the paid sick time and paid family leave credits under the Families First Coronavirus Response Act from March 31, 2021, through September 30, 2021. It also provides that paid sick and paid family leave credits may each be increased by the employer’s share of Social Security tax (6.2%) and employer’s share of Medicare tax (1.45%) on qualified leave wages.

Grants to restaurants. Under the ARPA, eligible restaurants, food trucks, and similar businesses that provide food and drinks may receive restaurant revitalization grants from the Small Business Administration. For tax purposes, amounts received as restaurant revitalization grants aren’t included in the gross income of the person who receives the money.

Much more

These are only some of the provisions in the ARPA. There are many others that may be beneficial to your business. Contact us for more information about your situation.

© 2021

The American Rescue Plan Act (ARPA) has been signed into law by President Biden and makes significant updates to several tax provisions to alleviate some of the pandemic’s financial burdens for individual taxpayers and businesses. Updates include expansions and extensions of various tax credits such as the employee retention credit (ERC), COBRA continuation coverage, Affordable Care Act (ACA) subsidies, and more. The bill also includes $1.46 billion for the IRS to manage the additional responsibilities on top of the annual tax filing season. Here are the critical tax updates.

Significant updates were made for individual taxpayers to deal with the financial ramifications of the pandemic.

COBRA continuation coverage credit expanded – Health care premiums will be subsidized at 100% for those who are eligible for COBRA from the date of enactment to Sep. 21, 2021.

ACA marketplace subsidies expanded – Health insurance premium cost savings for all marketplace exchange users are included in the bill.

Applicable extra subsidies can be claimed immediately or on the 2021 tax return. A special enrollment period is available until May 15, 2021, for most states.

Child tax credit increased – The child tax credit can now be claimed in advance of filing your return and increases to $3,000 per child (now including 17-year-olds) and $3,600 for children under six years of age. It phases out for married-filing-joint taxpayers with incomes over $150,000, $112,500 for heads of household, and $75,000 for all others. The credit will be paid monthly in cash up to $300 per month by the IRS from July through December.

Earned income credit expanded – The bill introduces rules for individual taxpayers with no children for 2021:

Student loan forgiveness – Any student loan forgiveness passed between Dec. 31, 2020, and Jan. 1, 2026, would be tax-free rather than the forgiven debt treated as taxable income.

Business tax provisions were also extended and expanded to help businesses with the financial challenges of the pandemic.

ERC extended – The ERC is extended through Dec. 31, 2021, and expands the eligibility to new startups established after Feb. 15, 2020 (capped at $50,000 per calendar quarter), and companies with a 90% revenue decline compared to the same calendar quarter of the previous year.

Child and dependent care credit expanded – The credit is refundable for 2021. It increases the employer-provided dependent care assistance exclusion to $10,500. The maximum allowable expenses increase to $8,000 (from $3,000) for one dependent and $16,000 (from $6,000) for two or more and allow the credit to cover 50% of expenses.

Family and sick leave credit extended – The Families First Coronavirus Response Act (FFCRA) credits are extended to Sept. 30, 2021, and include:

Executive compensation deduction expanded – The executive compensation deduction for publicly traded employers expands to include the 8 highest compensated employees other than the CEO and CFO by 2027. Currently, a deduction is available on the first $1 million paid to the CEO, CFO, and next three highest compensated officers.

For questions and assistance with any of the programs related to ARPA, contact us.

The American Rescue Plan Act (ARPA) of 2021 passed Congress and President Biden signed the bill into law on March 12, 2021. The ARPA approves $1.9 trillion in spending for individuals, businesses, governments, and certain industries impacted by the COVID-19 pandemic. The third Act in a year, the ARPA approves additional economic impact payments for individuals; the extension of federal unemployment benefits; additional funds for Paycheck Protection Program (PPP) Loans, and Economic Injury Disaster Loans (EIDL) for hard-hit small businesses; and grants for food and beverage establishments. Here are the key individual and business provisions in the bill.

The bill extends and slightly alters two key benefits many individuals have been relying upon through the pandemic.

Unemployment – Federal benefits of $300 per week (in addition to state benefits) are extended through Sep. 6, 2021. The first $10,200 in federal unemployment benefits is tax-free for households making less than $150,000 per year in 2020. Taxpayers who received unemployment income may need to update 2020 tax returns if already filed.

Economic impact (stimulus) payments (EIPs) – The IRS will issue another round of EIPs at $1,400 per individual, $2,800 per married filing joint (MFJ), plus $1,400 per dependent. Income phase-out limits reduce from previous EIPs to $80,000 for individuals and $150,000 for MFJ. Full-time students under the age of 24 are now eligible for economic impact payments (EIP), unlike previous rounds. Your 2019 or 2020 adjusted gross income (AGI) is the basis for EIPs, so taxpayers will want to consider when to file their 2020 tax return to ensure a maximum EIP benefit.

The bill includes additional funding for small business relief programs, including the PPP, EIDLs, and industry-specific relief.

PPP – The Act allocates an additional 7.25 billion in additional funds, and the eligibility expands to include:

The deadline is still Mar. 31, 2021, to apply, so don’t delay.

EIDL advance payments – The Act allocates $15 billion for EIDL advance payments, and eligibility requirements state:

Restaurants, bars, and other eligible food and beverage providers – The Act allocates $28.6 billion for grants, and $5 billion is set aside for applicants with 2019 gross receipts of $500,000 or less.

Shuttered venue operators – The program is extended from the Consolidated Appropriations Act (CAA) with $1.25 billion allocated.

Community navigator pilot programs – $175 million is allocated for programs that increase awareness of and participation in COVID-19 relief programs for socially and economically disadvantaged business owners.

For assistance with any of these provisions, please contact us.

The IRS has released additional guidance in Notice 2021-20 on the Employee Retention Tax Credit (ERC) with clarifications on the retroactive changes for expanded eligibility applicable to 2020. Employers who received a Paycheck Protection Program (PPP) loan have been waiting on guidance on claiming the credit in combination with forgiveness of their loan. The provisions outlined here apply to retroactive claims for 2020 as well as providing a plan for those yet to seek forgiveness.

As a reminder, eligibility to claim the 2020 ERC requires a business to have experienced a significant decline in revenues during 2020. Specifically, gross receipts for a calendar quarter during 2020 must have declined by 50% or more when compared to the same calendar quarter in 2019. Additionally, a company is eligible during any period where operations were suspended due to a government order.

The notice clarifies when and how PPP borrowers can claim the ERC on 2020 wages.

The ERC requires specific documentation and support of facts and circumstances in order to qualify and receive the credit. For assistance with claiming the ERC, contact us.

Form 1040, Schedule C taxpayers received an updated interim final rule (IFR) on the Paycheck Protection Program (PPP) from the Small Business Association (SBA). The IFR clarifies guidance released on Feb. 22 that made changes to how self-employed and sole proprietors could calculate their maximum loan amount to help expand the program for these groups. Approximately 2.6 million sole proprietors have applied for PPP loans, and it is estimated there are about 25 million sole proprietors across the country.

The biggest adjustment made by the IFR is that these borrowers may calculate their maximum loan amount using their gross income. Previously, the calculation was done by using payroll costs plus net profits. This excluded many sole proprietors who had little or negative net profit.

For sole proprietors with no employees the calculation is as follows:

First-draw and second-draw owner compensation is capped at $20,833; however, for accommodations and food services, second-draw owner compensation is capped at $29,167

For sole proprietors with employees, the calculation is as follows: Use either line 31 net profit or calculate the following using gross receipts:

The same owner compensation limits apply as for those with no employees.

Limited liability companies with only one member do qualify for these updated calculations, but single member S-corporations do not.

The calculation is only for loans submitted after the rule’s effective date of Mar. 3, 2021, meaning loans submitted between Jan. 1 and Mar. 2, 2021, would not be eligible for this new calculation. You can access the new forms here:

Additionally, the IFR states that first-draw PPP loans with $150,000 or less in gross income on a Schedule C will be eligible for the economic necessity safe harbor, but loans above will not and could receive additional SBA review.

The current PPP application period expires Mar. 31, 2021, and lenders are experiencing delays in implementing these new calculations. It is anticipated they will begin accepting applications the week of Mar. 8. We are continuously monitoring the situation for additional clarifications and updates.

The nation’s smallest businesses are getting revamped Paycheck Protection Program (PPP) rules and a special filing period announced in recent changes from the Biden-Harris administration. Small businesses with fewer than 20 employees make up 98% of the small businesses in the U.S. but have not received much assistance from the PPP so far and have accounted for a significant portion of business closures during the pandemic. These new rules seek to remedy that. Here’s what you should know.

Dedicated filing period – Small businesses with fewer than 20 employees will get a dedicated filing period starting Wednesday, Feb. 24 and running through Tuesday, March 9 to allow lenders to focus on loans for these businesses. This includes individuals who receive 1099s or are considered self-employed who file a Schedule C.

New calculations for ‘no-payroll’ business owners – Specifics have not yet been released, but self-employed, independent contractors, and sole proprietors can expect a new calculation method to account for the missing payroll component of their PPP loans. Additionally, $1 billion is being set aside for this group for those located in low and moderate-income areas.

More opportunities for underserved communities – Former felons (with nonfraud convictions) and non-citizen small business owners with Individual Taxpayer Identification Numbers (ITINs), green card holders, and those with visas will be eligible to apply for relief. Further guidance is expected.

Greater access for business owners with delinquent student loan debt – Business owners with delinquent or defaulted federal debt over the last seven years will now be able to apply for a PPP loan.

Address PPP processing delays – Anti-fraud violation checks have been a significant hold up for PPP processing, and the White House expects to continue to work with the Small Business Administration (SBA) to address this issue while maintaining program integrity.

Further guidance is expected in many of these areas, and we will continue to update you as it becomes available. Contact us for assistance with your PPP loan application or forgiveness application.

Last spring, the CARES Act created the ERC for businesses that were affected by the COVID-19 pandemic. However, the CARES Act disallowed the credit for businesses that received a Paycheck Protection Program (PPP) loan. Fast forward to December 2020, when Congress declared that businesses that had obtained PPP loans could also qualify for the ERC. In addition, Congress extended the availability of the ERC into the first two quarters of 2021, with a few new favorable provisions. The credit is refundable, which means that qualified businesses are able to get cash to the extent that the credit exceeds the payroll tax liabilities. The chart below outlines the terms of the ERC for both the original and extended filing periods:

|

As I previously noted, a business cannot “double dip,” or utilize the same wages to obtain PPP loan forgiveness while still benefiting from the ERC. However, the ERC was not available to PPP recipients prior to December 27, 2020. Accordingly, those businesses that applied for loan forgiveness would have included all eligible payroll costs paid or incurred during the covered period pursuant to the instructions in the loan forgiveness applications. Certainly, those businesses shouldn’t be penalized for already receiving forgiveness prior to this change in the law; however, this wouldn’t be the first time we’ve seen something like that with the evolution of the PPP.

On January 15, the American Institute of Certified Public Accountants (AICPA) sought clarification on this matter. In a letter to the IRS, the AICPA “recommends that the IRS and Treasury provide guidance stating that the filing of a PPP loan forgiveness application does not constitute an election to forgo the ERC with respect to the amount of wages reported on the application exceeding the amount of wages necessary for loan forgiveness.” It is clear — additional guidance is imminent.

As we await clarification from the IRS, businesses who have already received forgiveness on their PPP loans should first evaluate their eligibility for the ERC. After concluding their eligibility, businesses should begin gathering payroll reports, government shutdown orders and financial statements to calculate and claim their credits.

Borrowers of PPP loans who have yet to apply for loan forgiveness have an alternative path; those businesses looking to leverage the ERC now have an additional element to consider in their evolving journey to loan forgiveness. This change in guidance further emphasizes the importance of an intentional strategy to maximize the benefits of both programs, but also leaves questions unanswered for borrowers who have already received forgiveness on their PPP loans.

The coronavirus pandemic has forced many businesses and entire industries to move their operations remotely in the interest of employee and customer safety, and this has caused these businesses to change the way they think about their operations. During this time, businesses have had to quickly adapt and implement new technology and processes in order to meet customer and employee demands that did not exist previously. These disruptions can be a source of headache or opportunity for businesses who choose to embrace the virtual business model.

One process that is in the limelight more than ever is virtual outsourced accounting. Virtual outsourced accounting simply means working with an accounting firm that provides services virtually through cloud-based platforms. While many businesses have already made the move the cloud-based accounting platforms, some have resisted or have kept operations in-house due to the lack of incentive to change. However, the pandemic has created an incentive and highlights many of the reasons why a business would want to consider a virtual outsourced accounting option.

Safety – First and foremost is the safety of yourself and your employees. Virtual outsourced accounting allows you to conduct these financial operations remotely keeping you and your employees safe. When we return to our workplaces and safety is less of an issue, you continue to receive the other benefits of virtual accounting.

Security – Virtual accounting allows for heavy encryption of your sensitive and confidential data and frequent backups of information across multiple locations, keeping your records safe in the event of any number of physical or digital threats. Physical filing cabinets or local servers are at increased risk of physical or digital hacking because they often do not have the heavy encryption necessary for protection, nor the multiple back-ups in case of a data breach or natural disaster.

Consistency – Businesses are likely in this for the long-haul with many industries not anticipating a return to workplaces for several more months. When you outsource your accounting to a firm with virtual capabilities, you never have to worry about lost time due to illness or employee turnover. Accounting firms have adapted their workplaces to virtual as well, providing as uninterrupted service as possible.

Knowledge – Outsourcing your accounting provides you with greater access to a deeper bench of highly-skilled and knowledgeable accounting teams to help you bust through roadblocks or troubleshoot issues you are likely facing during the pandemic. When you’re encountering especially difficult and unforeseen challenges, a knowledgeable third-party adviser can help you stay on top of regulatory changes, financing opportunities, and provide guidance on forecasting and budgeting during unpredictable times.

Flexibility – As the pandemic increasingly throws new challenges at businesses, having access to virtual outsourced accountants allows you the flexibility to bring in help where and when you need it. Outsourced accounting teams can serve as a fill-in for your in-house accounting staff where needed due to illness, long-term leave, furloughs/layoffs, or employee turnover.

Remote Access – Working with a virtual accounting team that operates in the cloud allows you greater flexibility to perform tasks and access your numbers. Because data is updated in real time between you and your accountant, you can get a more accurate picture of your business’s financials – crucial during a turbulent time like the pandemic.

Cost Savings – Outsourcing your accounting to a firm that conducts operations virtually provides you with significant cost savings including salary/compensation, employee benefits, and overhead that you would experience by hiring and in-house employee. Furthermore, you never have to worry about turnover costs such as recruiting, hiring, and training a new staff member.

If you haven’t considered virtual accounting, now is the time. You do not have to face these pandemic challenges alone, and your financial processes shouldn’t be stifled due to inadequate operations that fail to consider the virtual world to which we’ve been forced to adapt. Contact us for more information on virtual accounting.

The employee retention tax credit (ERTC) is intended to provide liquidity to employers during the pandemic and was greatly expanded in the Consolidated Appropriations Act of 2021 thanks to Sections 206 and 207 of the Taxpayer Certainty and Disaster Relief Act portion, opening the doors to more businesses to be able to qualify for and receive this credit who are facing significant hardship as a result of the coronavirus pandemic. Many changes from the original credit were enacted including an expansion in the amount of credit and business eligibility, and how it plays with the Paycheck Protection Program (PPP).

Here’s what you need to know about this credit, how it works, and how to apply. Note that when a provision is designated as effective Jan. 1, 2021, it does not apply to any retroactive credit claims.

The following businesses and organizations engaged in a trade or business are eligible to qualify for the ERTC:

An eligible organization can qualify for the ERTC if:

The gross receipts test is Effective Jan. 1, 2021, this is an increase from the previous law and expands the threshold for eligible businesses.

Effective Jan. 1, 2021, businesses with 500 employees or less are eligible to claim the credit even if an employee is working during the first two quarters of 2021 (an increase in the threshold from 100 employees in the original law). For affiliated companies sharing more than 50% common ownership, the 500 count is aggregated.

The passage of the bill at the end of December extended the availability of the ERTC through the first two quarters of 2021, allowing for more relief as the pandemic continues on. Qualified wages paid after March 12, 2020, and before July 1, 2021, are eligible for the credit.

Additionally, the new law will allow for an advanced credit for companies with 500 or fewer employees, allowing these companies to monetize the credit before wages are paid. The amount is based on 70% of the average quarterly payroll for the same quarter in 2019, and if there is excess advance payment, companies will need to repay the credit to the government.

Effective Jan. 2021, 70% of qualified wages are eligible for the ERTC including the cost to continue providing health benefits (such as if an employee is on furlough). This is an increase from the 50% provided in the previous stimulus bill. The qualified wage limit was increased to $10,000 per quarter per employee for the first 2 quarters of 2020. Previously was $10,000 per employee for the entirety of 2020.

Also, effective Jan. 1, 2021, the credit maxes out at an aggregate $14,000 per employee, or $7,000 for the first two quarters of 2021, and is available even if the employer received the maximum credit for wages paid to the same employee in 2020. This is an increase from the $5,000 max in the previous bill.

Additionally, the credit is now available for certain pay raises including hazardous duty pay increases (previously not allowed and is retroactive).

First and foremost, companies with PPP loans can now also claim the ERTC, and the change is retroactive to the effective date of the original law (March 12, 2020). Key to note is that the ERTC cannot be applied toward wages covered by the PPP.

If, for example, your business received a PPP loan in 2020 and paid qualified wages in excess of the PPP loan amount, you could qualify and apply for the ERTC through an amended employment tax return (Forms 941X). This also applies to affiliate companies related to a PPP borrower. Furthermore, if your PPP payroll costs are not forgiven, those same payroll costs can be applied toward ERTC qualified wages. Your accountant can help you calculate and designate these costs.

Claiming the ERTC, with or without a PPP loan, requires careful calculation and documentation. Contact us for assistance with this credit.

On November 18, 2020, the Internal Revenue Service issued Revenue Ruling 2020-27 which provides needed clarity on a taxpayers’ ability to deduct eligible expenses for Paycheck Protection Program (PPP) loan forgiveness.

The Ruling notes that a taxpayer that received a covered loan guaranteed under the PPP and paid or incurred certain otherwise deductible expenses listed in section 1106(b) of the CARES Act may not deduct those expenses in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the covered loan on the basis of the expenses it paid or accrued during the covered period, even if the taxpayer has not submitted an application for forgiveness of the covered loan by the end of such taxable year.

What if forgiveness is denied, in whole or part, or not requested?

In conjunction with the Ruling, the IRS issued Revenue Procedure 2020-51 to outline the steps for when:

1.) The eligible expenses are paid or incurred during the taxpayer’s 2020 taxable year,

2.) The taxpayer receives a covered loan guaranteed under the PPP, which at the end of the taxpayer’s 2020 taxable year the taxpayer expects to be forgiven in a subsequent taxable year, and

3.) In a subsequent taxable year, the taxpayer’s request for forgiveness of the covered loan is denied, in whole or in part, or the taxpayer decides never to request forgiveness of the covered loan.

The Rev Procedure provides for two safe harbors for taxpayers in the event forgiveness is denied, in whole or in part, or otherwise not requested that would allow for the deduction of expenses in either the 2020 or a subsequent tax year.

Questions we still have

While the Ruling provides information on the deductibility of expenses and the tactical approach for borrowers whose forgiveness is denied or not requested, additional clarification is still needed. This guidance does not address the order in which the eligible expenses (payroll, rent, utilities and mortgage interest) lose the ability to be deducted.

Further, the guidance does not address other matters that could have significant tax implications including, but not limited to, the impact on the following:

Need Assistance in Choosing the Right PPP Loan Forgiveness Application?

We have put together a flowchart that can help: How to Select the Right Loan Forgiveness Application

The Small Business Administration (SBA) and Treasury announced on October 8 that a simplified application (Form 3508S) for Paycheck Protection Program (PPP) loan forgiveness is now available for borrowers whose loans fall in the $50,000 or less threshold. As more and more businesses begin filing for PPP loan forgiveness, this change outlined in a new interim final rule greatly simplifies the process for borrowers with smaller loans. However, it is important to note that this simplified form is not equal to automatic forgiveness.

Among the simplified provisions for borrowers with $50,000 or less in PPP loans is the exemption from a reduction in forgiveness based on reductions in full-time-equivalent (FTE) employees as well as reductions in employee salaries or wages. While certifications and documentation of payroll and non-payroll costs will still be required, this move streamlines the process significantly for borrowers with smaller loans who will not be responsible for potentially complicated calculations for FTE and salary reductions.

Borrowers with loans of $50,000 or less who are also included in affiliate loans totaling $2 million or more are not eligible for the new application. The SBA estimates that approximately 3.57 million loans were issued for $50,000 or less or $63 billion of the PPP funds, and that about 1.71 million of the loans were for businesses with one or zero employees.

Below are additional considerations to keep in mind:

Lenders should note the further guidance on their responsibilities released with the notice which includes review of borrower documentation for eligible costs for forgiveness for all forgiveness applications. Lenders are required to confirm receipt of the borrower certifications the borrower’s documentation of payroll and non–payroll costs. Borrowers are responsible for their calculations and accuracy of the information provided, and lenders are permitted to rely on what the borrower has submitted.

It’s important to note that the amount of forgiveness cannot exceed the principal amount of the loan even if a borrower submits documentation for eligible costs exceeding the amount of their PPP loan.

Regardless of what form is submitted for forgiveness, lenders must:

Many questions remain about the tax treatment of some expenses that fall under the PPP. Contact your CPA for assistance with your forgiveness application and to have a thorough discussion about the impact your PPP loan has on your tax strategy and when is the best time to apply for forgiveness.

Employers can now defer payroll tax withholding on employee compensation for the last four months of 2020 and then withhold the deferred amounts in the first four months of 2021, confirms a recent update from the IRS. President Trump’s memorandum on Aug. 8 gave employers the ability to defer payroll taxes for employees affected by the COVID-19 pandemic in an effort to provide financial relief.

The guidance directs that employers can defer the withholding, deposit, and payment of the employee portion of the old-age, survivors, and disability insurance (OASDI) tax under Sec. 3102(a) and Railroad Retirement Act Tier 1 under Sec. 3201 from employee wages from Sept. 1 to Dec. 31, 2020.

Employers must then withhold and pay the deferred taxes from wages and compensation during the period from Jan. 1, 2021, and April 30, 2021, with interest, penalties, and additions to tax to begin accruing starting May 1, 2021. Included in the notice is a line that indicates, if necessary, employers can “make arrangements to otherwise collect the total Applicable Taxes from the employee,” such as if an employee leaves the company before the end of April 2021, but does not provide details on what that entails.

Employees with pretax wages or compensation during any biweekly pay period totally less than $4,000 qualify for the deferral. Amounts normally excluded from wages or compensation under Secs. 3121(a) or 3231(e) are not included in calculating the applicable wages. The determination of applicable wages should be made on a period-by-period basis.

Companies may choose whether or not to enact the payroll tax deferral. We are closely monitoring updates related this and other presidential executive orders and will communicate if more information becomes available. For questions or assistance with this payroll tax deferral, contact us.

On Aug. 24, the Small Business Administration (SBA) and Treasury issued the latest interim final rule update to the Paycheck Protection Program (PPP) that seeks to clarify guidance related to owner-employee compensation and non-payroll costs. This guidance has been long-awaited and clears up several questions borrowers have had about forgiveness. Here are the main points:

1. Owner-employees of C or S corporations are exempt from the PPP owner-employee compensation rule for loan forgiveness if they have a less than 5% stake in the business. The intent is to provide forgiveness for compensation of owner-employees who do not have a considerable or meaningful ability to influence decisions over loan allocations. This clarifies earlier guidance that capped the owner-employee compensation regardless of what stake they have in the business.

2. Loan forgiveness for non-payroll costs may not include amounts attributable to the business operation of a tenant or subtenant of the PPP borrower. The SBA provides a few examples of what this means:

3. To achieve loan forgiveness on rent or lease payments to a related third–party, borrowers must ensure that (1) the amount of loan forgiveness requested does not exceed the amount of mortgage interest owed on the property attributable to the business’s rented space during the covered period, and (2) the lease and mortgage meet the Feb. 15, 2020, requirement for establishment. Earlier guidance had not addressed related third-party leases.

It’s important to note that mortgage interest payments to a related party are not eligible for forgiveness as PPP loans are not intended to cover payments to a business’s owner because of how the business is structured – they are intended to help businesses cover non-payroll costs owed to third parties.

For questions on any of these rules or assistance with your PPP loan forgiveness application, contact us today.

In an effort to help businesses cope with the impact of COVID-19, the CARES Act passed by Congress in March of this year eliminated some of the restrictions on the business interest deduction set in place in 2017 by the Tax Cuts and Jobs Act (TCJA). Now, the IRS has released much-needed guidance and final regulations for business interest expense deductions.

Limiting the business interest deduction was originally a way of helping pay for the TCJA and began with tax years starting after Dec. 31, 2017. The deduction was limited to the sum of:

The final regulations state that the deduction does not apply to:

Taxpayers must use Form 8990 to calculate and report their deduction and the carry-forward amount of disallowed business interest expense.

Additional regulations released by the IRS cleared up some of the remaining questions including issues related to the CARES Act. These additional regulations can be used with limitations until the final regulations are published in the Federal Register.

Additionally, a safe harbor was created in Notice 2020-59 that allows taxpayers engaged in a trade or a business managing or operating qualified residential living facilities to treat that as a real property trade or businesses in order to qualify as an electing real property trade or business.

Reach out for assistance with understanding and reporting your business interest expense.

On August 8, 2020, President Trump signed an executive order extending certain aspects of COVID-19 relief in the absence of a new bill from Congress. The executive order includes several measures to protect individuals as provisions of the CARES Act expire or have expired.

Here’s what was in the order:

Payroll tax delay – The order authorizes the Treasury to consider methods to defer the employee share of Social Security taxes (IRC section 3101(a) and Railroad Retirement Act taxes under section 3201(a)) for employees earning up to $104,000 per year ($4,000 biweekly) for a period beginning Sept. 1, 2020, through Dec. 31, 2020. No interest, penalty, or additional assessment would be charged on the deferred amount. At this point, this is not effective. It means the Treasury can exercise authority and explore ways to achieve forgiveness on the deferred amounts, such as legislation. While nothing will be done until the Treasury issues guidance, employers will need to be mindful of this as the liability of this payment could fall on them depending on the final rule.

Unemployment benefits – The $600 per week unemployment benefit authorized by the CARES Act expired on July 31. The executive order retroactively authorizes $400 per week from Aug. 1; however, states must contribute $100 and the remaining $300 would come from the federal government. The funding for the federal portion would come from the FEMA Disaster Relief Funds and would continue until the earlier of Dec. 6, 2020, or a drop in the Fund balance to below $25 billion. The state portion is to come from federal funds already distributed to the states. Questions of whether the FEMA funds can be used for this purpose are still outstanding.

Evictions – The evictions portion of the executive order asks the secretary of HHS and director of CDC to consider whether halting residential evictions is reasonably necessary to help prevent further spread of COVID-19 and also authorizes the Treasury Secretary and HUD Secretary to consider potential financial assistance for renters. The CARES Act banned evictions through July 25 for properties with federal mortgage programs or HUD funds.

Student loans – The student loan interest deferral enacted by the CARES Act is set to expire Sept. 30, 2020. The executive order would waive student loan interest until Dec. 31, 2020, for loans held by the Department of Education only.

Final guidance is required from the respective agencies before some of these measures can be enacted. Contact us with questions.

The Small Business Administration (SBA) and Treasury released an updated Paycheck Protection Program (PPP) FAQ on Aug. 4 in an effort to address PPP loan forgiveness issues that have arisen as borrowers begin to complete their applications. The 23 FAQs address various aspects of PPP forgiveness including general loan forgiveness, payroll costs, non-payroll costs, and loan forgiveness reductions. Here is a brief overview of some of the most notable clarified guidance.

The FAQ document also includes several examples for making calculations related to the above questions. Contact us for questions and assistance with your PPP loan forgiveness application.

Economic downturns are an almost inevitable reality for nearly every business owner. Decisions made far away from your community, catastrophic and unpredictable weather events, and even global pandemics as we’ve seen this year can disrupt the health and viability of a business. During these challenging times, business owners have to make difficult decisions about the future of their business that not only affect them but also their employees, vendors, clients, and communities. It’s an enormous responsibility to bear, but you don’t have to go it alone.

Your CPA advisor is your best resource for tackling the challenges of an economic downturn. As an outside party, they can help you make smart business decisions that protect your vision and mission while remaining financially responsible. Your CPA can help you:

Optimize your books

Never underestimate the power of good bookkeeping. By keeping your books in order, your CPA can help you plan and project for the future at each stage of an economic downturn. This includes planning for temporary closures and tiered re-openings (and potentially a back-and-forth of both depending on the state of the country and market). When your books are clean and up to date, you can better project how events and decisions will impact your finances on a weekly, monthly, and quarterly basis. Your CPA can help you flex the numbers on fixed and variable expenses to account for increases in costs, decreases in income, and potential changes to payroll. Knowing your numbers intimately can help you make better-informed decisions.

Minimize your tax burden

During times of economic crisis, staying abreast of new and changing tax legislation will be essential to projecting tax burden and uncovering tax savings opportunities. Your CPA is the best person to handle this because they know your business and your industry inside and out and can help you uncover tax savings opportunities that are unique to your circumstances. They do all the research, and you reap the rewards. With a CPA’s assistance, you achieve deductions and credits you may not have realized were available and develop a plan to defer costs where allowed depending on your business, industry, and location. Taxes are not an area you should or need to face alone during an economic downturn. Your CPA has done the homework, so you don’t have to.

Rationalize your decision making

When markets are in flux and your business is facing unprecedented challenges, the decisions you make can make or break your business. But you don’t have to go it alone. Your accountant can help you make data-informed decisions whether that be how to pay vendors, when and how to apply lines of credit, and the best ways to use your capital. Negotiating contracts with vendors that meet your needs and theirs during a downturn will not only achieve cost savings but also preserve relationships – your CPA can help develop a plan that makes sense. Knowing when to engage lines of credit can help you make better moves that you can either afford to pay back later, or maybe prevent you from taking on credit you can’t handle – your CPA can guide you in this process. Knowing where to allocate capital will be key to maintaining operations, and you may need guidance on what expenses to cut and what to keep such as marketing and payroll – your CPA can help you project the ramifications. With your CPA by your side, you don’t have to operate in a silo of decision-making.

Maximize your sense of relief

Most of all, your CPA can provide perspective, alleviate business back-end burden, and help advise you on financially feasible and sound decisions when much of the world feels like it’s in chaos. You have a lot to focus on during a downturn including how to handle your customers and employees in a changing marketplace. Having someone who can help you stay fiscally viable as you work through tough times, and develop a plan for future success, provides a welcome peace of mind.

You don’t have to go through any economic downturn alone. Your CPA can help you shoulder the challenges and weather the storms so you can continue doing what you do best – running your business.

The U.S. Senate and House of Representatives have both unanimously agreed to extend the Paycheck Protection Program (PPP) by five weeks in an effort to continue providing relief for small businesses hit hard by the pandemic. Applications officially closed for the program on June 30 when the Senate voted for a last-minute extension. President Trump is expected to sign the bill.

This extension would give small businesses until Aug. 8 to apply for a share of the approximately $129 billion in remaining PPP funding through the Small Business Administration (SBA). Thanks to the PPP Flexibility Act passed on June 5, recipients have 24 weeks to use loan funds for payroll and other essential expenses like rent/mortgage and utilities. The Flexibility Act also lowered the threshold for payroll expenses to 60% to achieve full forgiveness with a few safe harbor considerations. Over 4.9 million loans have been approved by the SBA so far, worth more than $520 billion.

Contact us for assistance in compiling information for your PPP forgiveness application to present to your lender.

In the midst of the uncertainty and instability that the COVID-19 pandemic has created for businesses and individuals, some relief is available for taxpayers in the form of deductible losses thanks to the preexisting Internal Revenue Code (IRC) Section 165(i). While the CARES Act and FFCRA have received much of the attention, taxpayers may also find relief thanks to Section 165(i) which allows for losses sustained as a result of the pandemic in 2020 to be claimed on the taxpayer’s 2019 tax return.

This deduction is triggered by a federally declared disaster, like the pandemic which was declared a national emergency on March 13, 2020. In the case of this deduction, losses attributed to federally declared disasters can be deducted on the previous year’s return. While not often used, this deduction comes at the right time for businesses struggling during the pandemic.

In order to claim the Section 165(i) deduction, losses must:

While some taxpayers will fit into this deduction, the rules and procedures are complex.

Examples of deductible losses as a result of COVID-19 vary from costs related to running your business during a pandemic like investments in personal protective equipment and cleaning supplies and services, to the closure of stores and facilities and disposal of unsaleable inventory. Other eligible costs include certain termination payments, losses from property sales or exchanges, abandonment of leasehold improvements, and nonrefundable event payments, to name a few.

To make the Section 165(i) election, taxpayers must include Form 4684, “Casualties and Thefts,” with their return within six months from the due date for filing the taxpayer’s federal income tax return for the disaster year.

We can assist you with identifying your deductible expenses and following the complex rules and procedures for making this election. Reach out for assistance.

On June 22, 2020, the U.S. Small Business Administration (SBA) released the: Paycheck Protection Program (PPP) Revisions to Loan Forgiveness Interim Final Rule

This guidance details two noteworthy changes impacting PPP loan borrowers, including:

The updated regulations also make minor updates to existing guidance addressing the extension of the covered period derived from the June 5, 2020 enactment of the Paycheck Protection Program Flexibility Act (H. R. 7010).

Read our blog summary of changes from H.R. 7010 here.

When Can a Borrower Apply for Loan Forgiveness?

A borrower can apply for forgiveness at any time on or before the loan maturity date. However, if the borrower applies for forgiveness before the end of the covered period and has reduced any employee’s salaries or wages by more than 25 percent, the borrower must account for the excess salary reduction for the full 8-week or 24-week covered period.

Expanded Limitations on Owner Compensation

The release of Revisions to the Third and Sixth Interim Final Rules on June 17, 2020, increased the maximum compensation for all employees and owners, which was summarized in our blog here. The new interim rules added that the employer portion of retirement plan funding for owner-employees of S-Corporations and C-Corporations is now capped at 2.5 months’ worth of the 2019 contribution amount. Furthermore, healthcare costs paid on behalf of owner-employees of S-Corporations are not eligible for forgiveness.

HT2 has established a dedicated PPP loan forgiveness team that is constantly monitoring new guidance from the SBA, as well as the Treasury, Congress, and the IRS, to ensure we have the latest information when advising our clients.

The CARES Act includes provisions that allow individuals to take early retirement plan distributions within certain rules. These changes include provisions for people with COVID-19 or who have family members with the illness. It also includes those who experience adverse financial consequences as a result of being quarantined, laid off, furloughed or having work hours reduced because of the illness.

The recently passed CARES Act includes provisions that allow individuals to take early retirement plan distributions of up to $100,000 from their retirement accounts without being subjected to the 10% penalty and gives them three years to pay the taxes on the distribution or return the funds to their account.

Also included, is the provision allowing individuals required to take Required Minimum Distributions (RMD’s) to elect to return the funds they have taken during 2020 or to not take their RMD for the year. In order to take these early distributions, or to return RMD’s taken prior to January 31, 2020, an individual must be able to designate them as a Coronavirus-Related Distribution. To establish these items as Coronavirus-Related Distributions the individual must fall into one of the following categories:

It is important to note that these items only apply to early distributions and to RMD’s taken prior to January 31, 2020 for the current year that would therefore not fall in the normal 60-day window an individual would have to return distributions without repercussions.

If you have taken an RMD after January 31, 2020 you can simply write a check within 60 days of receiving the distribution and return those funds to your account without having to meet any of these requirements.

If you have not yet taken any RMD and do not wish to take the funds for the current year, there is nothing you will need to do to defer that payment. For any individuals that deferred their 2019 payment because they reached 70 ½ in 2019 and would have been required to take two distributions in 2020, this requirement is also eliminated.

Additionally, for those who typically use a portion of their RMD to support charitable organizations, these funds can still be withdrawn for those purposes allowing individuals to use pre-tax dollars to support the organizations that mean the most to them.

On June 16, 2020, the U.S. Small Business Administration (SBA) released the updated Paycheck Protection Program (PPP) Loan Forgiveness Application (see link below) which supersedes the application previously released on May 15, 2020. The new application incorporates changes to the PPP per the Paycheck Protection Program Flexibility Act (H. R. 7010), which was signed into law on June 5, 2020. The latest PPP loan forgiveness application, in conjunction with the June 17, 2020 release of the Revisions to the Third and Sixth Interim Final Rules, addresses some of the previously unanswered questions, including:

The SBA also released the PPP Loan Forgiveness Application Form 3508EZ (Form EZ) on June 16, 2020. The Form EZ is a simplified version of the loan forgiveness application and is applicable to PPP loan borrowers who are willing to certify they have met one of the following conditions:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

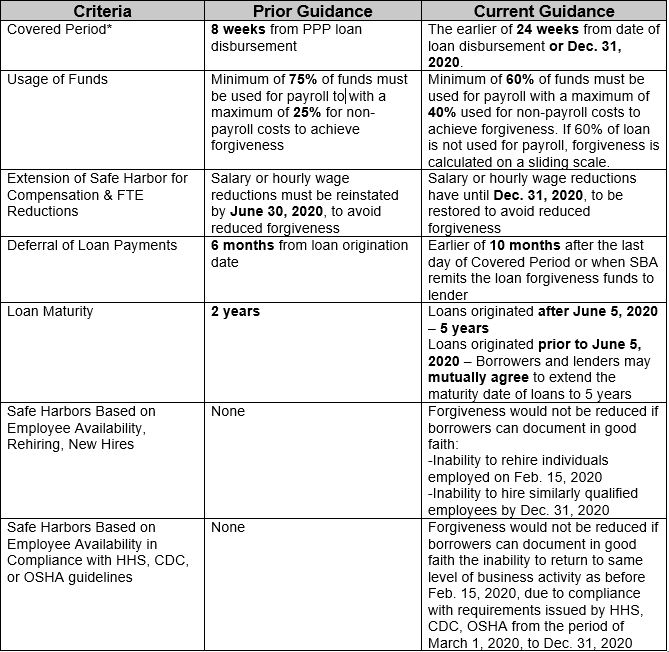

On June 10, 2020, the Small Business Administration (SBA) issued an updated interim final rule for the Paycheck Protection Program (PPP) in response to the PPP Flexibility Act passed on June 5, 2020. The updated guidance accounts for revisions made to the covered period, usage of funds changes, extended safe harbors, and more.

Here is a quick rundown of the changes made by the PPP Flexibility Act.

Also of note:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

Helpful Links:

Nothing is more important than the health and safety of you and your loved ones as you deal with the COVID-19 pandemic. The coronavirus crisis has had a wide-reaching effect on just about every aspect of our lives. We’ve all been asked to adjust our daily routines. Unfortunately, our health and wellbeing aren’t the only things of which we need to be concerned. The sudden downward shift in our economy has had a devastating effect on employment. The U.S. is currently experiencing a jobless rate unseen since the Great Depression. If you, or someone close to you, lost a job as a result of the economic shutdown caused by COVID-19, we’re sure you’ve got questions. In this article, we’ll address some of those questions, particularly with respect to unemployment benefits.