California taxpayers should note the changes made to these tax laws over the last several months. Here’s an overview of what you may have missed:

California law requires holders of unclaimed property to attempt to notify owners of the property regularly, to keep records of the property and to turn over the property to the State Controller’s Office after the appropriate dormancy period. Unclaimed property could be:

Under California Assembly Bill 466, the dormancy period has been set to one year for payroll accounts and three years for Securities, Accounts Receivable and Payable, and Disbursements. The law also requires businesses to review their books and records annually to determine if they have any unclaimed property to report. Keep in mind, businesses must also complete the following reporting requirements:

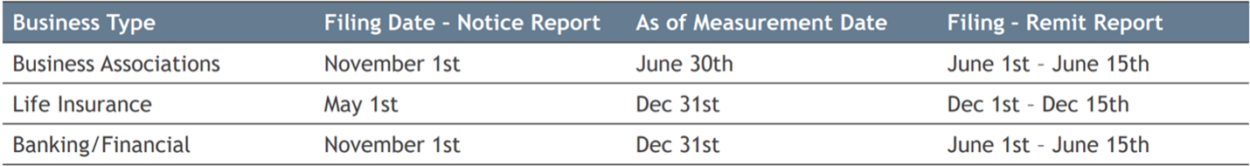

In addition, the State of California identifies the following filling and reporting deadlines:

Personal property owners in California will receive annual assessments and tax bills for the personal property based on their county or local jurisdiction laws. In order to stay in compliance with tax laws, keep these points in mind:

The Tax Cuts and Jobs Act limited the state tax deduction for personal income in pass-through entities to $10,000. In California, pass-through entities pay tax, and the PTE owns remain taxable on the distributive shares of income. However, the owners receive a tax credit for a share of the PTE tax. The nonrefundable tax credit can be carried forward for up to 5 years.

In order to qualify as a pass-through entity, the election must be made annually and consented to by each owner to the pass-through entity. Payments of more than $1,000 or 50% of the prior year PTE tax are due by June 15 of the current tax year, with the remaining due on March 15 of the following year. This is effective for tax years beginning January 1, 2021 or later and before January 1, 2026.

The following are business taxes that business owners should be aware of for San Francisco and Los Angeles.

In late 2022 and early 2023, California issued qualified taxpayers a total of $9.2 billion in refunds of tax overpayments, called the Middle Class Tax Refund. The State of California noted these payments are not liable for state taxes previously. In February, the IRS determined that it will not challenge the tax treatment of these payments on 2022 tax filings, citing their general welfare and disaster relief exception.

Due to historically high rain, snow, and flooding in much of California, the IRS is offering disaster relief assistance in the form of due date extensions on required tax filings and payments. The new deadline for tax payments due from January through October is October 16, 2023. This includes:

For more information on the counties qualified for tax relief and what payments have been extended, please visit the IRS press release or call our team.

Receive Free financial tips & Tax Alerts!

"*" indicates required fields

Businesses usually want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it wise to do the opposite? And why…

Navigating the realm of capital gains and optimizing tax outcomes require strategic thinking and informed decision-making. Understanding and employing effective capital gains tax strategies is crucial for businesses contemplating asset…

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example,…