Whether you are an individual taxpayer or a small business owner, understanding your eligibility for tax credits is an essential facet of income tax planning. Unlike deductions, which only reduce taxes owed by the product of the amount of your deductions multiplied by your marginal tax rate, tax credits provide dollar-for-dollar tax reduction. The following post addresses key tax provisions and tax minimizing strategies to keep on your radar during year-end tax planning for 2019.

Individual Tax Credits

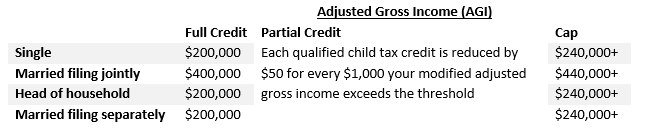

The Child Tax Credit

Thanks to the increase in phaseout thresholds made by the 2017 Tax Cuts and Jobs Act, many taxpayers can look forward to another year of the child tax credit. The child tax credit, which is $2,000 for every eligible child, is available to parents and guardians of children under 17 whose household falls within specified income brackets. In addition, up to $1,400 of the credit amount is refundable. This means that certain taxpayers can claim the credit even after their tax bill is reduced to zero. Households that include dependents over the age of 17 or for children you care for or whose support you provide may be eligible for a nonrefundable $500 family credit. The child tax credit may be taken by taxpayers who claim the qualifying child as a dependent and is fully phased out when the adjusted gross income of a taxpayer reaches the amounts listed below. For this reason, separated or divorced parents should plan for which parent can claim the dependency exemption for an eligible child.

Educational Tax Credits

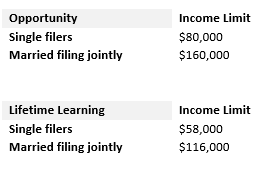

For taxpayers enrolled in an

undergraduate program, the American Opportunity tax credit pays 100% of

eligible tuition and required fees up to $2,000, plus 25% of the next $2,000,

bringing the full tax credit to $2,500 per year. Partial tax credits are

available to those that fall outside the income threshold. Likewise, the Lifetime Learning tax credit

offers students of graduate programs, vocational schools, and other

nontraditional programs a 20% tax credit on up to $10,000 in qualified

education expenses.

These credits are phased out for taxpayers with modified adjusted gross incomes in excess of the above amounts. The number of years the lifetime learning credit may be claimed is not limited.

Retirement Savings Contribution Credit

This little-known tax credit is designed to stimulate private saving for retirement. Depending on filing status and AGI, qualifying taxpayers could be looking at as much as 10%, 20%, or 50%, or as much as $2,000, of your qualified retirement contributions per tax year. Contributions to a Roth/SIMPLE IRA, 401(k), Thrift Savings, SARSEP, 501(c)(18) or governmental 457(b) plans, as well as any voluntary after-tax employee contributions to your qualified retirement, 403(b) plans and ABLE accounts are eligible as long as you are the designated beneficiary.

Business Tax Credits

While businesses cannot feasibly have children, go back to school, or invest in retirement accounts, they do pay taxes. Business owners that want to go beyond deductions to reduce their taxes can claim tax credits. General business tax credits directly decrease taxes but are typically non-refundable, meaning, they can only lower your tax bill to zero. Below we have highlighted some of the most common General Business Tax Credits.

Energy Credits

The Rehabilitation, Energy, and Reforestation Investment Credit covers 10% of your expenditures, capped at $10,000 per year. These credits are available to qualified businesses that spent money renovating an old building, restocking existing forest and woodlands, or investing in alternative energy sources. Companies that either use or sell biodiesel, biofuel, or low sulfur diesel can claim Alternative Fuel Credits.

If your business purchased and used a qualified plug-in electric vehicle or a vehicle that runs on alternative fuel, you could claim one or both vehicle credits. The Qualified Plug-in Electric and Electric Vehicle Credit is worth up to $7,500, while the Alternative Motor Vehicle Credit is worth up to $8,000. This credit is scheduled to phase out after manufacturers sell 60,000 qualifying vehicles. If you want to take advantage of this credit, keep in mind that this credit must be taken last and is subject to availability.

If you installed solar energy systems in your home or second residence, you may qualify for the Federal Energy Star Program which offers a credit equal to 30 percent of the total equipment cost. There are several implications to consider before taking this credit:

Improvement Tax Credits

The Work Opportunity Tax Credit (WOTC) is a federal, employment-based tax credit that is available to employers who hire individuals to begin work before January 1, 2020, from select target groups that might otherwise go untapped. For employees that face significant barriers to employment and work at least 120 hours in a year, businesses can claim 25% of the employee’s first-year wages, up to the maximum credit ($9,000 over two years). For employees who work at least 400 hours in a year, that percentage goes up to 40% of the employee’s first-year wages, up to the maximum credit.

The Empowerment Zone and Renewal Community Employment Credit nets businesses a credit of up to $3,000 for each full or part-time employee who lives and works in an Empowerment Zone. The credit is capped at 20% of the first $15,000 in wages.

Human Resource Tax Credits

The Small Employer Pension Plan Startup Costs Credit is worth up to $500, or 50% of your startup costs incurred to establish or administer an eligible plan or to educate employees about retirement planning. You can claim this credit for the first three years of your plan. Qualified businesses include those that employ fewer than 100 employees that received more than $5,000 in compensation; have not had a 401(k) plan for at least three years, and seriously intend to start a pension plan for employees.

The Family Leave Act Tax Credit expires in 2020, so businesses that want to take advantage of this incentive need to act soon. To qualify, a business that voluntarily offers up to twelve weeks of paid family leave each year to qualifying employees under a written policy may claim a partial tax credit toward wages paid during their leave. As defined, this paid leave goes beyond standard time off (vacation, sick time, other paid time off) and only applies to employees making less than $72,000. Employer eligibility is dependent on several factors. For instance, to receive the credit, the employer must offer at least two weeks of paid family leave each year to qualifying employee, and they must pay out at least 50% of typical wages. To those that do meet the requirements, the government will credit the benefit costs on a sliding scale, starting 12.5%.

Businesses should note that the credit does not apply if paid leave is mandated by state or local law. A qualified employer must claim this credit unless an election out is made. An employer’s deduction for wages and salaries is reduced by the amount of this credit that is claimed.

Research and Development Tax Credit

Businesses that engage in research to either improve a product or their business performance may be eligible for the federal Research and Development (R&D) Tax Credit. This credit allows businesses to take a credit of up to 13 percent of Contract Research Expenses for new and improved products and processes, including payroll. Qualified research must meet specific criteria and must satisfy three tests. (This is an excellent great option for owners looking to advance technology in their businesses.)

Tax credits are a fantastic way to save money, but they are neither easy to track nor simple to disseminate. All of these credits come with limits and qualifications that you must meet to receive the credit.

To find out if you qualify for these individual or business tax credits, contact one of the professionals in our office. We would love the opportunity to help you understand your tax credit eligibility as you prepare for the upcoming tax season.

Receive Free financial tips & Tax Alerts!

"*" indicates required fields

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example,…

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim…

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so…