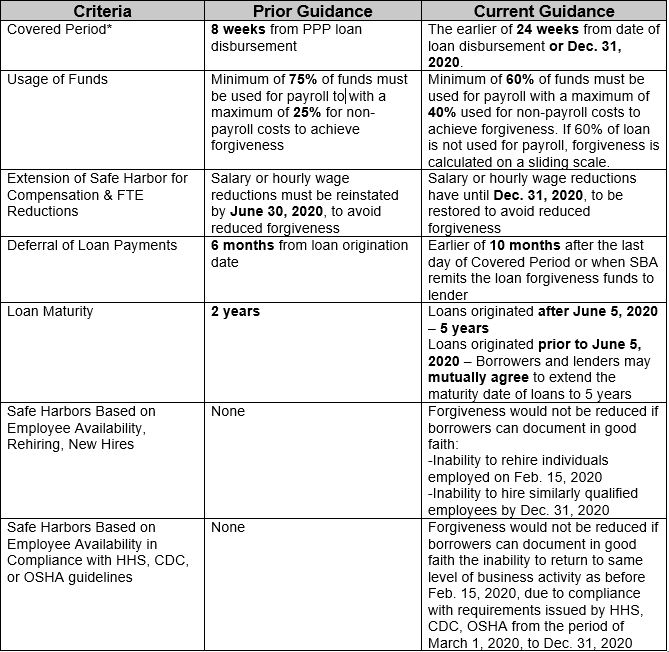

On June 10, 2020, the Small Business Administration (SBA) issued an updated interim final rule for the Paycheck Protection Program (PPP) in response to the PPP Flexibility Act passed on June 5, 2020. The updated guidance accounts for revisions made to the covered period, usage of funds changes, extended safe harbors, and more.

Here is a quick rundown of the changes made by the PPP Flexibility Act.

Also of note:

Further guidance and instructions are anticipated, especially as they relate to the PPP Loan Forgiveness Application. The HT2 COVID-19 Task Force is hard at work deciphering new regulations as they are published! Stay tuned for updates and contact us for assistance with your loan forgiveness application.

Helpful Links:

Receive Free financial tips & Tax Alerts!

"*" indicates required fields

Businesses usually want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it wise to do the opposite? And why…

Navigating the realm of capital gains and optimizing tax outcomes require strategic thinking and informed decision-making. Understanding and employing effective capital gains tax strategies is crucial for businesses contemplating asset…

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example,…