The United States saw some of the most sweeping changes in December 2017 with the passing of the Tax Cuts and Jobs Act (TCJA). Many of the amendments to the Internal Revenue Code are temporary in nature, set to expire at the end of 2025. For example, the basic exclusion amount (BEA), which doubled from $5 million to $10 million prior to being adjusted for inflation, will return to pre-2018 levels when the TCJA is set to expire. One major concern, raised by public comments, is what will happen to individuals taking advantage of the increased gift and estate tax exclusion amounts when the exclusion amounts drop to pre-2018 levels? Will they be adversely impacted?

For example, what would happen if a taxpayer chose to gift their entire $11.4 million (adjusted for inflation) lifetime exclusion amount during the TCJA? Rather than using up their basic exclusion amount at their time of death, a taxpayer may choose to use their basic exclusion amount during their lifetime by making large gifts. Any unused portion would be used to offset or possibly eliminate estate taxes when a taxpayer perishes.

Those concerns were laid to rest last month when the Treasury Department and the Internal Revenue Service issued final regulations confirming that individuals who plan to take advantage of the TCJA-increased basic exclusion amount will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. The final regulations also provide a special rule that allows the estate to compute its estate tax credit using the higher of the BEA applicable to gifts made during life or the BEA applicable on the date of death.

For 2019, the inflation-adjusted BEA is $11.4 million. If you are considering making a large gift within the next few years it is important to understand how these changes will impact your personal or business operations. The professionals in our office can answer your questions, call us today!

Hamilton Tharp was recently announced as a 2019 winner of CPAsNET’s A Great Place to Work Award!

Recognized for their standard of excellence as an employer of choice, Hamilton Tharp joins a select number of firms nationwide to earn this reputable and highly competitive award.

CPAsNET’s A Great Place to Work Award is employee driven. Data is compiled and assessed from a combination of employee feedback and firm data including workplace benefits, policies, practices, philosophies, systems and demographics. Participating firms must meet a minimum standard of workplace excellence to be considered for the award.

Participation in this survey allowed us to benchmark our workplace policies and practices to the marketplace. “Through our participation in this survey, we have been able to gain valuable insights into employee engagement and how our benefits compare nationally,” said Christina Tharp, Managing Partner of Hamilton Tharp.

We are honored to be a 2019 winner of CPAsNET’s a Great Place to Work Award!

On September 24, 2019, the IRS issued Revenue Procedure 2019-38 finalizing safe harbor allowance of rental real estate for the purpose of Section 199A deduction. If all the safe harbor requirements are met, a rental real estate enterprise will be treated as a trade or business and the related rental income will be eligible for the 20% Section 199A deduction, subject to possible limitations.

The Revenue Procedure clarified that the following requirements must all be met by taxpayers or relevant passthrough entities to qualify for safe harbor –

Rental services that count toward the 250 hour requirement include:

Activities that do not qualify as rental services include:

If you have questions about the safe harbor requirements, call us today.

The Internal Revenue Service (IRS), Department of the Treasury (DOT), Employee Benefits Security Administration (ESA), and Department of Health and Human Services (DHS) recently issued a final ruling on the use of employer-funded health accounts. Effective January 1, 2020, employers of all sizes that do not offer a group coverage plan may use HRAs as a vehicle to help employees pay for health insurance premiums. This ruling extends beyond the current scope of health reimbursement arrangements (HRAs), which allows businesses to offer employer-funded accounts for employees to apply to out-of-pocket medical expenses and now allows employees to pay for insurance premiums.

The new ruling is expected to affect more than 800,000 employers and 11 million employees, making it a far-reaching update to the current system. Under the guidance, employers may offer two new types of HRAs:

The Benefits

Considerations:

To assist employers, the DOL issued this Individual Coverage HRA Model Notice: https://www.dol.gov/sites/dolgov/files/ebsa/laws-and-regulations/rules-and-regulations/completed-rulemaking/1210-AB87/individual-coverage-model-notice.pdf .

This notice is not exhaustive. If you would like more information on how your business might benefit from an ICHRA, give the professionals in our office a call. We can go over your options and determine if you satisfy the ACA’s affordability and minimum value requirements.

Whether you are an individual taxpayer or a small business owner, understanding your eligibility for tax credits is an essential facet of income tax planning. Unlike deductions, which only reduce taxes owed by the product of the amount of your deductions multiplied by your marginal tax rate, tax credits provide dollar-for-dollar tax reduction. The following post addresses key tax provisions and tax minimizing strategies to keep on your radar during year-end tax planning for 2019.

Individual Tax Credits

The Child Tax Credit

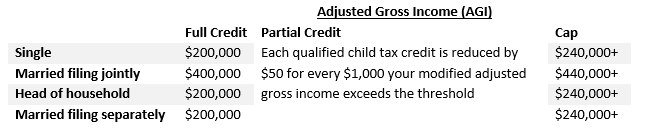

Thanks to the increase in phaseout thresholds made by the 2017 Tax Cuts and Jobs Act, many taxpayers can look forward to another year of the child tax credit. The child tax credit, which is $2,000 for every eligible child, is available to parents and guardians of children under 17 whose household falls within specified income brackets. In addition, up to $1,400 of the credit amount is refundable. This means that certain taxpayers can claim the credit even after their tax bill is reduced to zero. Households that include dependents over the age of 17 or for children you care for or whose support you provide may be eligible for a nonrefundable $500 family credit. The child tax credit may be taken by taxpayers who claim the qualifying child as a dependent and is fully phased out when the adjusted gross income of a taxpayer reaches the amounts listed below. For this reason, separated or divorced parents should plan for which parent can claim the dependency exemption for an eligible child.

Educational Tax Credits

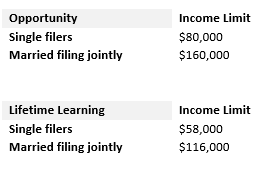

For taxpayers enrolled in an

undergraduate program, the American Opportunity tax credit pays 100% of

eligible tuition and required fees up to $2,000, plus 25% of the next $2,000,

bringing the full tax credit to $2,500 per year. Partial tax credits are

available to those that fall outside the income threshold. Likewise, the Lifetime Learning tax credit

offers students of graduate programs, vocational schools, and other

nontraditional programs a 20% tax credit on up to $10,000 in qualified

education expenses.

These credits are phased out for taxpayers with modified adjusted gross incomes in excess of the above amounts. The number of years the lifetime learning credit may be claimed is not limited.

Retirement Savings Contribution Credit

This little-known tax credit is designed to stimulate private saving for retirement. Depending on filing status and AGI, qualifying taxpayers could be looking at as much as 10%, 20%, or 50%, or as much as $2,000, of your qualified retirement contributions per tax year. Contributions to a Roth/SIMPLE IRA, 401(k), Thrift Savings, SARSEP, 501(c)(18) or governmental 457(b) plans, as well as any voluntary after-tax employee contributions to your qualified retirement, 403(b) plans and ABLE accounts are eligible as long as you are the designated beneficiary.

Business Tax Credits

While businesses cannot feasibly have children, go back to school, or invest in retirement accounts, they do pay taxes. Business owners that want to go beyond deductions to reduce their taxes can claim tax credits. General business tax credits directly decrease taxes but are typically non-refundable, meaning, they can only lower your tax bill to zero. Below we have highlighted some of the most common General Business Tax Credits.

Energy Credits

The Rehabilitation, Energy, and Reforestation Investment Credit covers 10% of your expenditures, capped at $10,000 per year. These credits are available to qualified businesses that spent money renovating an old building, restocking existing forest and woodlands, or investing in alternative energy sources. Companies that either use or sell biodiesel, biofuel, or low sulfur diesel can claim Alternative Fuel Credits.

If your business purchased and used a qualified plug-in electric vehicle or a vehicle that runs on alternative fuel, you could claim one or both vehicle credits. The Qualified Plug-in Electric and Electric Vehicle Credit is worth up to $7,500, while the Alternative Motor Vehicle Credit is worth up to $8,000. This credit is scheduled to phase out after manufacturers sell 60,000 qualifying vehicles. If you want to take advantage of this credit, keep in mind that this credit must be taken last and is subject to availability.

If you installed solar energy systems in your home or second residence, you may qualify for the Federal Energy Star Program which offers a credit equal to 30 percent of the total equipment cost. There are several implications to consider before taking this credit:

Improvement Tax Credits

The Work Opportunity Tax Credit (WOTC) is a federal, employment-based tax credit that is available to employers who hire individuals to begin work before January 1, 2020, from select target groups that might otherwise go untapped. For employees that face significant barriers to employment and work at least 120 hours in a year, businesses can claim 25% of the employee’s first-year wages, up to the maximum credit ($9,000 over two years). For employees who work at least 400 hours in a year, that percentage goes up to 40% of the employee’s first-year wages, up to the maximum credit.

The Empowerment Zone and Renewal Community Employment Credit nets businesses a credit of up to $3,000 for each full or part-time employee who lives and works in an Empowerment Zone. The credit is capped at 20% of the first $15,000 in wages.

Human Resource Tax Credits

The Small Employer Pension Plan Startup Costs Credit is worth up to $500, or 50% of your startup costs incurred to establish or administer an eligible plan or to educate employees about retirement planning. You can claim this credit for the first three years of your plan. Qualified businesses include those that employ fewer than 100 employees that received more than $5,000 in compensation; have not had a 401(k) plan for at least three years, and seriously intend to start a pension plan for employees.

The Family Leave Act Tax Credit expires in 2020, so businesses that want to take advantage of this incentive need to act soon. To qualify, a business that voluntarily offers up to twelve weeks of paid family leave each year to qualifying employees under a written policy may claim a partial tax credit toward wages paid during their leave. As defined, this paid leave goes beyond standard time off (vacation, sick time, other paid time off) and only applies to employees making less than $72,000. Employer eligibility is dependent on several factors. For instance, to receive the credit, the employer must offer at least two weeks of paid family leave each year to qualifying employee, and they must pay out at least 50% of typical wages. To those that do meet the requirements, the government will credit the benefit costs on a sliding scale, starting 12.5%.

Businesses should note that the credit does not apply if paid leave is mandated by state or local law. A qualified employer must claim this credit unless an election out is made. An employer’s deduction for wages and salaries is reduced by the amount of this credit that is claimed.

Research and Development Tax Credit

Businesses that engage in research to either improve a product or their business performance may be eligible for the federal Research and Development (R&D) Tax Credit. This credit allows businesses to take a credit of up to 13 percent of Contract Research Expenses for new and improved products and processes, including payroll. Qualified research must meet specific criteria and must satisfy three tests. (This is an excellent great option for owners looking to advance technology in their businesses.)

Tax credits are a fantastic way to save money, but they are neither easy to track nor simple to disseminate. All of these credits come with limits and qualifications that you must meet to receive the credit.

To find out if you qualify for these individual or business tax credits, contact one of the professionals in our office. We would love the opportunity to help you understand your tax credit eligibility as you prepare for the upcoming tax season.

The Taxpayer First Act (the Act) of 2019 was signed into law on July 1, 2019. The bill, having gone through a few changes on its way to the president’s desk, passed with bipartisan support – a rare thing in Washington these days. The law aims to reform the Internal Revenue Service (IRS) by making it more taxpayer-friendly and has been praised by the American Institute of Certified Public Accountants (AICPA). The summary of the bill, its titles and subtitles signal a much-needed pivot to the way the IRS fits into the 21st-century economic narrative. Among the areas of impact, the main themes include customer service, enforcement procedures, cybersecurity and identity protection, management of information technology, and use of electronic systems. While the following table is not exhaustive, it does highlight the key points of reform.

| Issue | Action |

| Customer Service | The IRS will adopt best practices of private sector customer service providers, starting with a comprehensive training plan. They will officially benchmark and track their endeavors and be responsible for measuring their success. |

| IdentiTy Theft Protection | The IRS is required to work behind the scenes and take their position front and center to assure greater identity protection. By 2024, any taxpayer will be able to request a personal identification number (PIN) to use when filing their tax return. The IRS is also legally bound to notify taxpayers of suspected fraud and point them in the right direction for next steps. Finally, if a taxpayer’s return is adversely affected by identity theft, the IRS must provide a single point of contact to track the case and resolve the issue. |

| Card Payments | Now, taxpayers can skip the third-party service when paying their bill. The new law allows the IRS to accept direct payment as long as the taxpayer agrees to pay the processing fees. The IRS is also tasked with securing contracts with minimal fees. |

| Information Protection | The Act locks down taxpayer information as it relates to contractors, such as outside attorneys, when it is obtained by summons. Furthermore, by 2023, disclosures of tax information for third party income verification must be fully automated and accomplished in real-time. |

| Independent Review | Tax disputes will get a second look under the Act. Taxpayers with a legitimate claim now have legal access to an independent appeals process. The IRS is also required to provide written notice of denial to the taxpayer and Congress and turn over its case files to qualified individual and business taxpayers. |

| Audit Notice | The IRS loves the word “reasonable.” When it comes to audit inquiries, the ambiguity of the term has now come to an end. The Act demands a 45-day notice requirement before contact with a third party can be made. |

| Internet Filing | The IRS has been tasked with creating a secure online user interface that allows taxpayers to prepare and file Forms 1099 electronically. The platform, which must be established by 2023, will also keep a historical record of submitted forms. |

| Seizure limitations | Small business owners that structure their bank deposits can rest a little easier. Legal deposits that fall below the $10,000 threshold are no longer subject to the threat of IRS seizure. |

| Consent | The Act prohibits consent-based disclosures from being used for purposes other than their original intent. |

The Taxpayer First Act is a welcome change. The Act helps protect business owners from IRS seizures and allows them to avoid the expenses and time-consuming process of having to go through the courts to reclaim their assets. Perhaps the most critical component of the new law is the attention to cybersecurity and customer service. Small business owners will still need to interact with the IRS, but if the law accomplishes its goal, the process will be easier and safer.

How will this law impact my payroll compliance?

It is important to note that several of the Taxpayer First Act provisions will directly influence your company’s payroll operations.

If you have questions about the law in its entirety or want to know how this legislation will impact your company’s payroll operation compliance, give the professionals in our office a call today.

Have you ever thought, I know we made more money than our statement shows, or I know we don’t owe that much in taxes; we never have any money! These moments of confusion are usually the result of either an assumption that your data is accurate, or a misunderstanding of how financial statements work.

Where did all the cash go?

You can always find the answer in your balance sheet. One of the first red flags that something is amiss is when your balance sheet tells a different story than your income statement. The key to unraveling the mystery is understanding the balance sheet, which shows your financial data at a fixed point in time. There are three pillars of a balance sheet.

A business owner’s primary goal is to increase profit month over month. So, when a CEO reviews a balance sheet, their eyes typically skim right to net value. A mistake on the balance sheet will never be in your favor. If the value is inflated, demise awaits. If the value is deflated, you miss opportunities. Novice bookkeepers tend to make the mistake of confusing assets and expenses. The ripple effect is showing less expense and more profit and failing to price future jobs with the true associated costs. Ensuring the right people with the correct understanding control your books is the first step to avoiding errors. Outsourcing accounting services is a great way to make sure the job is done right the first time.

Another tip is to approach your assets, liabilities, and equity in the same the way you look at your income statements. Keep a historical record or your balance sheet and compare the data month over month. A snapshot view is great for a quick assessment, but if you want to avoid discrepancies, you need to look at the whole story.

Understanding your financial statements

When a CEO lacks the financial knowledge to catch nuances in their statements, they are unable to take corrective action to change the results. Once you understand the language of your financial statements, you can interpret what they mean to your organization’s financial health. For example, knowing what you sell beyond the widget is a critical step to calculating your true assets. Likewise, a mature business owner knows that most likely reason for a discrepancy between a healthy P&L statement and a low cash account is lagging receivables. The numbers on the page are clues. When you learn to read the clues with the big picture in mind, you are better positioned to make sound business decisions. Failing to understand variances, overreacting to numbers on a page, and not catching insufficient and inaccurate data are clear indications that you are a good candidate for external help.

Financial statements can be misleading. As a business owner, noticing when something is amiss is a key element to managing your organization and driving growth. Do not let misleading financial information or a misunderstanding of financial statements be the downfall of your company. Ensure that you and your managers have the right financial management skills. We can assist you in developing accounting practices that will help make your company more profitable. Call us to learn more about our outsourced accounting services.

For a chart which shows which meals and entertainment are deductible, please click here.

In a Technical Advice Memorandum, the IRS evaluated whether meals and snacks that the taxpayer provided to employees at its headquarters were includible in the employees’ wages. The taxpayer provided:

(1) meals without charge to all employees, contractors, and visitors, without distinction as to the employee’s position, specific job duties, ongoing responsibilities, or other external circumstances; and

(2) unlimited snacks and drinks in designated snack areas that were available to employees, contractors, and escorted guests.

The IRS ruled that generally the value of meals the taxpayer provided to its employees was includible in the employees’ wages because the taxpayer failed to show that the meals were provided for substantial business reasons or for the employer’s convenience. However, it ruled that meals provided to employees on call to handle emergency outages were for a substantial business reason and were therefore excludable from income.

The IRS also concluded that the snacks the taxpayer provided in its designated snack areas were outside of the scope of Sec. 119 because they were not meals prepared for consumption at a meal time, and because quantifying the value of snacks consumed by each employee was administratively impractical, they were excludable from employees’ gross income as a de minimis fringe benefit.

Outsourced accounting services are a cocktail experience – a carefully chosen mix of professionals, curated to leverage their expertise to grow your business. Each firm does things a little differently, but there are a few fundamentals across the board.

The most successful engagements begin with the right expectations and proper set up. Many businesses do not take the time to set their office up with right considerations. Here are a few ways to make sure your virtual accounting office is efficient and successful.

Regardless of your industry, size or stage of growth, outsourcing accounting services can be a tremendous advantage to your business. When the arrangement is a good fit, it allows business owners to operate more effectively. Starting off on the right foot, with the right expectations is critical to overall success. Our experienced CPAs and consultants can help you get started working with a virtual accounting office. Call us today.

Summertime is a time of year when people rent out their property. In addition to the standard clean up and maintenance, owners need to be aware of the tax implications of residential and vacation home rentals.

Receiving money for the use of a dwelling also used as a taxpayer’s personal residence generally requires reporting the rental income on a tax return. It also means certain expenses become deductible to reduce the total amount of rental income that’s subject to tax.

Here are some basic tax tips that you should be aware of if you rent out a vacation or residential home:

Please contact us if you have any questions regarding vocational rentals.

The Internal Revenue Service recently revised the depreciation limits for business-use passenger vehicles first placed in service during calendar year 2019 and the amounts of income inclusion for lessees of passenger automobiles first leased in 2019. The updated amounts under Revenue Procedure 2019-26 are in table format below.

For passenger automobiles to which the Sec. 168(k) additional (bonus) first-year depreciation deduction applies and that were, and placed in service during calendar year 2019, the depreciation limits are as follows:

Passenger Automobiles (includes trucks and vans)

acquired before September 28, 2017 acquired after September 27, 2017

1st tax year $14,900 1st tax year $18,100

2nd tax year $16,100 2nd tax year $16,100

3rd tax year $9,700 3rd tax year $9,700

Each succeeding tax year $5,760 Each succeeding tax year $5,760

When no Sec. 168(k) additional (bonus) depreciation rules apply, the first-year limitation is $10,100 for the first year. In this case, limitations for subsequent years remain the same. The professionals in our office can answer the questions you may have on the updated auto depreciation limits, call on us today.

The Internal Revenue Service recently unveiled a draft version of Form W-4, Employee’s Withholding Allowance Certificate. The revised form is in response to changes made by the Tax Cuts and Jobs Act and aims to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors. It is open for review and feedback until July 1, 2019.

We want to remind our clients that this is only a draft and the new form will not be used until 2020. However, we are closely following this and will continue to provide updates. Below is a high-level summary of what we know so far.

What’s being proposed? The new form will account for:

The final draft is expected to be released mid-to-late July. We will continue to monitor changes to Form W-4 and keep you abreast. In the meantime, we encourage taxpayers to make sure they have the right amount of tax taken out of their paychecks and thus avoid a larger tax bill next year. Taxpayers with major life changes, including marriage or a new child, should especially check their withholding amounts.

Determining how much to withhold depends on your unique financial situation. The professionals at Hamilton Tharp can help, call us today for a paycheck checkup.

The Qualified Opportunity Zone Program has kept many investors paralyzed in uncertainty due to regulatory confusion. In the update below, we provide an overview of the highly sought-after guidance, which was recently released by the Internal Revenue Service (IRS) and the US Treasury Department… We have put together the following high-level overview of the 169-page guidance and will explain how the new clarifications will impact investors.

First let’s recap: Opportunity Zone Program

Definition

Eligibility

Considerations

Challenges

The original Opportunity Zone legislation left eager investors with more questions then answers. Below are some of the challenges that the guidance addresses.

Further Clarification

Below are a few of the key clarifications giving investors the confidence to move forward:

The IRS also provided several situations where deferred gains may become taxable. If an investor transfers their interest in a QOF, e.g., if the transfer is done by gift, the deferred gain may become taxable. However, inheritance by a surviving spouse is not a taxable transfer, nor is a transfer, upon death, of an ownership interest in a QOF to an estate or a revocable trust that becomes irrevocable upon death.

We encourage you to read the update in its entirety as it includes additional guidance on the term “original use,” and addresses all the issues mentioned above. If you are still hesitant about moving forward with this investment opportunity, the professionals in our office can help provide clarity, address your concerns and answer any specific questions you may have.

Americans share at least one dilemma when it comes to retirement planning. From the worker to the employer to the policymaker, everyone is living longer. On May 23, 2019, the House passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act. This legislation, receiving almost unanimous bipartisan support, offers the most significant shift to retirement plans and opportunities since the Pension Protection Act of 2006. In the bill, there are over 25 changes and provisions that expressly aim to encourage retirement savings among all workers. This bill, along with the Senate’s Retirement Enhancement Securities Act (RESA), addresses the apparent need for a worker’s wealth to run (and finish) the race with them. These documents may face modification before being signed into law, but one thing is clear: change is coming. Below we have prepared a synopsis of the changes that present the most opportunity.

Pooled Employer Plans

Many businesses are without affiliation and are too small to offer a savings retirement plan on their own. The new bill will reduce fiduciary responsibility and lower the overall costs associated with providing 401(k) plans by expanding the option to run multi-employer plans through a plan administrator. Sec. 106 goes a step further to incentivize smaller businesses to offer a retirement savings plan. The Act introduces a $500 tax credit for automatic enrollment into their retirement plan.

Annuities

The SECURE Act eases the liability concern over offering annuities. Most businesses have shied away from annuity providers because of their inherent risk. Section 204 updates safe harbor provisions, thus opening the door for employees to take advantage of converting their 401(k) balances to a pension-like payout plan. Another provision of the bill will allow workers to transfer a defunct annuity contract to an IRA while maintaining contributions. The only criticism on this update is the broad guidelines surrounding annuity providers. Some fear that ambiguity will lead to insurance companies offering shoddy plans.

Required Minimum Distribution (RMD) Age

The current law requires that most individuals begin withdrawing a minimum distribution from their retirement savings at the age of 70.5. Six-months-past-70 has invited an unnecessary amount of confusion since its inception in the Tax Reform Act of 1986. The SECURE Act seeks to simplify matters by raising the RMD age to 72. If the RESA Act passes in the Senate, the age requirement will be raised even higher to 75.

IRA Contributions

One of the most confounding retirement rules is the age limitation on IRA contributions, currently set at 70.5. The SECURE Act repeals the age limitation for traditional IRA contributions.

Benefit to Parents

Section 113 removes the 10 percent penalty tax from qualified early retirement plan withdrawals. Parents will be able to take an aggregate amount of $5,000 within one year of the adoption or birth of a child, penalty free. Section 302 expands section 529 plans by allowing withdrawals of as much as $10,000 for repayments of some student loans.

Stretch Provisions

Currently, beneficiaries of inherited retirement plans like 401(k), traditional IRAs, and Roth IRAs can spread the distributions until their dying breath. The new revenue provisions (Section 401) changes the rules, requiring most beneficiaries to distribute the account over a 10-year period and pay any taxes due. The tax-generating change will accelerate the depletion of many inherited accounts but will not affect surviving spouses and minor children.

Disclosures

Another administrative improvement provided in the Act requires employers to provide a lifetime income disclosure once every 12 months. The disclosures are meant to show the amount of monthly payments the participant or beneficiary would receive based on the total accrued benefit.

Kiddie Tax

Under the current law, the unearned income of children would be taxed at their parent’s marginal tax rate. Section 501 repeals the “kiddie tax” measures that were added by the 2017 Tax Act. The new provision states that unearned income of children would not be taxed at trust rates. Taxpayers can retroactively elect to not pay the taxes. The bill benefits many Americans, including families of deceased active-duty service members, survivors of first responders, children who receive certain tribal payments, and college students receiving scholarships.

Other changes proposed in bill include increased penalties for failures to file and the portability of lifetime income options. The SECURE Act is as likely to pass as it is to undergo slight modifications. We will keep an eye on the state of the bill and keep you abreast of its status. In the meantime, our professionals are standing by to answer your questions and address your concerns.

Payroll fraud can put a huge dent in your bottom line – costing companies billions of dollars annually. Unfortunately, companies are often unaware that a corrupt employee is in their midst. According to data from the Association of Certified Fraud Examiner’s (ACFE) 2016 global fraud study, Report to the Nations on Occupational Fraud and Abuse, payroll fraud is an especially high risk for small organizations. In the United States, 131 cases of payroll fraud, representing 12.6% of all asset misappropriation schemes, were reported in 2016. While most fraud is uncovered within one fiscal year, payroll fraud tends to fly under the radar for an average of two years before detection and on average costs companies $90,000 per occurrence.

As business advisors, we stress the importance of internal controls to prevent fraud and theft and to ensure the accuracy of accounting data. However, many situations still exist in which organizations fail to establish adequate control systems to reduce transaction costs for many reasons. Whether it is a lack of information or a lack of personnel, the fact of the matter is that payroll fraud is usually perpetrated by a single or multiple insiders. The following strategies can help prevent and detect payroll fraud in your organization.

This is one of the most effective strategies, and if you do not already have one, we strongly recommend implementing processes that regularly check for schemes. Consider specialized software that combats ghost employee tactics by looking for red flags such as duplicate Social Security numbers, addresses or direct-deposit accounts. Another step is to be transparent with your audit plan. Making employees aware that you conduct such audits may be enough to deter them.

Compare payroll numbers against output. A spike in overtime hours during a slow month, for example, should prompt further investigation. We can help you analyze your data and identify any red flags.

This will prevent incompatible functions from being performed by the same individual, especially in the accounting department. Ask your payroll company if they allow multiple people to be in the authorization chain of command. Most payroll companies allow for multiple recipients of payroll reports; be sure you send final reports to an outside accountant and the owner. If one employee handles payroll, we recommend hiring an outside person to input the information into the accounting system, acting as the internal control.

Check documents such as timecards and any other payroll documentation. You should be on the lookout for employees who are claiming excess hours and overtime as well as any other items that seem suspect. If employees know you are regularly checking time cards, they will be less likely to test the waters.

These are often overlooked. Make sure you collect the right documentation when adding new employees. Equally important is following protocol for terminated employees. While failure to remove a terminated employee from payroll is not fraud, controls will help you avoid the embarrassment of paying an employee after termination.

If you have concerns about payroll fraud in your organization, please call one of our professionals today.

Have you ever stopped to think about whether outsourcing financial management functions of your business would benefit your organization?

You will probably be surprised how many activities they encompass and how vital they are to the success of your company. Your business thrives when these activities are in order. When faced with the options, a business owner quickly realizes that either they will need to manage their organization’s finances or hire someone else to do it.

Financial planning, financial risk assessment, record-keeping, and financial reporting are time-consuming cogs in the wheel of a functional business and are best managed by someone who has the right qualifications. But the fact of the matter is, CFOs cost money, and most small businesses do not have forty hours of work for a qualified individual. Rightly dividing resources within an organization is a critical matter, which is why outsourcing CFO services makes a lot of sense.

What is an outsourced CFO?

An Outsourced CFO is a valuable partner that can:

Beyond these critical finance utilities, an Outsourced CFO can deliver expert “back office” support to organizations so they can focus on growing their business. The finance function can be broken up into three main activities, each with a series of sub-functions.

Is it time to consider outsourcing?

Determining whether to outsource requires a focused and deliberate approach. Below are six advantages that will help you decide whether outsourcing financial management would benefit your organization:

Before determining whether to outsource financial management functions, there are many factors to consider including the size of your business, industry, number of employees, volume of transactions, and skill sets.

As a business owner, accepting the “virtual” reality of outsourcing means adjusting your expectations. In this environment, you will not be your CFOs only client, but you will have access to exceptional quality. If you are involved in the authorization process and can extend trust beyond your four walls, then you will truly benefit from this arrangement. However, if you are hung up on signing checks and are not able to hand over responsibilities, you will hinder the process and negate the experience.

Outsourcing services from your organization may enable you to operate more effectively. With our requisite knowledge of different types of organizational structures, we can help you create innovative changes in your organization. If you would like to learn more, please call our office to speak with one of our professionals and learn how you can enhance the success of your business.

Learn more about our outsourced CFO services by clicking here.

There are many reasons why revenue can slip through the cracks of an organization. Common culprits include outdated technology, lack of training, employee turnover and complacency. Accounts Payable tends to be the land of the lost – overlooked and underappreciated. Ignoring best practices in this department leads to lost revenue and exposes your operation to significant financial risk. Accounts Payable is critical to capital optimization; it is time to bring this core strategy into the light.

Taking a strategic approach to Accounts Payable requires a business owner first to identify which practices are holding up their business. Common mistakes include:

A well-functioning Accounts Payable department is an opportunity to optimize payables and free up the working capital needed to fuel growth. Strengthening your accounts payable department processes and procedures is a big task. Addressing the following areas first will help build momentum:

Poor Accounts Payable practices occur in both emerging and mature businesses. If you need assistance strengthening your Accounts Payable department process and procedures or would like to talk about creating a strategy around capital optimization, the professionals in our office can help! Give us a call today to get started.

What does your tax return say about your financial situation? The fact is, the paperwork you file each year offers excellent information about how you are managing your money—and highlights areas where it might be wise to make changes in your financial habits. If you have questions about your financial situation, we can help. Our firm is made up of highly qualified and educated professionals who serve as trusted business advisors to clients all year long.

Whether you are concerned about budgeting; saving for college, retirement or another goal; understanding your investments, cutting your tax bite, starting a business, or managing your debt, you can turn to us for objective answers to all your tax and financial questions.

We Can Help You Address the Issues that Keep You Up at Night

Where will your business be in five years? Would strategic budget cuts improve your company’s health? Are there ways you can boost revenue? If you are nearing retirement, do you have a buyer or successor in the wings? These are the kinds of questions that keep many business owners up at night. Fortunately, we can help you find financial peace.

Be Confident that You’re Making Tax-Advantageous Decisions

It’s tough to be proactive when tax laws are constantly changing. But it can be done! Our experienced team of CPAs can help you navigate the tax complexities affecting your business.

We review financial situations and develop creative strategies to minimize tax liabilities so you can meet your financial goals. Contact one of our professionals today.

Opportunity Zones allow Americans to combine their patriotism with their love of tax breaks. The Opportunity Zone Provision gives taxpayers who have invested in the sale or exchange of a property in a Qualified Opportunity Zone Fund (QOZF) the opportunity to elect or defer paying taxes on the capital gains until they sell their investment.

The Opportunity Zones provision is based on the bipartisan Investing in Opportunity Act, which defines Opportunity Zones (OZ) as low-income census tracts that have been nominated by governors and certified by the U.S. Department of the Treasury. This stimulus program invites investors to put their capital to work in areas that have struggled to bounce back from The Great Recession or have never had the opportunity to grow. This article will define Opportunity Funding and offer guidance on how to target qualified OZ investments.

Investor Benefits from Qualified Opportunity Zone Fund Investments

The innovative approach to spurring long-term private sector investments in low-income communities is available in over 8,700 Opportunity Zones in every state and territory. Investors can claim the QOZF tax advantage in the following ways:

Opportunity Funds

The IRS states that all types of capital gains are eligible for the Opportunity Zones tax incentives through the use of Opportunity Funds, which invests at least ninety percent of its assets in Qualified Opportunity Zone Property. It is important to note that ordinary gains do not meet the qualification test. Furthermore, while a partnership may elect to defer part of all of a capital gain, the deferred portions of the gain will not be included in the distributed shares.

Qualified Opportunity Zone Funds (QOZF) are subject to specific regulations as set forth by the IRS, namely the types of gains that may be deferred, the timeline by which the amounts by invested, and how investors may elect to defer specified gains. Here is a snapshot to get you started:

The IRS defines eligible Opportunity Zone Property as QOZF stock, QOZF partnership interest, or QOZF business property. Besides being located and operated in a QOZF, qualified opportunity property must also be new to the entity and abide by the following requirements:

It is important to note that specific trades and businesses cannot qualify as opportunity zone businesses, including, any private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.

Targeting Qualified Opportunity Zone Investments

To be able to invest in a QOZF, you must have a qualified gain (as noted above) from a previous sale to an unrelated party. A taxpayer then has 180 days from the date of the previous sale to invest in a QOZF. The investment must be made through a cash contribution and may consist of both tax-deferred (the previous gain) and non-tax deferred funds (additional amounts you wish to invest). Any cash contribution made of non-tax deferred funds will not receive the tax benefits noted above.

If you have allocated a gain from an asset sold within a pass-through entity, your 180-day investment window defaults to starting on the date of the pass-through entity’s tax year-end. Alternatively, taxpayers can elect to have their 180-day window begin on the actual date the partnership recognized the gain.

If you’ve decided to invest in a QOZF, understanding the landscape of the opportunity zone will help you assess the trajectory of growth for that area. Steve Glickman, the co-founder of the Economic Innovation Group thinktank that designed Opportunity Zones, developed an Opportunity Zone Index to help anxious investors take the next step.

Taxpayers must act soon to take advantage of this opportunity. According to the TCJA, investors have until 2020 to reap the full tax benefits of investing in a QOZF. If you’d like to learn more about investing in a QOZF, give us a call. We can help you better understand your options!

As April 15th approaches, taxpayers may rush to try and complete their returns, missing out on key opportunities for planning and strategy. While it’s ideal to file your return by the IRS due date when you have all the information, there are many instances that prevent this, such as taxpayers with K-1s from pass through entities. In many cases, K-1s from pass through entities are not received until well after the deadline or right before it.

We recently experienced a situation where a client, whose information was received too close to the deadline, did not want to file an extension. After speaking with one of our professionals, the client understood their unique situation and agreed to extend. After April 15th, we discovered that the client had not provided information on an $80,000 deduction! Without time for an accurate review, this deduction could have been missed.

Extending your return allows for the appropriate amount of time to plan for and prepare your return. If you find yourself in this scenario, it’s always better to extend your return.

Extending your return does not require that you have all the information to complete your return. Instead, you need enough key information to estimate your tax liability. Any payments due to the IRS are still due regardless of whether you extend.

Many taxpayers are concerned that an extension will increase their risk of an IRS audit. While there isn’t a direct correlation between extensions and audits, there is an increased risk of being audited if the taxpayer rushes to file a return by the deadline only to have to file an amended return at a later date. The best reason to go on extension is if you need time to consider proper reporting, get professional advice, and file an accurate return. Amended returns are more likely to be scrutinized, so file once accurately if possible. Filing a return without complete information can result in needing to amend your return, which always incurs additional fees.

It’s our goal to help clients make the right decision around extending versus filing. If you have questions about which is best for you, please contact us.

Furthermore, please note that any returns received after March 15th of this year will automatically be extended due to commitments we have already made to other clients whose information we have already received.

Catch Kim Spinardi, CPA, Michael Frost, and Ralph Nelson, JD, CPA discussing the new tax laws and how working with one firm that can handle your tax, financial planning and investing needs may be your greatest asset.

Hamilton Tharp, LLP is proud to have been asked to be a part of this discussion on Real Talk San Diego’s “Your Wealth Hour” segment!

The Treasury Department and the Internal Revenue Service recently issued final regulations and guidance addressing implementation of the new qualified business income (QBI) deduction (section 199A deduction). The guidance is an attempt to simplify this complicated deduction.Although one of the more complex changes in TCJA, this deduction has the potential to cut tax bills by up to one-fourth for eligible businesses. Below we have highlighted the major takeaways from the 247-page document released by the IRS last month.

If you are unfamiliar with this new deduction, which was created by the Tax Cuts and Jobs Act (TCJA), it allows entrepreneurs, self-employed individuals, and certain investors to deduct 20 percent of their business income from their taxable income. This is considered a “below-the-line” deduction, meaning it will not reduce your adjusted gross income.

Determining eligibility for this deduction depends on whether your business is considered a specified trade or business and is above or below the required threshold. The structure of your business also determines eligibility. Eligible structures include trust and estates, individuals, partnerships, s corporations and sole proprietors. The QBI deduction is not available for wage income or business income earned by a C corporation.

Calculating the QBI deduction also depends on whether a business is considered a “specified service.” A Specified Service Trade or Business (SSTB) includes services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or businesses in which the principal asset is the reputation of one or more employee (endorsements or appearance fees). It is important to note that the rules change if your business is not considered a specified service.

Understanding the Final Ruling Around 199A

Below we have listed the most pertinent details issued last month by the IRS:

Also included in the final regulations, the IRS issued a proposed revenue procedure that provides a safe harbor for rental real estate enterprises to be considered a trade or business and qualify for the deduction. A rental real estate enterprise is defined as an interest in real property held for the production of rents and may consist of an interest in multiple properties.

According to Notice 2019-7, a rental real estate enterprise will be treated as a trade or business if the following requirements are satisfied during the tax year:

There are exceptions and exclusions to consider, including:

While this deduction will make the rules more manageable for some businesses, these rules will require more planning and additional complexities for others, including larger pass-through entities.

There are still many questions left unanswered, such as:

The deduction is available for tax years beginning after December 31, 2017, and before January 1, 2026. There is speculation whether a future Congress will uphold individual provisions. To discuss your future options regarding the QBI deduction and your eligibility to take advantage of the real estate safe harbor, contact our office.

In July, the U.S. Supreme Court issued one of the biggest tax cases in decades, which dramatically expands when states can require out-of-state businesses selling to customers in their state to collect and remit sales and use taxes. This change will have a huge impact on anyone selling items or services over the internet.

If you are selling items to customers in other states, it’s important that we talk soon so we can set up systems now to track what sales are being made where, and whether you might be required to register in any other state due to expanding filing requirements. Getting ahead of these changes now can prevent you from being subjected to numerous fines and penalties later.

Prior to U.S. Supreme Court’s decision in Wayfair, Inc. vs. South Dakota, a state could only require a business to collect sales or use tax from customers if the business had some type of physical presence in the state, usually by owning, leasing or storing property in the state or having an employee or agent in the state.

Now states can require out-of-state sellers to collect and remit sales and use taxes if they make a minimum number of sales to customers in their state (in terms of dollars and / or transactions), even if they have no physical presence in the state.

This is a huge revenue raiser for the states and, not surprisingly, states are changing their requirements for out-of-state sellers on an almost daily basis. To complicate matters even more, each state and each local taxing jurisdiction may have different rules.

Most small retailers making only a few sales into a state will not be impacted because states are providing exceptions for businesses only making a minimum level of sales (e.g., less than $100,000 in annual gross revenues and / or less than 200 annual transactions.

To determine exceptions for small retailers, click here to check this listing by state.

Please contact us if you need assistance in determining your out-of-state sales tax obligations.

The Board of Directors has named Christina Tharp, CFO of Hamilton Tharp; Chairman of the Europe, the Middle East and Africa (EMEA) International Executive Committee.

Tina is the Managing Partner of Hamilton Tharp, LLP, the Solana Beach, California-based public accounting and business consulting firm. As Chairman of the EMEA International Executive Committee she will be responsible for the strategic planning of the organization’s international alliances with Auditrust International. Tina will also represent CPAsNET by traveling to Auditrust International’s EMEA Meeting in the Fall of 2019.

CPAsNET’s partnership with Auditrust was conceived because of the increasing need of business who rely on their CPA firms to provide global resources and specialists. CPAsNET firms meet their client’s growing international demands by working within a system of international associates who help serves mid- market enterprises looking to expand their footprint.

Tina was unanimously re-elected for this prestigious position by her peers. Sarah Johnson Dobek, President of CPAsNET noted that: “Tina is well-respected within the organization, profession and international community of trusted financial advisors. A true trailblazer, Tina understands the importance of continued innovation and providing clients with the local, national and international perspective needed to prosper in challenging markets and times. The International Executive Committee will benefit from her expertise” said Dobek.

Tina has nearly a quarter century of experience in working with international financial issues and is the youngest member of CPAsNET to be elected to this post. In addition to holding her B.S. degree in Finance from San Diego State University she also serves on the Executive Committee of the Professional’s Education Network, an organization dedicated to providing opportunities to minority student seeking careers in the accounting professions.

Tax audit. These two simple words are enough to strike fear and loathing into the hearts of many business owners. But, in reality, the Internal Revenue Service (IRS) won’t arbitrarily make your company the subject of an audit investigation. In fact, according to IRS.gov, out of the 196 million returns filed in 2016, only 1.1 million (0.5%) came under examination in 2017. You are more likely to be summoned for jury duty (1 in 10) this year.

Unless you’re operating below the board or completely ignoring best practices, you have little to fear. However, even the most prudent sometimes miss a step. From managing the filing cabinet to the people who hold the keys, ensuring your business doesn’t catch unnecessary attention from the government comes down to good habits. Here are a few ways you can minimize the likelihood that you’ll be audited or ensure a more positive experience should you be audited.

If the IRS contacts you about an audit, CPAs advise that you don’t panic. Remember, you are not going on trial, you’re simply being asked to verify some of the claims you made on your tax return. It’s best to remain calm and cooperative when dealing with the IRS.

It’s also a good idea to contact your local CPA for advice and assistance in case you are audited. He or she can help you understand the process and work with you to try to achieve the best resolution.

Surprising but true, small and mid-sized businesses are more susceptible to and crippled by fraud when compared to larger organizations that have more resources to invest in anti-fraud initiatives. The Association of Certified Fraud Examiners recently published its 10th annual report to the nations. The largest global study on occupational fraud, the publication highlights 2,690 real cases of occupational fraud and includes data collected from 125 countries. The 80-page report explores the costs, schemes, victims, and perpetrators of fraud. According to the 2018 report, organizations with fewer than 100 employees experienced the greatest percentage of fraud cases and suffered the largest median loss.

Unfortunately, most small to mid-sized companies are ill-prepared to detect, prevent, and react to instances of fraud in their businesses. In this article, we will provide information that business owners can use to identify gaps in their fraud prevention processes and provide recommendations on ways to better protect your business from internal fraud.

The Association of Certified Fraud Examiners identifies and defines three primary categories of occupational fraud that are most the common:

(1) Financial Statement Fraud – a scheme in which an employee intentionally causes a misstatement or omission of material information in the organization’s financial reports.

(2) Asset Misappropriation – a scheme in which an employee steals or misuses the employing organization’s resources.

(3) Corruption – a scheme in which an employee abuses his or her influence in a business transaction in a way that violates his or her duty to the employer in order to gain a direct or indirect benefit.

The following strategies can help deter and detect payroll fraud from occurring in your organization.

Deterrents

As business advisors, we stress the importance of internal controls to deter and prevent fraud and to ensure the accuracy of accounting data. Small to mid-sized businesses often fail to establish adequate internal control systems for a number of reasons. The most common reasons are often a lack of resources or putting too much trust in employees and vendors.

One of the most effective strategies in deterring fraud is having a system in place that regularly checks for schemes. As a business owner, you have enough on your plate. Consider automating your internal controls by leveraging software that can detect red flags such as duplicate social security numbers, addresses or direct-deposit accounts.

Other recommendations for deterring fraud include increasing overall transparency and generating awareness that you will be conducting fraud audits. When you communicate the importance of internal fraud-prevention initiatives, transactions and systems will be better monitored, and any suspected scams can be quickly identified and investigated.

Finally, avoid delegating accounting and bookkeeping functions to one person. Concentrating these duties to one person makes it too easy for fraud to go unnoticed. Separating functions is the best way to increase accountability. We suggest having at least two people handle these functions or outsourcing a virtual CFO.

Detecting

According to the ACFE’s 2018 report, understanding and recognizing behavioral red flags can help organizations detect fraud. The ACFE has identified six red flags that have consistently been displayed by fraud perpetrators in every one of its studies since 2008. They include living beyond means, financial difficulties, unusually close association with vendors or customers, control issues and unwillingness to share duties, divorce or family problems, and a “wheeler-dealer” attitude.

While also remind business owners that a fraud perpetrator may not exhibit any behavioral red flags. In these circumstances, be on the lookout for concealment methods. According to the ACFE’s 2018 report, the top three concealment methods used by fraudsters include creating fraudulent physical documents, altering physical documents, and creating fraudulent transitions in the accounting system.

Reacting

Generally, developing strong controls and maintaining a close watch over your accounts can help you both prevent and catch fraud. If you discover fraud, do not confront the presumed perpetrator directly. Contact your organization’s attorney. While one may believe to have caught an individual “red-handed,” this version may not pass muster in court. Once an attorney assures it is a valid case, notify your insurance carrier.

The ACFE’s 2018 report identifies the most common actions organizations take to penalize fraud perpetrators. They include termination, settlement agreements, required resignation, and probation or suspension.

The professionals in our office can assess your fraud risk and provide you with a comprehensive and personalized plan to mitigate that risk. Contact one of our professionals today for more information.

Today’s workforce is a gig economy. According to a study by intuit, by 2020 40% of American workers will be independent contractors.

Independent contracts can save businesses from the cost of benefits, office space, taxes and many other perks given to employees. Becoming an independent contractor can be very attractive to the individual performing those services as well because of the flexibility over their schedule and the choice in the work they will perform.

Today’s gig economy doesn’t come without implications. Many businesses still employ people and will continue to do so. It’s important to understand the effect of classifying individuals as employees or independent contractors. Many business owners fail to recognize the effect of classifying an individual as an employee or independent contractor. If you have misclassified the individual, you could expose yourself to significant tax liabilities.

As described by the IRS, an employee is anyone who performs services for you where you can control what will be done and how it will be done. Classifying workers as employees requires that a company withhold applicable Federal, state and local income taxes, pay Social Security, Medicare taxes, state unemployment insurance tax and pay any workers compensation fees. Employee status also requires filing a number of returns during the year with various taxing authorities and providing W-2’s to all employees by January 31. Not to mention, employees may also have rights to benefits such as vacation, holidays, health insurance or retirement plans.

Over the years, we have come to learn that there are a number of common myths that you should avoid in classifying your workers. The more frequent inappropriate decisions to classify an employee as an independent contractor include:

The IRS notes that simply because a worker does assignments for many companies does not necessarily suggest independent contractor status. The determination of whether a worker is an employee or an independent contractor rests primarily upon the extent that the employer has to direct and control the individual with regard to what and how an activity is to be accomplished. Generally, the employer controls how an employee performs a service. On the other hand, independent contractors determine for themselves how a given assignment is to be completed.

To aid business owners, the IRS has developed tests to be used as guiding points to indicate the extent and direction of control present in any employer/employee/independent contractor situation. The degree of importance of each factor varies depending on the occupation and the facts of the particular situation.

IRS Control Test

1. Behavioral Control

Employee status is determined when the business can direct and control the work performed by the worker. Consider:

2. Financial Control

If the business can direct or control the financial and business aspects of the worker’s job, it may suggest employee status. Consider:

3. Relationship

The type of relationship is dependent upon how the worker and business perceive their interaction with one another. Consider:

In addition, the Voluntary Classification Settlement Program (VCSP) offers certain eligible businesses the option to reclassify their workers as employees with partial relief from federal employment taxes.

The Internal Revenue Service recently issued the 2019 optional standard mileage rates to be used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

As of January 1, 2019, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) are:

It is important to remember that a taxpayer may not use the business standard mileage rate for a vehicle after using any depreciation method under the Modified Accelerated Cost Recovery System (MACRS) or after claiming a Section 179 deduction for that vehicle.

Taxpayers always have the option of calculating the actual costs of using their vehicle, rather than using the standard mileage rates. For more information, please contact one of our professionals today.